Sustainable Finance

Primate Principles: What Chimpanzees Can Teach Us About a Smarter Financial Future

A lesson from chimpanzees suggests that reciprocal altruism, not pure self-interest, is the key to a more resilient and sustainable financial future.

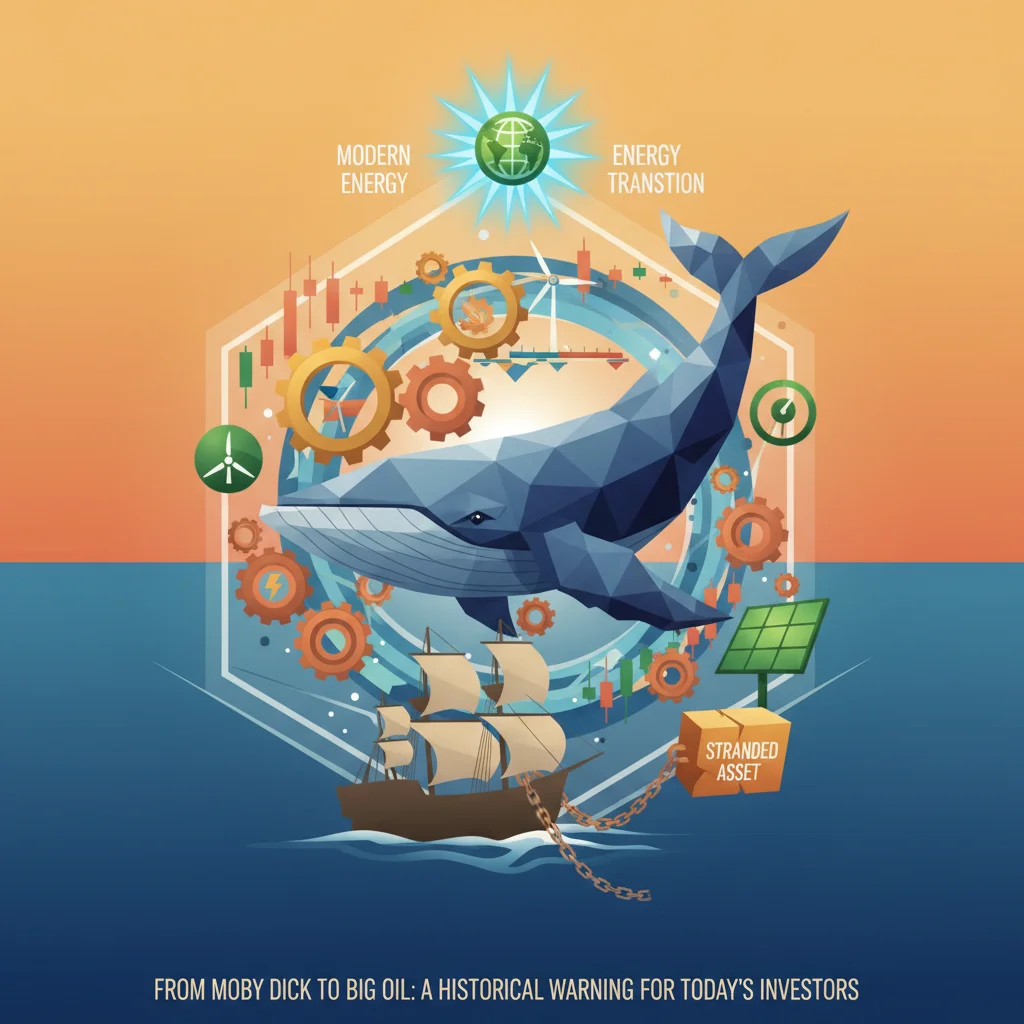

The Whale in the Portfolio: A 19th-Century Lesson on Stranded Assets and the Modern Energy Transition

The 19th-century collapse of the whale oil industry offers a stark warning for today’s fossil fuel investors about stranded assets and technological disruption.

Indonesia’s $20 Billion Gamble: Forests for Food and the New Fault Line in ESG Investing

Indonesia’s plan to clear 3mn hectares of forest for food security creates a major conflict for ESG investors and the global economy.

Untangling the Green Tape: Is the EU’s Climate Ambition Creating a Global Trade Nightmare?

The EU’s ambitious climate regulations, like the CBAM, risk creating a “green spaghetti bowl” of complex rules that stifle trade and harm developing nations.

The EU’s High-Stakes Gamble: Why Diluting Corporate Due Diligence is a Losing Bet for the Global Economy

The EU’s landmark due diligence law faces pressure for dilution. This is a mistake for investors, finance, and the long-term health of the global economy.

Beyond the Bottom Line: How Europe’s New Reporting Rules Are Redefining Global Finance

A new EU regulation, CSRD, is revolutionizing global finance with “double materiality,” forcing companies to report on both their financial risks and their societal impact.

Natural Capital or Natural Treasure? The Words Shaping the Future of Sustainable Investing

The language of finance prices nature as “natural capital,” but risks emotional detachment. We explore a dual-language approach for sustainable investing.

The Trillion-Dollar Ripple Effect: Why a Farmer’s Poverty is Wall Street’s Problem

The economic precarity of the world’s poorest farmers is not just a social issue; it’s a systemic risk for the global economy and a major opportunity.

The £100 Billion Dividend: How the UK’s Green Transition Will Reshape the Economy and Your Portfolio

A landmark forecast suggests the UK’s green energy shift could halve energy costs as a share of GDP by 2050, unlocking a £100bn+ economic dividend.

From Protest to Portfolio: The Financial Reboot of Green Activism

A new era of activism is dawning, moving from street protests to the stock market. Discover how shareholder engagement is rebooting the green movement.

Beyond the Balance Sheet: Why the EU’s Due Diligence Law is a Game-Changer for Finance and a Myth-Buster for Critics

The EU’s new CSDDD isn’t a threat but a financial game-changer, debunking myths and creating a new playbook for investors and business leaders.

The Carbon Tax is Coming for Your Shopping Cart: What the EU’s CBAM Expansion Means for Global Finance

The EU’s carbon border tax (CBAM) is expanding to consumer goods, a move set to reshape global trade, finance, and investment strategy.