stranded assets

Beyond the Brink: Why Climate Tipping Points Are the Ultimate Black Swan for the Global Economy

Climate tipping points are not just an environmental issue; they represent the biggest unpriced, non-linear risk to the global economy and financial markets.

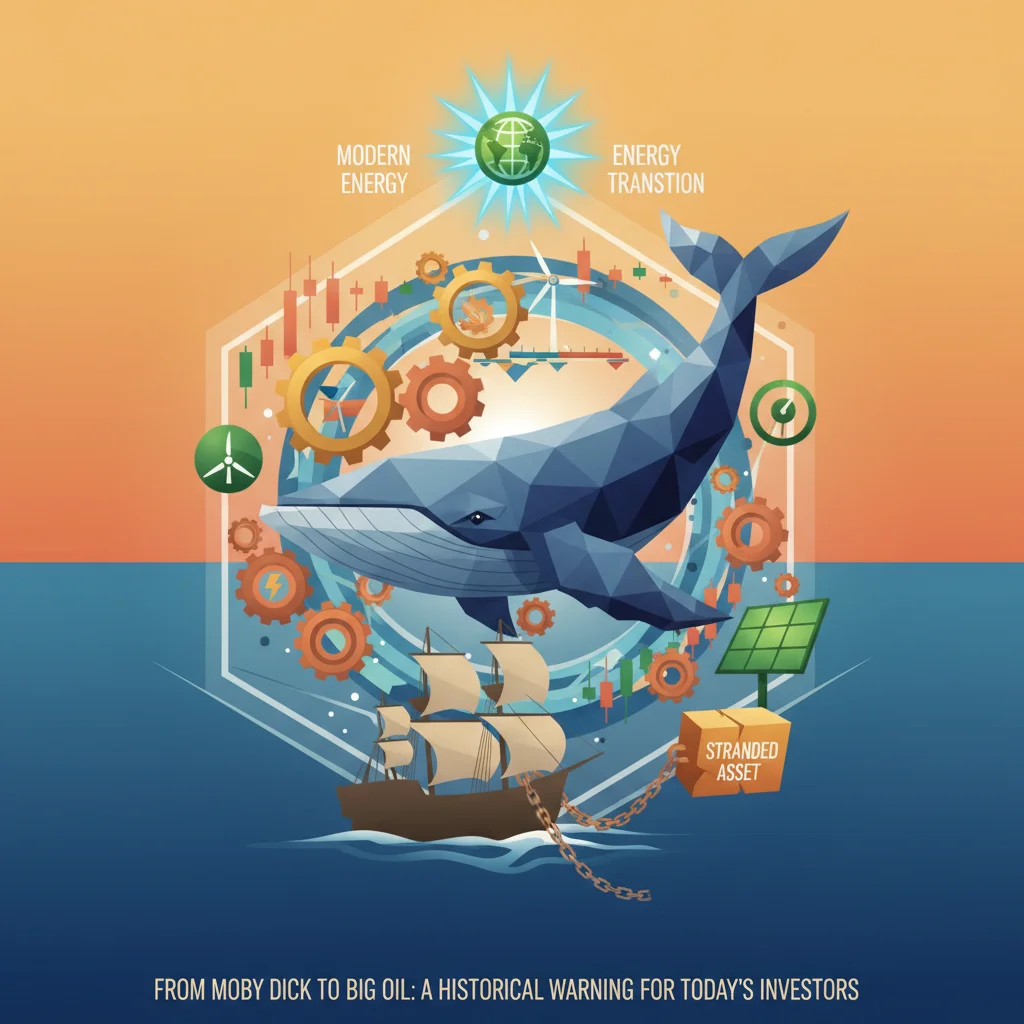

The Whale in the Portfolio: A 19th-Century Lesson on Stranded Assets and the Modern Energy Transition

The 19th-century collapse of the whale oil industry offers a stark warning for today’s fossil fuel investors about stranded assets and technological disruption.

The Ticking Time Bomb in Your Portfolio: Why International Climate Law is Reshaping Finance

International climate law, once seen as toothless, is now a major financial risk as courts force governments and corporations to act.

The £500k Stranded Asset: Why the Economy Can’t Afford to Have Unemployed Doctors

A bottleneck in medical training is creating a costly economic paradox: a doctor shortage alongside unemployed medics. This is a market failure we can’t afford.

The Trillion-Dollar Roadmap: Why a Global Push to Exit Fossil Fuels is the Defining Event for Finance and Investing

Over 80 nations are demanding a fossil fuel exit plan, signaling a seismic shift for the global economy, stock market, and long-term investment strategies.

The Trillion-Dollar Question: How European Courts Are Reshaping the Future of Energy Investing

European courts are shifting from blaming oil firms for past climate damage to questioning if their future business models align with the Paris Agreement.

The Trillion-Dollar Pivot: Why Latin America’s Green Transition is the Next Big Play in Global Finance

Latin America’s shift from fossil fuels is a multi-trillion-dollar opportunity for finance, investing, and fintech. This is the next big global play.

Beyond the Hype: Why Climate Risk is the Real “Monkey Business” for the Global Economy

While markets chase short-term hype, the real systemic risk is climate change. This is the ultimate test for finance, investing, and the global economy.

From a Reader’s Plea to a Financial Mandate: The Economics of Climate Inaction

A reader’s simple plea on climate change is a stark warning to the financial world. It’s time to translate emotion into economics and address climate risk.

Grounded Ambitions: Reassessing the Financial Viability of Airport Expansion in a Climate-Conscious Economy

A UK MPs’ report on airport expansion signals a major shift. Climate risk is no longer just an environmental issue; it’s a core financial concern.

The Trillion-Dollar Legacy: How Climate Policy is Reshaping Finance and the Global Economy

A president’s legacy is measured in economic terms. Climate policy inaction could be the most destructive financial legacy of our time.

The Point of No Return: Why Climate Tipping Points Are Reshaping Global Finance and Investing

Scientists warn that key climate tipping points have been breached, signaling a new era of systemic risk for the global economy, finance, and investing.