Geopolitical Finance

The Price of Power: How a Trump Megadonor’s Firm Scored the First Venezuelan Oil Deal

A Trump megadonor’s firm, Vitol, secured the first US-approved Venezuelan oil deal, raising questions about the intersection of politics and finance.

The Nobel Gambit: What María Corina Machado’s White House Visit Means for Venezuela’s Economy and Global Investors

Machado’s White House visit highlights the deep link between Venezuela’s political future and its economic recovery, a high-stakes gamble for global investors.

Nvidia’s Tightrope Act: Navigating the US-China Tech War for AI Supremacy

Nvidia navigates the US-China tech war by selling modified AI chips to China, a move with huge implications for investors, finance, and the global economy.

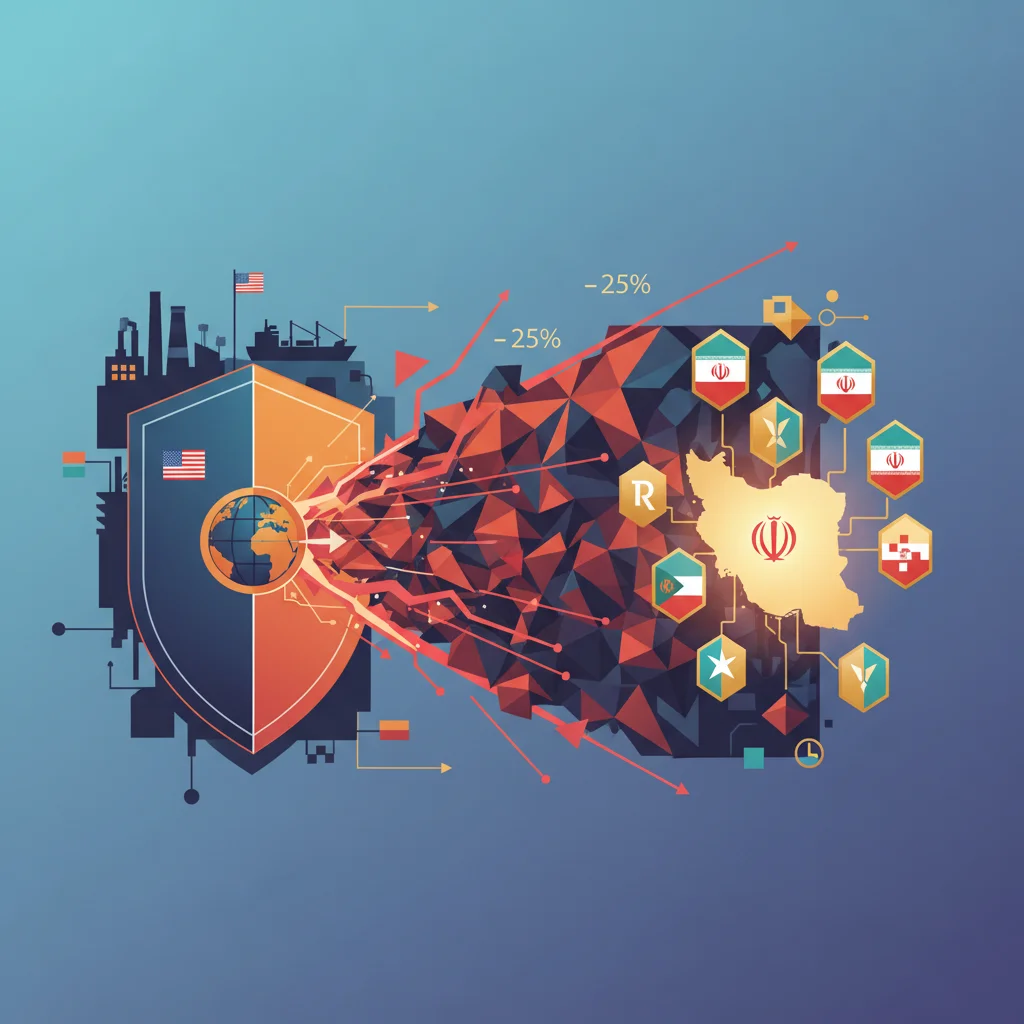

The New Economic Iron Curtain: Decoding Trump’s 25% Tariff Threat on Iran’s Trade Partners

A new 25% US tariff threat on countries trading with Iran could reshape global finance, impacting the economy, stock market, and international banking.

The Silent War on the Dollar: Why Legal Attacks on the Fed Threaten Global Financial Stability

Political “lawfare” targeting the Federal Reserve and its chair, Jay Powell, poses a serious threat to the U.S. dollar’s global dominance.

The EU’s New Arsenal: How Loans-for-Arms Will Reshape European Finance and Defense

The EU is launching a “loans-for-arms” program, a seismic shift in policy that merges high finance with defense, reshaping the European economy and stock market.

Clash of Titans: Trump, Exxon, and the High-Stakes Gamble for Venezuelan Oil

A clash between Donald Trump and Exxon’s CEO over investing in Venezuela highlights the growing political risks facing multinational corporations in a volatile world.

The Digital Euro: Europe’s Final Defense for Monetary Sovereignty?

Top economists, including Thomas Piketty, urge MEPs to back the digital euro as a crucial defense of Europe’s monetary sovereignty against US tech giants.

The Venezuelan Oil Gambit: A High-Stakes Bet on a Post-Maduro Economy

A potential Trump administration could ease sanctions on Venezuela post-Maduro, creating a high-stakes scenario for oil investors and the global economy.

Beyond the Balance Sheet: The Geopolitical Chess Match for Global Currency Supremacy

The push for de-dollarization is not just business; it’s a geopolitical strategy with huge implications for finance, investing, and the global economy.

Venezuela’s Oil Crossroads: A $100 Billion Gamble or the Next Great Investment?

A high-stakes meeting reveals a deep divide: Exxon calls Venezuela “uninvestable” while Chevron sees 50% growth potential. What’s next for investors?

The Venezuelan Oil Gambit: Why Trump’s $100 Billion Pitch Clashed with Corporate Reality

Trump’s ambitious $100B plan for Venezuela’s oil meets a wall of skepticism from executives who call the nation ‘uninvestable’ due to past seizures.