Investment Strategy

Beyond the Shopping Cart: What Gold, Tech, and a Sunny Summer Tell Us About the Real Economy

Recent retail data reveals a split economy: while food sales stagnate, good weather and economic anxiety are fueling spending on clothing, gold, and tech.

Sunshine and Spending: Is the UK’s Retail Surge a True Economic Dawn or a Weather-Driven Mirage?

UK retail sales hit their highest level since 2022, spurred by good weather. Is this a sign of economic recovery or a temporary blip?

Beyond the Ballot Box: Why a Welsh By-Election Is a Red Flag for UK Investors

A local by-election signals a major shift in UK political risk, with profound implications for the economy, finance, and long-term investment strategy.

Echoes of 1929: Is Today’s Tech Boom a Modern-Day Tale of “Shiny Toy Hubris”?

A look at the “shiny toy hubris” of the 1920s and its eerie parallels to today’s tech-driven market, exploring lessons on investing and market psychology.

The Trillion-Dollar Handshake: Unpacking the Global Economic Stakes of the Trump-Xi Summit

A deep dive into the Trump-Xi summit’s impact on the global economy, stock market, finance, and investment strategies.

The Great Economic Card Trick: Are You Watching the Wrong Hand?

An analysis of the economic “card trick” where soaring markets, fueled by central bank liquidity, distract from underlying issues like inflation and inequality.

The £150 Billion Problem: How Britain’s Health Crisis is Quietly Crippling its Economy

Britain’s economic inactivity crisis, driven by long-term sickness, is a major threat to its economy, impacting finance, investing, and public policy.

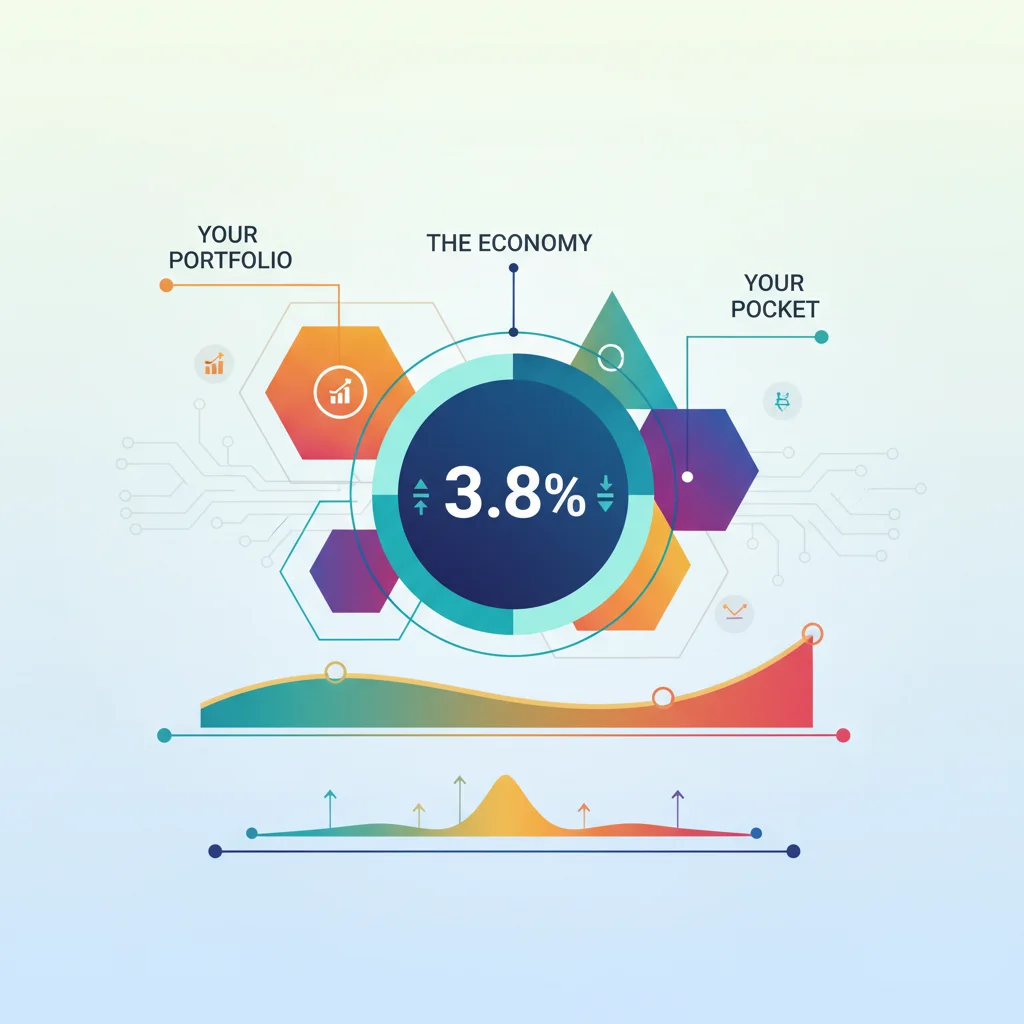

UK Inflation Holds at 3.8%: What This Number Really Means for Your Portfolio, Your Pocket, and the Economy

UK inflation holds at 3.8%. We break down what this key economic indicator means for your savings, investments, and the future of the UK economy.

The Financial War: How New US Sanctions are Reshaping Global Energy and Investment

A deep dive into the new US sanctions on Russian oil, analyzing their impact on the global economy, finance, investing, and the stock market.

The Bitter Truth: Unwrapping the Complex Economics Behind Your Shrinking Chocolate Bar

A 15% price surge and shrinking sizes reveal a complex story of commodity trading, shrinkflation, and the global economy’s impact on your chocolate bar.

The Bitter Truth: How Your Shrinking Chocolate Bar Explains Global Finance and the Economy

Your shrinking chocolate bar isn’t just shrinkflation; it’s a lesson in global finance, commodity trading, and the economic impact of supply chain crises.

Beyond the Headlines: Decoding the New US Sanctions on Russia’s Oil and the Global Economic Fallout

New US sanctions on Russian oil are more than a headline; they’re a complex financial maneuver with global economic and investment implications.