banking

Beyond the Textbook: The Economic Principles Shaping Modern Finance and Investing

Remember high school economics? For many, it was a blur of supply and demand curves, abstract theories about scarcity, and discussions of GDP that felt worlds away from our daily lives. We memorized definitions for a test and promptly forgot them. But what if those foundational lessons are the most critical, yet overlooked, tool for […]

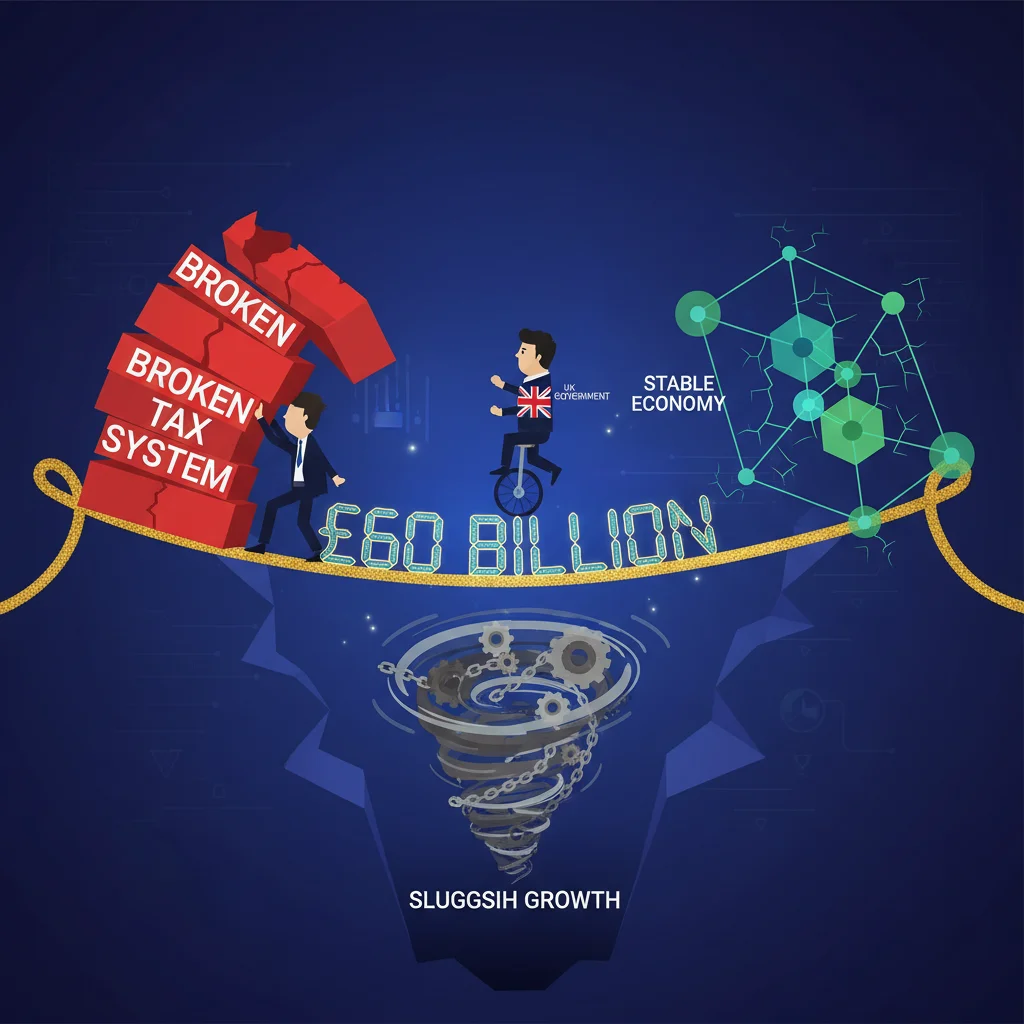

The £60 Billion Tightrope: Can the UK’s Next Government Fix a Broken Tax System Without Breaking the Economy?

