behavioral finance

The VAR Paradox: Why We Forgive Human Error But Despise Flawed Algorithms in Finance

The backlash against VAR in football reveals a critical lesson for finance: we are far less tolerant of machine errors than human ones.

Beyond the Numbers: What a 10-Digit Puzzle Reveals About Our Financial World

A simple 10-digit puzzle reveals a profound truth about the self-referential nature of markets, economics, and financial technology.

The £40,000 Freeloader: What a Serial Fare Evader Reveals About Systemic Risk, the Economy, and the Fintech Revolution

A man’s 112 unpaid train tickets reveal deep truths about systemic risk, behavioral economics, and the future of finance and fintech.

Hushed Caskets & Bull Markets: A Keatsian Guide to Escaping Financial Insomnia

Sleepless nights over your portfolio? This post explores the high cost of financial anxiety and offers strategies to reclaim your peace of mind in finance.

Beyond the Ticker: What John Maynard Keynes’s Wine Cellar Teaches Us About Modern Investing

John Maynard Keynes’s contrarian wine-investing strategy offers timeless lessons that challenge today’s data-driven, fintech-obsessed financial world.

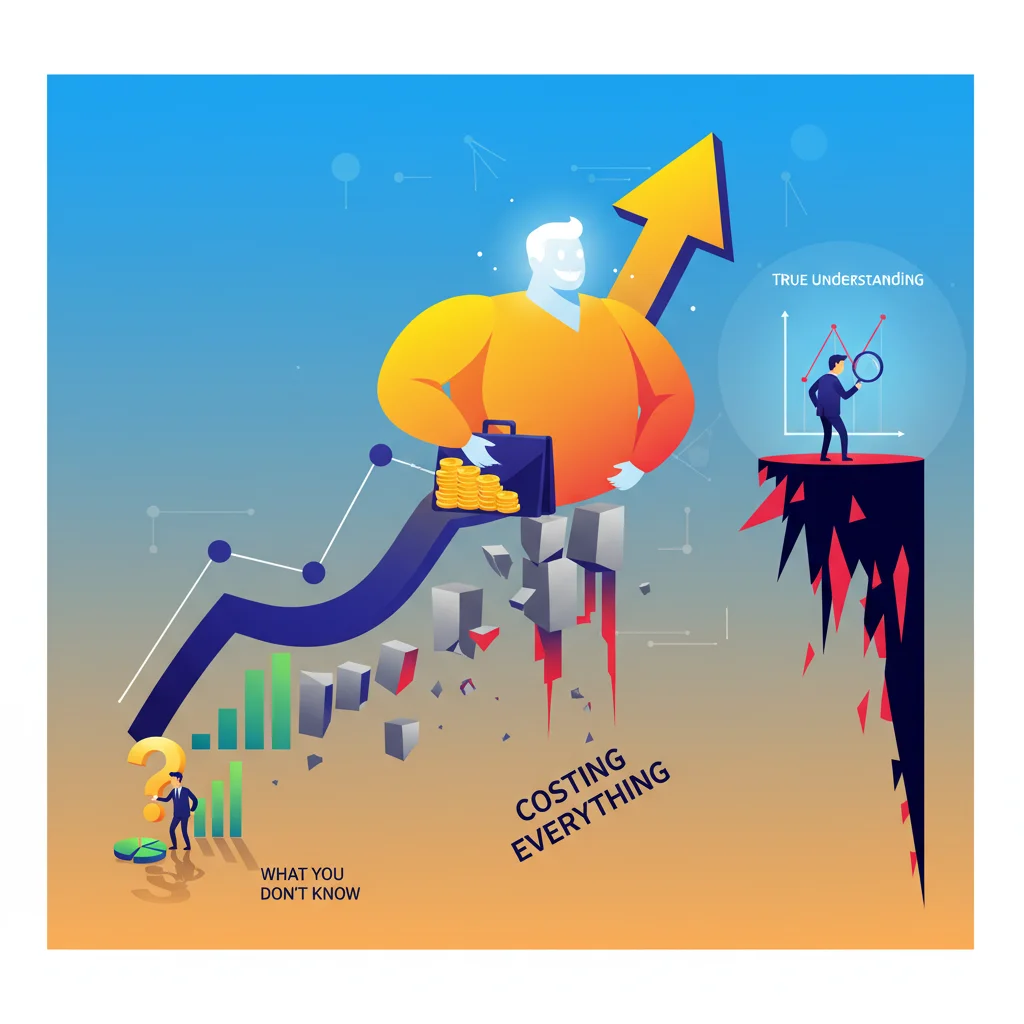

The Dunning-Kruger Effect in Your Portfolio: Why What You Don’t Know Can Cost You Everything

Cognitive blind spots and overconfidence are the biggest risks in finance. Learn why knowing what you don’t know is the key to successful investing.

The Brussels Sprout Effect: Why Seemingly Small News Can Trigger a Stock Market Stampede

A short letter to the FT about sprouts serves as a perfect metaphor for how minor, unpalatable news can trigger oversized, irrational stampedes in finance.

The Market is a Board Game: Unpacking the Unseen Rules of Finance Through Joanna Kavenna’s “Seven”

A mind-bending novel offers a surprising lens on finance, revealing the stock market as a game and the economy as a story we collectively tell.

The Christmas Card Portfolio: Reimagining a Holiday Tradition for the Modern Investor

A novel idea to replace Christmas cards with equity investments offers a powerful lesson in finance, fintech, and long-term wealth creation.

The Economist’s Dangerous Blind Spot: Why Mainstream Models Fail Investors

Mainstream economics has a dangerous blind spot that fails investors. Discover the hidden risks and the alternative theories that can lead to smarter decisions.

The ‘Run Away’ Economy: Decoding Competing Plotlines in Your Investment Portfolio

Like a Harlan Coben thriller, today’s economy is full of twists. Learn to navigate the competing plotlines and secure your financial future.

The Quant Who Broke the World: Robert McNamara’s Cautionary Tale for Modern Finance and Leadership

A brilliant technocrat’s journey from corporate savior to wartime architect offers a chilling cautionary tale for today’s data-driven leaders and investors.