Stock Market Analysis

The Uniform Indicator: Why a Second-Hand Clothing Store Is a Must-Watch Signal for the Global Economy

A surge in demand at a second-hand uniform store is a powerful micro-indicator of macro-economic trends, offering key insights for finance and investors.

China’s Economic Paradox: Decoding the Boom, the Doubts, and the Global Impact

China’s official GDP growth, driven by a powerful export boom, is met with significant skepticism from global analysts due to domestic economic weaknesses.

From Boom to Bust: The Economic Hangover Shaking the Global Spirits Market

After a post-pandemic boom, spirits makers face a crisis of oversupply, forcing production halts and price cuts as consumer demand plummets.

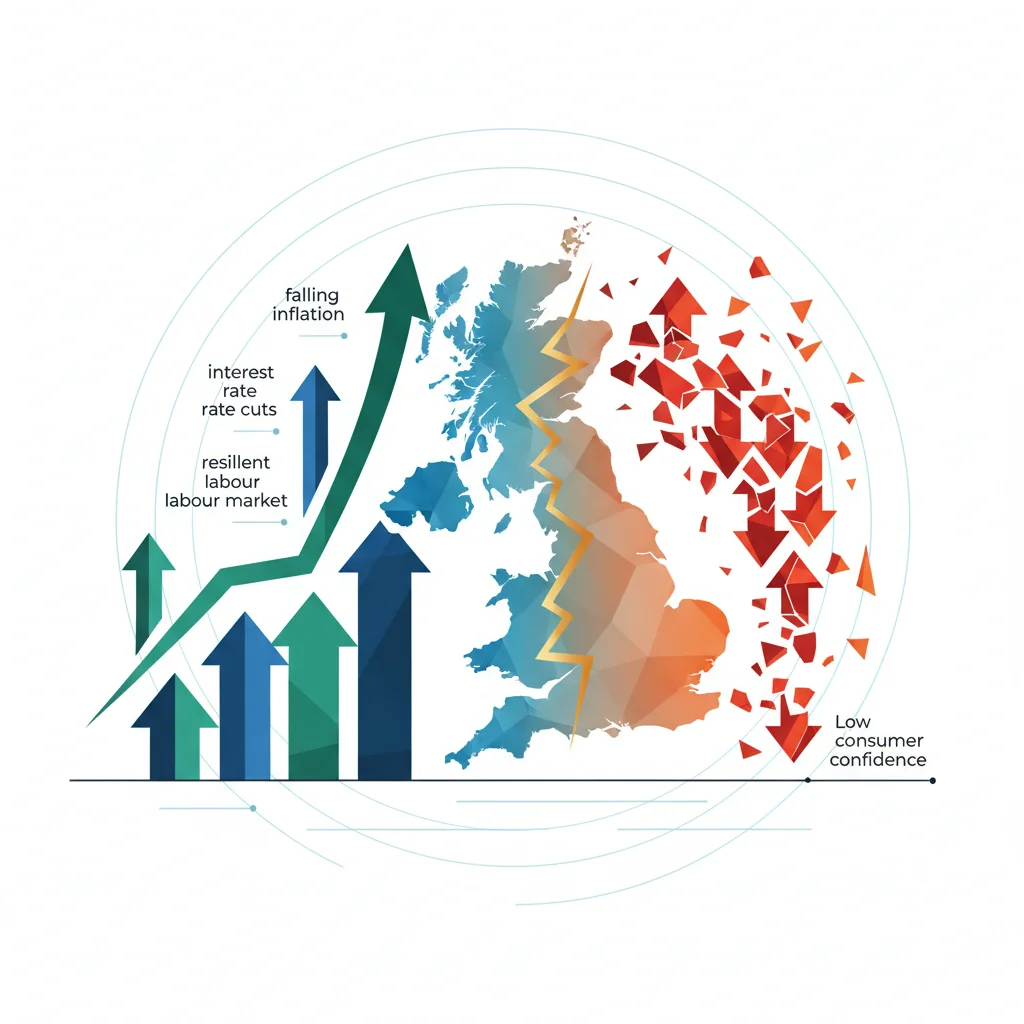

The UK’s Economic Paradox: Why Consumer Confidence Reveals a Nation Divided

Beneath the UK’s rising consumer confidence lies a stark generational divide, with profound implications for investing, finance, and the broader economy.

The Canary in the Coal Mine: What Skipping a Doctor’s Visit in Guernsey Tells Us About the Global Economy

A local healthcare issue in Guernsey reveals deep-seated economic stress, signaling red flags for investors, the stock market, and the global economy.

UK’s Chilly Christmas: Why Muted Retail Sales Are a Red Flag for the 2024 Economy

UK retail spending saw its slowest growth in 7 months this December, a red flag for the economy signaling deep consumer caution amid inflation.

Heineken’s Hangover: Decoding the CEO Exit and What It Means for the Global Economy

Heineken’s CEO exit signals a major shift in the beverage industry, driven by slowing sales and the no-alcohol trend. A deep dive for investors.

Beyond the Logo: The New Economics of Luxury and Why Investors Should Care

The power of a logo is fading. Modern luxury consumers demand more: authenticity, sustainability, and verifiable value. Discover this economic shift.

A Tale of Two Baskets: What Tesco & M&S Christmas Sales Reveal About the UK Economy

A deep dive into Tesco and M&S’s Christmas sales, revealing key insights into consumer behaviour, the UK economy, and strategic investment plays.

The $1.5 Trillion Gambit: Deconstructing the Economic Shockwaves of a Proposed US Defense Budget Overhaul

A proposed $1.5T US defense budget could trigger an economic earthquake. We analyze the impact on the stock market, national debt, and investment strategies.

The 3% Illusion: Why a Minor Correction in Sinochem’s Pirelli Stake Reveals Major Truths About Global Finance

A minor 3% correction in Sinochem’s Pirelli stake reveals major truths about corporate governance, geopolitical risk, and the need for data integrity.

Solving the Financial Puzzle: How to Navigate Today’s Complex Economic Landscape

The global economy is a complex puzzle. This post decodes the key clues in finance, fintech, and investing to help you build a winning strategy.