taxation

Beyond the Bar Tab: Why the UK Hospitality Crisis is a Red Flag for the Entire Economy

Over 40 hospitality firms are protesting UK tax hikes, a crisis signaling wider economic risks for investors, finance, and the UK’s high streets.

Beyond the Pub: Why the UK’s Business Rates Debate is a Bellwether for the Entire Economy

A potential tax break for UK pubs has other sectors demanding equal treatment, exposing deep flaws in the business rates system and impacting the wider economy.

From Boston Tea to Bitcoin: Why the American Revolution’s Economic Lessons Still Drive Today’s Markets

The economic principles of the American Revolution are being re-litigated today in global finance, from corporate tax battles to the rise of blockchain.

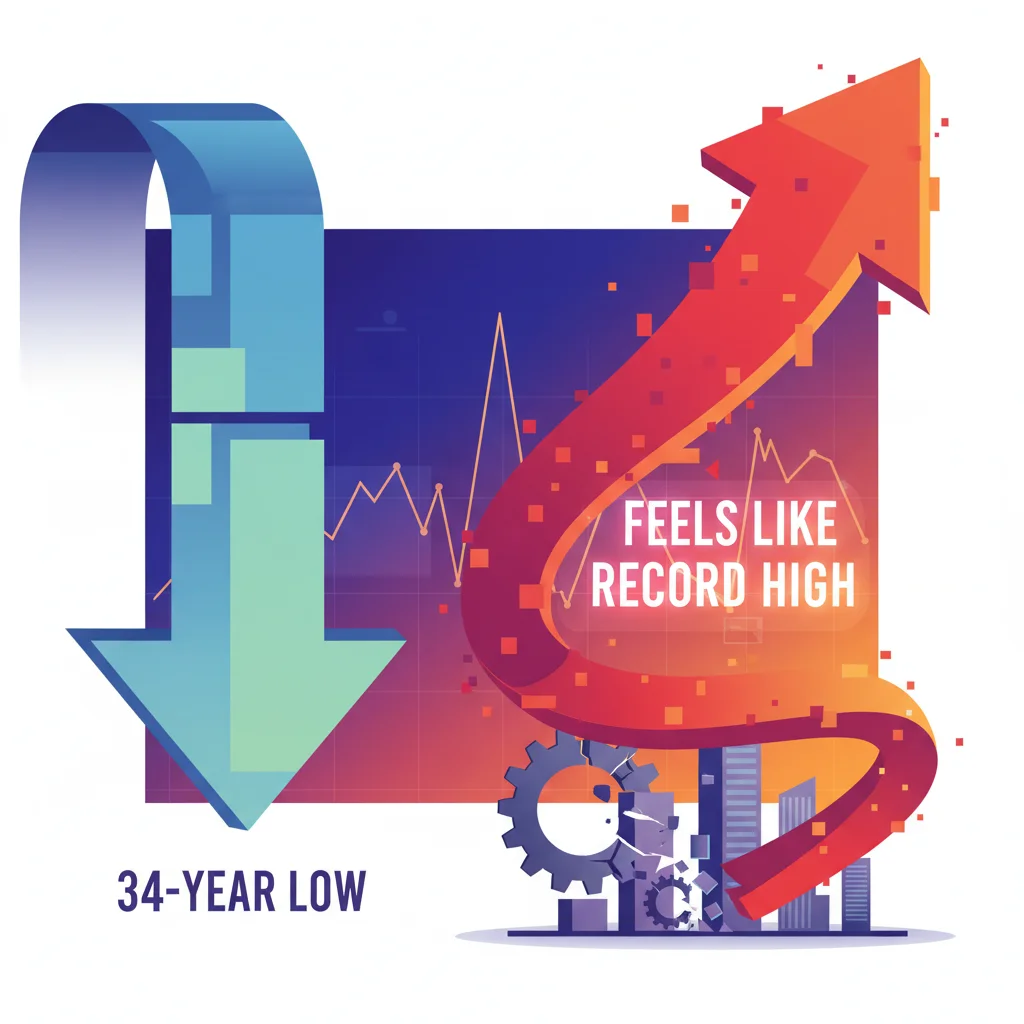

The Business Rates Paradox: Why a “34-Year Low” Feels Like a Record High for UK Businesses

A government claim of a 34-year low in business rates masks a painful reality of soaring bills for UK businesses. We unravel the paradox.

The £4.3bn Squeeze: Is the UK’s Business Rates Shift a Stealth Tax on Recovery?

The UK government’s cut to a pandemic-era business rates discount is being called a “stealth tax,” squeezing small businesses and risking economic recovery.

The Great British Tax Paradox: Decoding the Real Impact of the Latest UK Budget

A deep dive into the UK Budget, revealing how a headline tax cut is overshadowed by fiscal drag, impacting personal finance, the economy, and investors.

The People’s Budget: Decoding Public Demands in a High-Stakes UK Economy

An analysis of public budget demands, from free bus travel to tax cuts, and their impact on the UK economy, investing, and the future of fintech.

The Chancellor’s Tightrope: Why UK Businesses and Families Are Demanding More Than a Pre-Election Budget

On the eve of the budget, UK businesses plead for stability while families face a crucial child benefit decision. What’s at stake for the economy?

The People’s Budget: Decoding Public Demands vs. Economic Reality Ahead of the UK Budget

An in-depth analysis of public demands for the UK Budget, from scrapping stamp duty to funding services, and the economic realities the Chancellor faces.

The Chancellor’s Tightrope: Decoding the Upcoming Budget’s Impact on UK Business and Finance

A deep dive into the UK Budget’s high-stakes implications for business leaders, investors, and the future of the UK economy, finance, and stock market.

The November Budget Crossroads: Navigating Tax Hikes, Spending Cuts, and the Future of the UK Economy

Chancellor Rachel Reeves faces a stark choice between tax rises and spending cuts in the 26 Nov Budget, a decision that will define the UK’s economic future.

The Chancellor’s High-Stakes Gambit: Can the UK Budget Defy Economic Gravity?

Facing slow growth, the UK Budget must perform a delicate balancing act: provide certainty, boost confidence, and fill a major fiscal gap.