ESG investing

The £200 Micro-Miracle: How a Community Shop Rewrites the Rules of Economics and Investing

A local shop saving families £200/month is more than charity; it’s a blueprint for the future of finance, ESG investing, and economic resilience.

The Unpriced Risk: What Climate Fiction Teaches the World of Finance

Climate fiction isn’t just art; it’s a qualitative risk report. This is what investors and business leaders must understand about pricing climate risk.

The Sentimental Value Portfolio: Balancing Art and Science in Modern Investing

A film’s themes of sentimental value and generational divides offer a powerful allegory for modern finance, from stock market valuation to fintech disruption.

The Cardboard Economy: What Your Christmas Deliveries Reveal About the Stock Market and Global Finance

The “cardboard economy” is a powerful, real-time barometer of consumer health, offering key insights for finance, the stock market, and ESG investing.

The Price of “Proportionate” Risk: Why a New Building Safety Law Could Burn Investors

A new Welsh building safety law is being called “spineless” by industry critics, creating a potential minefield of risk for investors and the economy.

Beyond the Barrel: Why BP’s $6 Billion Castrol Deal Signals a Seismic Shift in Energy Investing

BP’s $6bn sale of a Castrol stake to Stonepeak isn’t just a deal; it’s a sign of a seismic shift in energy, finance, and private capital investment.

From Food Parcels to Financial Portfolios: The Investment Case for the Social Economy

Discover how social supermarkets are more than charity; they are a sophisticated economic model with huge implications for ESG investing, fintech, and the economy.

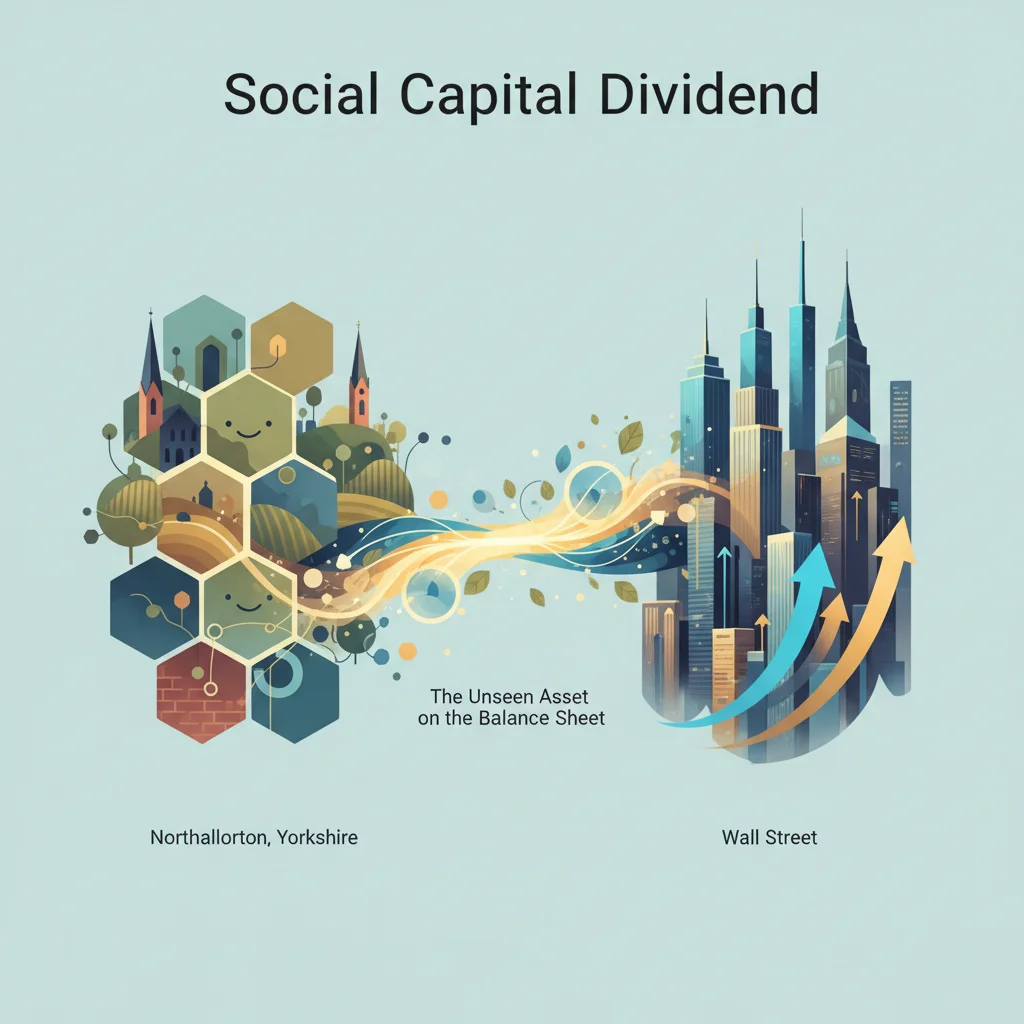

The Social Capital Dividend: What a Yorkshire Town Can Teach Wall Street About Real Investment

A Yorkshire town’s welcome for refugees offers a powerful lesson on social capital—the most undervalued asset in the modern economy and a key to long-term growth.

The ROI of a Fish and Chip Supper: Deconstructing the Economics of Corporate Goodwill

A fish and chip shop’s charity reveals a key lesson for investors: corporate goodwill is a powerful, measurable asset in the modern financial economy.

The Plastic Price War: Why the EU’s Crackdown on Cheap Imports is a Game-Changer for Investors

The EU is cracking down on cheap plastic imports to save its recycling industry, a move with huge economic and investment implications.

The Invisible Drag: Why Child Homelessness Is a Ticking Time Bomb for the U.S. Economy

Child homelessness isn’t just a social crisis; it’s a multi-trillion-dollar economic time bomb. Discover the hidden costs and financial solutions.

Beyond the Balance Sheet: Why a Local Florist’s Success is a Major Signal for the Stock Market

A local florist’s surprising success reveals deep insights into consumer behavior, ESG investing, and the real drivers of the modern economy.