The United Kingdom stands at a fiscal precipice. For the incoming government, the keys to Number 11 Downing Street come with a poisoned chalice: a national economy grappling with sluggish growth, strained public services, and a mountain of public debt. The old levers of economic policy—a tweak to income tax here, a nudge to corporation […]

Dieselgate’s Long Shadow: Why the Emissions Scandal Still Rocks the Financial World

The Scandal That Won’t Die: A New Trial Reignites a Decade-Old Corporate Crisis Nearly a decade after the “Dieselgate” scandal first erupted, sending shockwaves through the global automotive industry and the financial markets, the story is far from over. A massive new trial has begun in London’s High Court, representing the latest chapter in this […]

The Geographer’s Guide to the Galaxy of Finance: Why Your Atlas is as Important as Your Balance Sheet

In the hallowed halls of finance, we are trained to revere the numbers. We dissect earnings reports, scrutinize P/E ratios, and build intricate models to predict the future of the stock market. We speak the language of economics, of quantitative analysis, and of market sentiment. But what if I told you that one of the […]

The Green Battery of South America: Is Paraguay Powering the Next Global Tech Hub?

When investors and business leaders scan the globe for the next great technology hub, their eyes typically land on familiar names: Silicon Valley, Tel Aviv, Bangalore, or Shenzhen. These centers of innovation are defined by venture capital, elite talent, and a relentless drive for disruption. But what if the defining characteristic of the next tech […]

Beyond the Game: Why Elon Musk’s “World Model” AI is a Multitrillion-Dollar Bet for Investors

In the relentless arena of technological supremacy, the battle lines are constantly being redrawn. While the world remains captivated by generative AI’s ability to write poems and create images, a far more profound revolution is quietly taking shape. It’s a race to build not just intelligent agents, but entire simulated realities. Now, Elon Musk’s ambitious […]

Gold Beyond $4,000? Decoding the Market Forces Behind the Ultimate Safe Haven

The glint of gold has captivated humanity for millennia, serving as a symbol of wealth, power, and stability. In modern finance, its role is no less significant. When the Financial Times posed a hypothetical scenario for economics students—gold prices topping $4,000 for the first time—it wasn’t just an academic exercise. It was a prompt to […]

Beyond the Budget Box: Why the UK Needs a Tax Revolution, Not a Quick Fix

The Siren Song of Simple Tax Tweaks As the UK political and economic landscape braces for a potential shift in government, all eyes are on the upcoming Budget and the fiscal strategy of Shadow Chancellor Rachel Reeves. In this high-stakes environment, the temptation to offer voters simple, palatable “tax fixes” is immense. A small cut […]

France’s New Government Walks a Political Tightrope: What the High-Stakes Budget Battle Means for the Global Economy

In the grand theater of European politics, a new act has begun in France. President Emmanuel Macron, navigating the complexities of a fractured parliament, has appointed a new government under Prime Minister Sébastien Lecornu. Their first and most formidable challenge: to finalize a national budget under the looming threat of a no-confidence vote from a […]

Unlocking Britain’s Potential: How New Planning Reforms Could Reshape the UK Investment Landscape

For decades, the United Kingdom’s economic potential has been shackled by a planning system renowned for its complexity and glacial pace. Major infrastructure projects and vital housing developments often languish for years in a bureaucratic quagmire, deterring investment, stifling growth, and exacerbating the national housing crisis. However, a significant policy shift is on the horizon. […]

The Economic Frontline: How Strikes on Russian Energy are Reshaping Global Finance

The New Battlefield: Where Geopolitics and Your Portfolio Collide In the intricate dance of global markets, the most significant moves often happen far from the trading floors of New York or London. Today, the critical front is not in a boardroom but in the skies over Russia, where a strategic campaign against the nation’s energy […]

Macron’s High-Stakes Gambit: Can France’s New Cabinet Secure Its Economic Future?

In the high-stakes world of European politics, France has just made a pivotal move. With the appointment of 34-year-old Gabriel Attal as its youngest-ever prime minister, President Emmanuel Macron is signaling a desire for new energy. Yet, a closer look at Attal’s newly formed cabinet reveals a different story—one of deliberate, calculated continuity. Key figures, […]