Economic Theory

The No-Free-Lunch Economy: What a Simple Seat Upgrade Teaches Us About Inflation, Investing, and the Stock Market

A simple request for a flight upgrade reveals a deep economic truth: there’s no free lunch. This principle explains the inflation reshaping our economy today.

The Cellular Secret to Economic Stability: What Biology Teaches Us About Supply Chains, Fintech, and Market Crashes

A lesson from cellular biology reveals why supply chains, fintech, and the stock market are more fragile than they seem, all thanks to queueing theory.

The Ultimate Black Swan: What the Search for Alien Life Teaches Us About Investing and Risk

The search for alien life offers a profound masterclass in risk, probability, and long-shot investing, with key lessons for finance, fintech, and the economy.

The Dressmaker’s Economy: Why Our Measures of Growth Are All Wrong

A dressmaker’s letter to the FT reveals a deep flaw in how we measure our economy, with huge implications for finance, investing, and fintech.

The Cardboard Box Economy: Unpacking Hidden Value in the Foundations of Finance

Discover how the simplest concepts in finance, like cardboard in art, are being transformed into revolutionary innovations like blockchain and index funds.

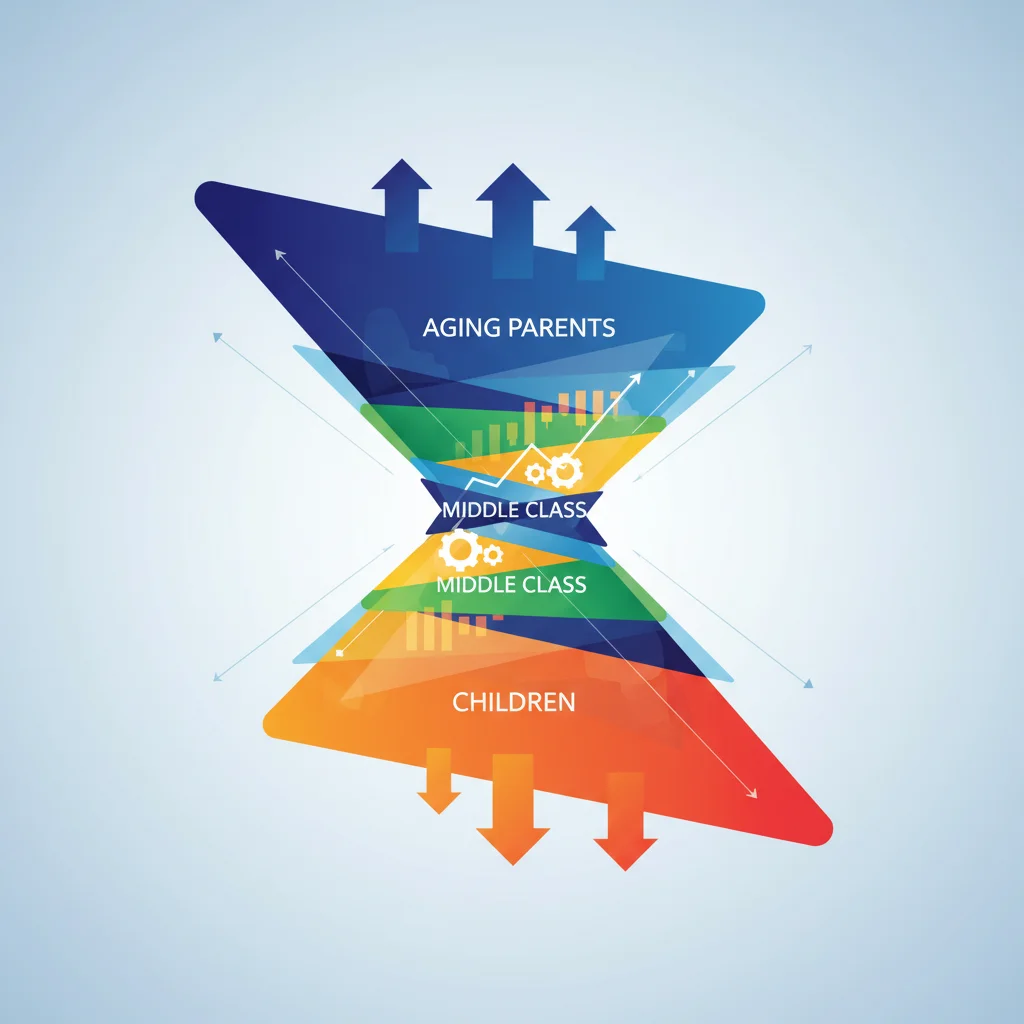

The Sandwich Economy: Why the Middle Class is Being Squeezed and What it Means for Investors

The middle class is the filling in an economic sandwich, squeezed by the wealthy and the poor. This powerful metaphor explains the unsustainable pressures on our economy.

