fintech

London’s Big Bet: Unpacking the UK’s Radical Reforms to Reclaim its Financial Crown

The UK has launched sweeping reforms to its stock market listing rules. Is this the dawn of a new “golden age” for London or a high-stakes gamble?

Davos 2024: Decoding the Global Agenda in an Age of Unprecedented Disruption

Davos 2024 grapples with a perfect storm of geopolitical conflict, the AI revolution, and a fragile global economy. What does it mean for investors?

The Ghost in the Kitchen: How Big Chains Are Disrupting the Market and What It Means for Investors

Large chains are launching “virtual brands” on delivery apps, masquerading as local eateries. This strategy impacts the economy, investors, and small businesses.

The Canary in the Coal Mine: What One Pensioner’s Story Reveals About Our Economic Future

An 84-year-old’s struggle with fuel poverty is a microcosm of major economic trends, revealing systemic risks and opportunities for investors and leaders.

The VAR Paradox: Why We Forgive Human Error But Despise Flawed Algorithms in Finance

The backlash against VAR in football reveals a critical lesson for finance: we are far less tolerant of machine errors than human ones.

Iran’s Tense Calm: A Deep Dive into the Economic Fault Lines and Investment Risks

Beneath Tehran’s tense calm lies a deep economic crisis, where political repression and sanctions fuel a shadow economy driven by fintech and blockchain.

Crypto’s High-Stakes Gamble: Why the Industry Is Suddenly Fighting the Regulation It Begged For

The crypto industry, once desperate for regulation, is now fighting a key US bill it helped create. Discover the high-stakes political gamble behind this reversal.

The £1,500 Refund That Took 15 Months: A Case Study in Corporate Inefficiency and the Fintech Imperative

A 15-month delay for a £1,500 refund reveals deep operational risks, impacting investors, brand value, and highlighting the urgent need for fintech.

The ‘Farage Clause’: Brussels’ New Brexit Gambit and Its High-Stakes Impact on the UK Economy

The EU’s ‘Farage clause’ demand in Brexit talks could reshape the UK’s economic future, creating new risks for investors and key sectors like finance.

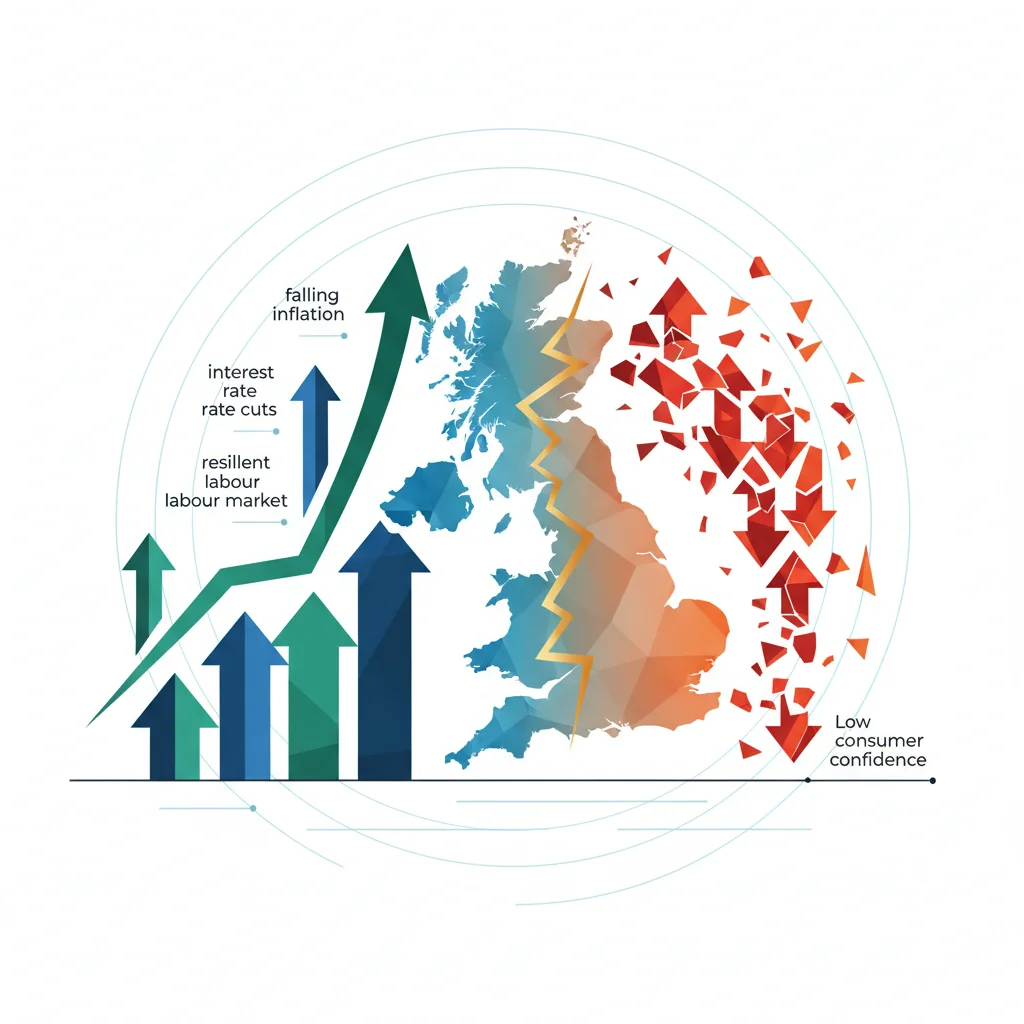

The UK’s Economic Paradox: Why Consumer Confidence Reveals a Nation Divided

Beneath the UK’s rising consumer confidence lies a stark generational divide, with profound implications for investing, finance, and the broader economy.

The ROI of a Free Breakfast: Deconstructing the Financial Power of Corporate Social Responsibility

A local cafe’s charity reveals a powerful link between Corporate Social Responsibility, ESG investing, and long-term financial performance in the modern economy.

Reform UK as a Stock: A Financial Analyst’s Due Diligence on a Political Disruptor

Analyzing Reform UK as a stock reveals a high-risk, high-volatility political asset. Is it a speculative buy for disruption or a penny stock bound to fail?