fossil fuels

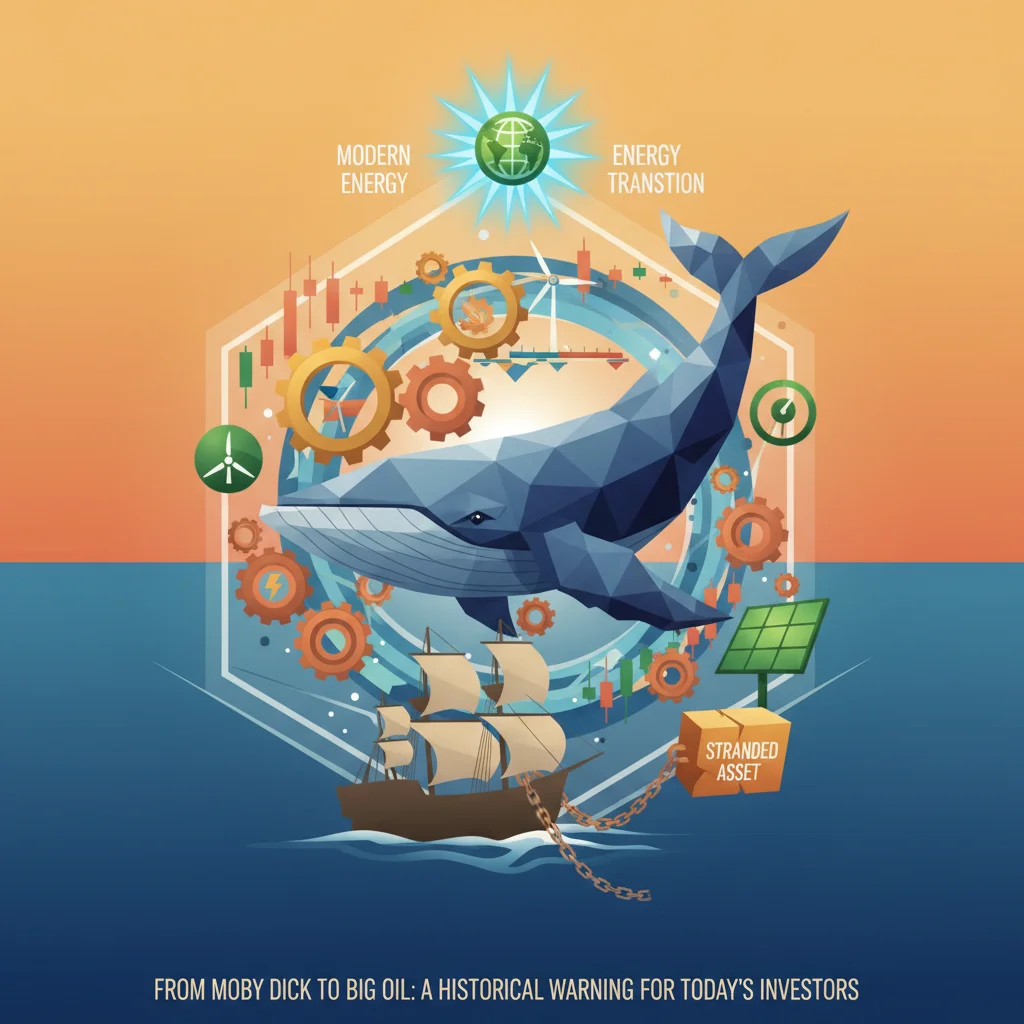

The Whale in the Portfolio: A 19th-Century Lesson on Stranded Assets and the Modern Energy Transition

The 19th-century collapse of the whale oil industry offers a stark warning for today’s fossil fuel investors about stranded assets and technological disruption.

Spain’s Green Revolution on the Brink: A Financial Analysis of Political Risk and Investment Futures

Political instability in Spain threatens its renewable energy leadership, creating significant risks and uncertainty for investors and the national economy.

Shell on Trial: Why a Landmark Climate Lawsuit Could Reshape the Future of Energy Investing

A landmark UK lawsuit by typhoon survivors against Shell signals a new era of climate risk, with profound implications for finance, ESG investing, and the economy.

Labour’s North Sea Pivot: What a New Drilling Strategy Means for the UK Economy and Your Portfolio

Labour’s new North Sea drilling plan signals a major economic and investment shift, balancing energy security with climate goals. What does it mean for you?

The Trillion-Dollar Impasse: Why the COP30 Climate Deadlock is a Critical Signal for Global Finance

The UN climate summit’s deadlock over fossil fuels and finance is a red flag for the global economy, creating major risks for investors and markets.

The 25-Year Fossil Fuel Reality: What the IEA’s Stark Warning Means for Your Investments and the Global Economy

The IEA issues a stark warning: without major policy shifts, oil and gas demand will rise for 25 years. What does this mean for investors and the economy?

Beyond the False Choice: Why Climate Finance is the Key to Unlocking Global Economic Growth

Bill Gates’s idea that developing nations must choose between fossil fuels and climate action is a dangerous false choice. The real path to growth is through green finance.