Financial Planning

Beyond the Generational War: Why Your Birth Year is a Terrible Financial Indicator

Generational labels are a flawed and dangerous lens for viewing finance. Economic conditions, policy, and technology—not birth year—shape our financial lives.

Your 2026 Travel Portfolio: An Investor’s Guide to Maximizing the ROI of Your Time Off

Treat your time off like a financial portfolio. Discover how to apply investment principles to your 2026 travel plans for maximum personal and professional ROI.

Beyond the Tinsel: A Strategic Guide to Holiday Spending in a Shifting Economy

Master holiday spending with expert insights. This guide connects personal finance to economics and investing for a financially secure festive season.

Australia’s $3.5 Trillion Pension Paradox: Why the System’s Biggest Success is Also its Hidden Flaw

Australia’s famed superannuation system is a marvel of wealth accumulation. But a critical flaw in its design leaves retirees facing a perilous future.

The Silent Wallet: Uncovering the Rise of Financial Infidelity and Its Economic Impact

A majority of adults hide purchases from partners, a trend signaling deep financial divides with major implications for investing, fintech, and the economy.

The New UK Mansion Tax: A Deep Dive for Investors and Homeowners

A new UK “mansion tax” on properties over £2m is here. This deep dive analyzes its impact on the economy, real estate investing, and financial planning.

The Chancellor’s Tightrope: Why UK Businesses and Families Are Demanding More Than a Pre-Election Budget

On the eve of the budget, UK businesses plead for stability while families face a crucial child benefit decision. What’s at stake for the economy?

The Paralysis of Prediction: How UK Budget Leaks Are Stalling the Economy

Budget leaks spark debate: Are they harmless political chatter or a genuine threat causing economic paralysis for businesses and investors?

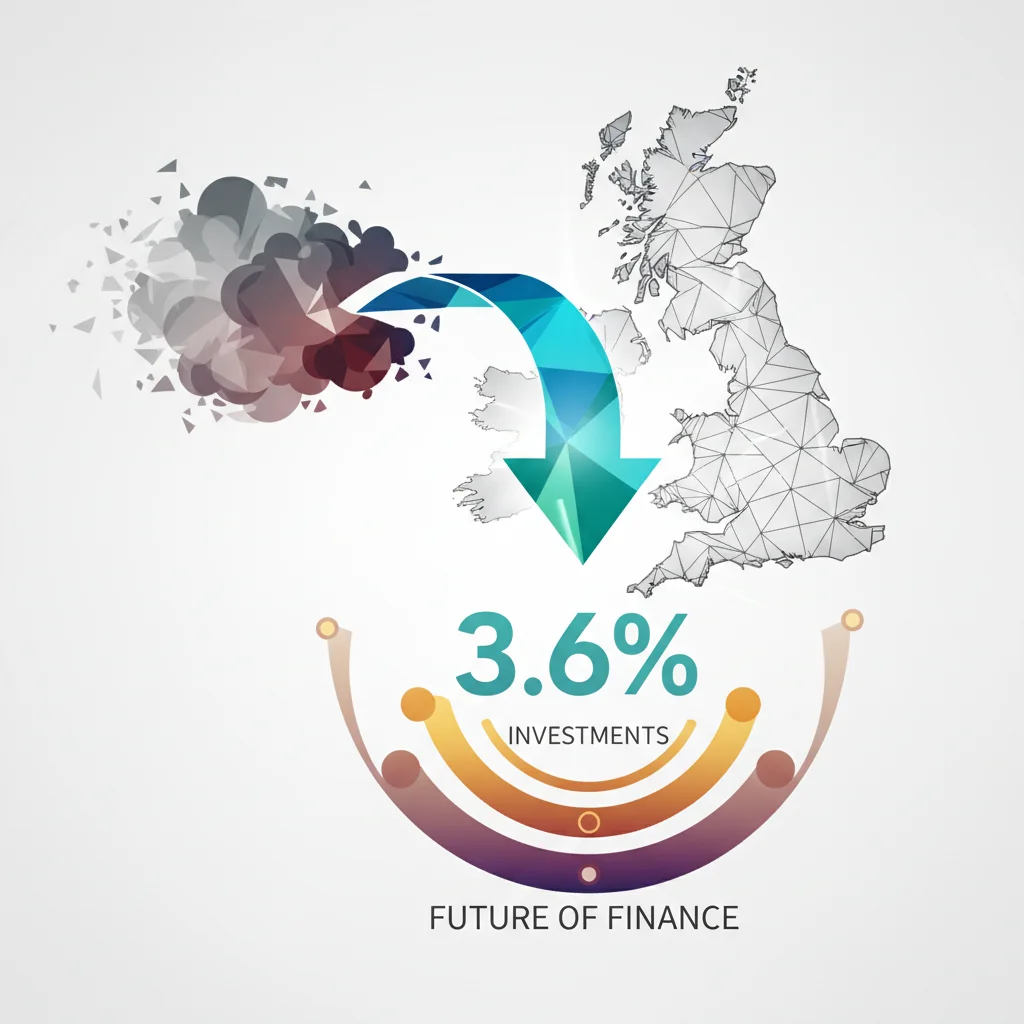

UK Inflation Cools to 3.6%: A Turning Point for the Economy, Your Investments, and the Future of Finance?

The UK inflation rate has dropped to 3.6%, a pivotal moment for the economy. Discover what this means for investors, the stock market, and fintech.

The Debit Card Deception: Why Your ‘Safe’ Spending Habit Could Be a Major Financial Risk

The common belief that debit is ‘good’ and credit is ‘bad’ is a dangerous oversimplification. Discover the hidden risks and powerful protections.

The £1 Million ISA: Decoding the Investment Playbook of the UK’s 5,000 Tax-Free Millionaires

Discover the investment playbook of the UK’s 5,000 ISA millionaires. Learn their secrets of infrequent trading, global diversification, and long-term success.

Beyond the Basics: Four Pillars of Financial Mastery in the Modern Economy

Transform simple saving habits into a sophisticated wealth-building strategy. Learn to master cash flow, automate investing, and leverage fintech for success.