The Great Myth of the Maverick CEO: Are Capitalists Innovators or Just Accumulators?

Forget entrepreneurial flair. This post explores the argument that modern capitalism is a system of wealth accumulation, not just innovation.

The Goldilocks Economy: Why “Just Right” Is the Hardest Target in Modern Finance

Unpacking the “Goldilocks economy”: a state of ideal balance that is the ultimate, yet elusive, goal for central banks, investors, and modern finance.

Beyond Infinite Growth: Why Planetary Limits Are the New Frontier for Finance and Investing

Our economic models demand infinite growth, but our planet is finite. This post explores why Earth’s limits are the biggest risk and opportunity in finance.

The Economist’s Dangerous Blind Spot: Why Mainstream Models Fail Investors

Mainstream economics has a dangerous blind spot that fails investors. Discover the hidden risks and the alternative theories that can lead to smarter decisions.

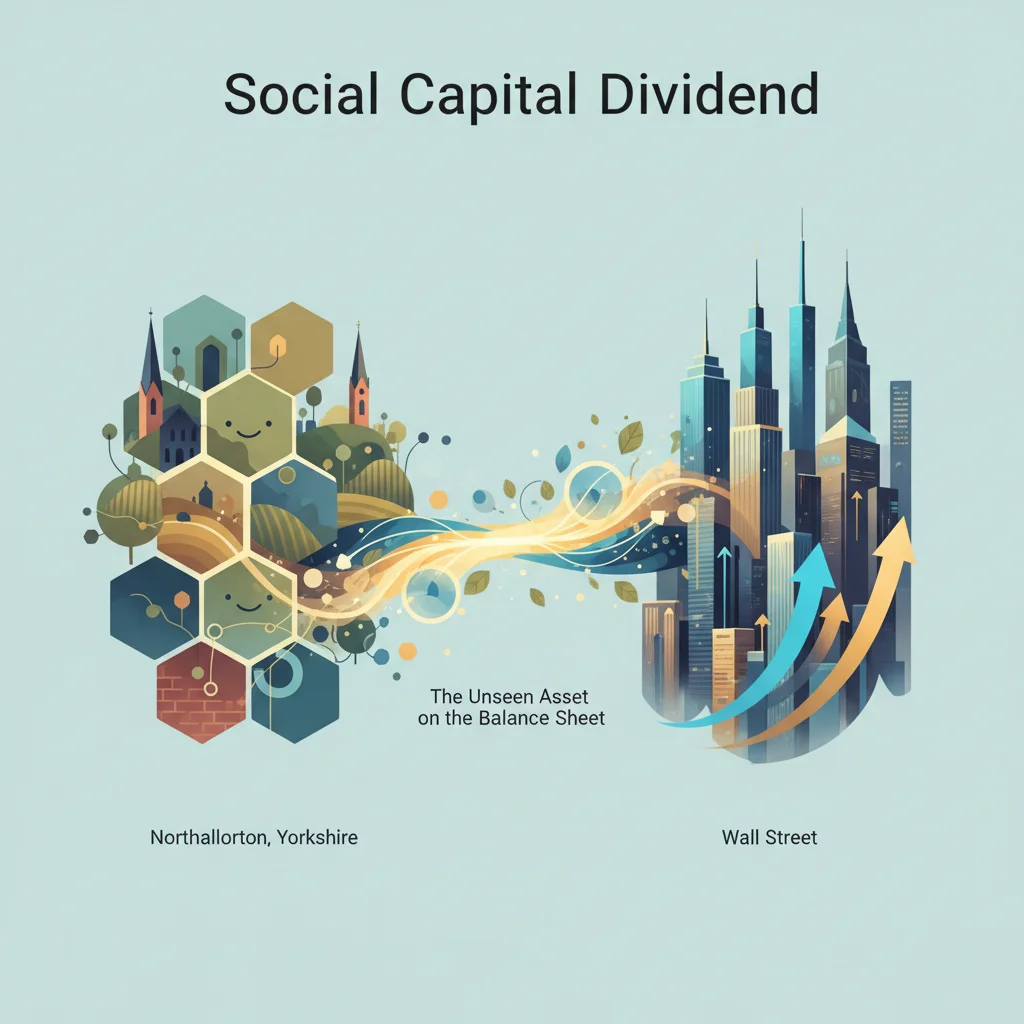

The Social Capital Dividend: What a Yorkshire Town Can Teach Wall Street About Real Investment

A Yorkshire town’s welcome for refugees offers a powerful lesson on social capital—the most undervalued asset in the modern economy and a key to long-term growth.

Beyond the Spark: Uncovering the True Origins of Financial Fire

Financial innovation isn’t just about a brilliant idea. It requires the right conditions to ignite, a lesson crucial for investors in fintech and blockchain.