Investment Strategy

The Financial Polymath: Why Solving for ‘X’ in Today’s Economy is Like a Crossword Puzzle

Modern finance is a complex puzzle. Success requires a polymath’s mind to navigate the intersection of macroeconomics, technology, and global events.

The Ghost in the Machine: Are Modern Trading Apps Just 1920s Bucket Shops in Disguise?

Modern fintech promises to democratize finance, but a historical lens reveals unsettling parallels between today’s trading apps and 1920s bucket shops.

The Great Myth of the Maverick CEO: Are Capitalists Innovators or Just Accumulators?

Forget entrepreneurial flair. This post explores the argument that modern capitalism is a system of wealth accumulation, not just innovation.

King Henry II’s Sour Grapes: A 12th-Century Lesson in Modern Finance and Supply Chain Risk

A 12th-century king’s massive wine purchase went sour, offering timeless lessons on supply chain risk, value investing, and modern financial technology.

The Goldilocks Economy: Why “Just Right” Is the Hardest Target in Modern Finance

Unpacking the “Goldilocks economy”: a state of ideal balance that is the ultimate, yet elusive, goal for central banks, investors, and modern finance.

The AI Feedback Loop: How a Billionaire’s Theory Explains the Tech Gold Rush

Is the AI boom a bubble? Legendary investor George Soros’s theory of reflexivity offers a powerful lens to understand the feedback loop driving AI hype.

FTSE 100 Shatters 10,000: A New Era for UK Markets or a Precarious Peak?

The FTSE 100 has shattered the 10,000 mark for the first time, signaling a potential new era for the UK stock market. What’s driving this historic rally?

China’s High-Stakes Gamble: Can an Export Blitz Revive a Stagnant Economy?

China is doubling down on its export-led growth model to combat domestic deflation, risking a new wave of global trade wars. What does this mean for investors?

The 2026 Climate Crossroads: Two Major Tests That Will Define the Future of Green Finance

The year 2026 marks a critical test for climate action, as the EU’s carbon tax and major clean energy projects will reshape global finance and trade.

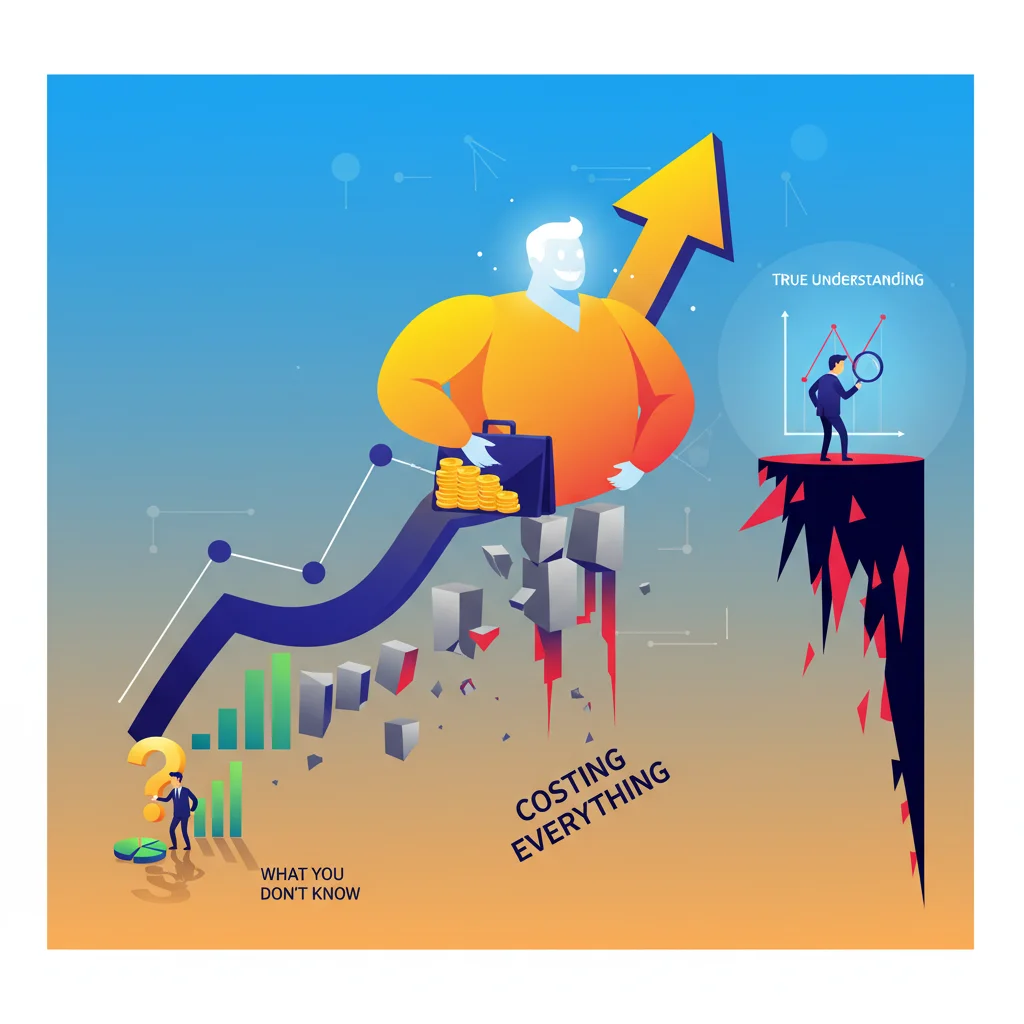

The Dunning-Kruger Effect in Your Portfolio: Why What You Don’t Know Can Cost You Everything

Cognitive blind spots and overconfidence are the biggest risks in finance. Learn why knowing what you don’t know is the key to successful investing.

Beyond the Classroom: An Investor’s Guide to the Economic Fallout of UK School Fee VAT

A deep dive into the economic fallout of the UK’s proposed VAT on private school fees, revealing concentrated impacts and unintended consequences for investors.