UK property market

A Turning Tide? Unpacking the Nuances of UK Housing Affordability for First-Time Buyers

Housing affordability for UK first-time buyers has improved, but a stark regional divide, particularly with London, complicates the national picture.

UK Housing Market Defies Gravity: A Post-Budget Rebound or a Bull Trap for Investors?

UK house prices saw a surprise jump in January, reversing previous declines. Is this a sustainable recovery fueled by post-Budget optimism or a temporary blip?

Spring in Their Step: Why UK Property Market Optimism is a Bellwether for the Broader Economy

A key survey shows UK estate agents’ optimism at a one-year high, signaling a potential turning point for the property market and the wider UK economy.

The UK Mortgage Market’s Turning Point: Why a “Boom” Could Reshape the Economy

UK mortgage rates are set to fall as lender competition heats up. Discover the economic drivers and what this means for investors and homebuyers.

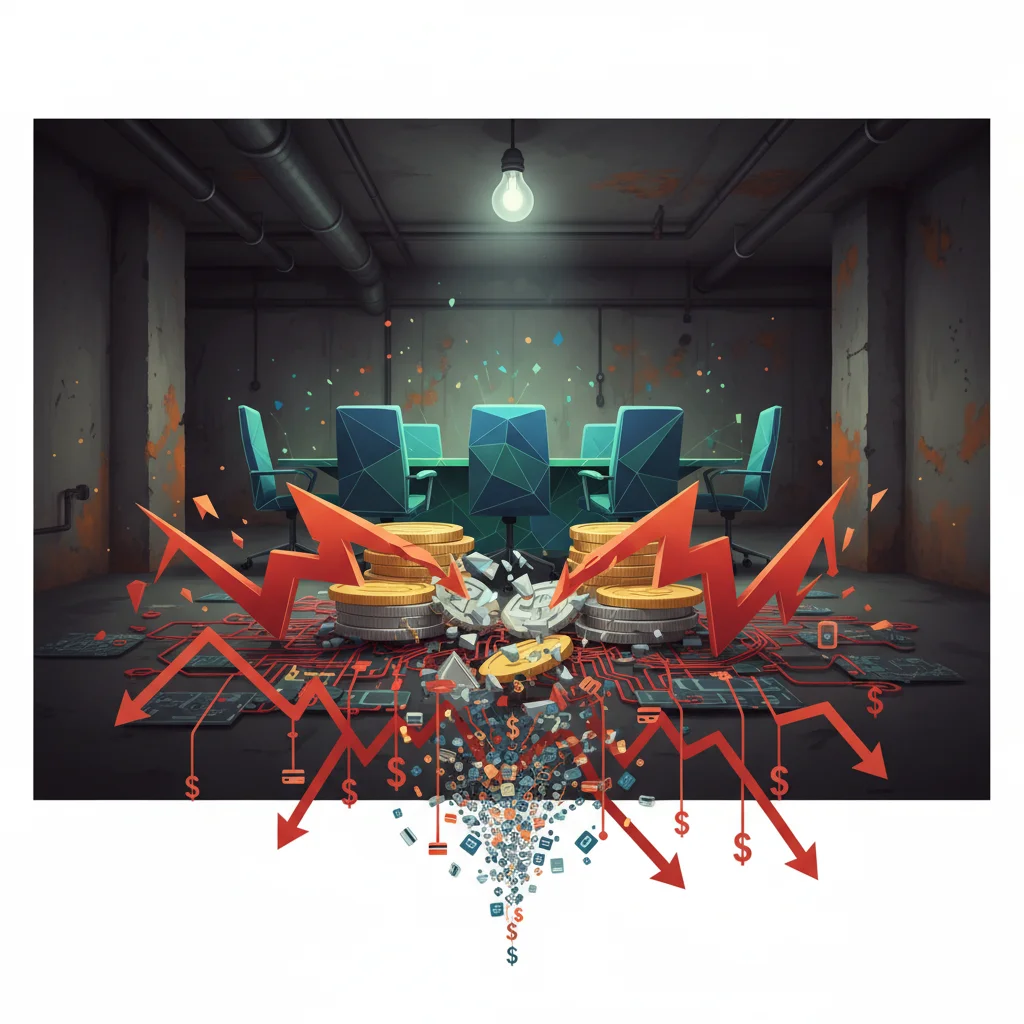

The Boardroom in Your Basement: Why Your Flat’s Management Could Be Your Biggest Financial Risk

Your flat’s management isn’t just a nuisance; it’s a major financial risk. Discover how poor governance can impact your biggest investment.

UK Housing Correction: Decoding the £2,000 Price Drop and What It Means for Your Investments

A £2,000 drop in UK asking prices signals a major market shift. We dissect the economic forces, investor strategies, and future trends.

The New Landlord on the Block: Unpacking Lloyds Bank’s £2 Billion Real Estate Empire

Lloyds Bank is quietly building a £2bn+ property portfolio. We dive into the strategy, risks, and what it means for banking, investing, and the UK economy.

The End of the Dip: Why Mortgage Rates Are Climbing Again and What It Signals for the UK Economy

For the first time since February, UK mortgage rates are rising, signaling lender caution amid economic uncertainty. Discover the reasons why and the impact.