Business

The Business of Snow: Uncovering Investment Slopes in the 2025 Winter Sports Economy

The Unseen Economy on the Slopes: From Olympic Gold to High-Tech Gear As the winter air turns crisp and thoughts turn to snow-capped peaks, the world of winter sports prepares for a pivotal 2025 season. Beyond the thrill of a perfect downhill run or the pristine beauty of untracked powder lies a dynamic, multi-billion dollar […]

Training Your Replacement: How AI Is Forcing Professionals to Automate Their Own Jobs

The Unsettling Request: “Make Yourself Obsolete” Imagine your boss calls you into a meeting. You’re a skilled professional, a craftsperson with years of experience. Instead of assigning you a challenging new project, they give you a new task: teach a machine to do your job. Not just to assist you, but to replace you. Your […]

The Pharma-Political Gambit: How AstraZeneca’s Deal with Trump Rewrote the Rules of Healthcare Economics

The High-Stakes Intersection of Politics, Pills, and Profits In the world of high-stakes corporate strategy, few moves are as audacious as those that play out on the global political stage. For investors and business leaders, these moments are more than just headlines; they are critical case studies in risk management, negotiation, and value creation. A […]

Dieselgate’s Second Wave: The Billion-Pound Legal Storm Shaking the Automotive Stock Market

The Scandal That Won’t Die: Why “Dieselgate” is Back in the Headlines Cast your mind back to 2015. The automotive world was rocked by a scandal of seismic proportions: Volkswagen, a titan of German engineering, admitted to cheating on emissions tests for its diesel vehicles. The term “Dieselgate” entered the global lexicon, symbolizing corporate deceit […]

The Trump Doctrine: Peace Through Disruption and Its Price on the Global Economy

In the world of high-stakes international relations, predictability has long been the currency of stability. For investors, business leaders, and financial institutions, a clear understanding of geopolitical direction is fundamental to risk assessment and strategic planning. Yet, former President Donald Trump’s “America First” foreign policy upended this convention, replacing diplomatic precedent with a transactional, often […]

From Desert Sands to Idaho Skies: The Billion-Dollar Geopolitics of Qatar’s New US Fighter Jet Base

In a move that underscores the intricate tapestry of modern geopolitics, international finance, and national security, the Pentagon has given the green light for a project that might seem surprising at first glance: Qatar, a key Middle Eastern ally, will construct its own fighter jet facility at an American military base in Idaho. This development, […]

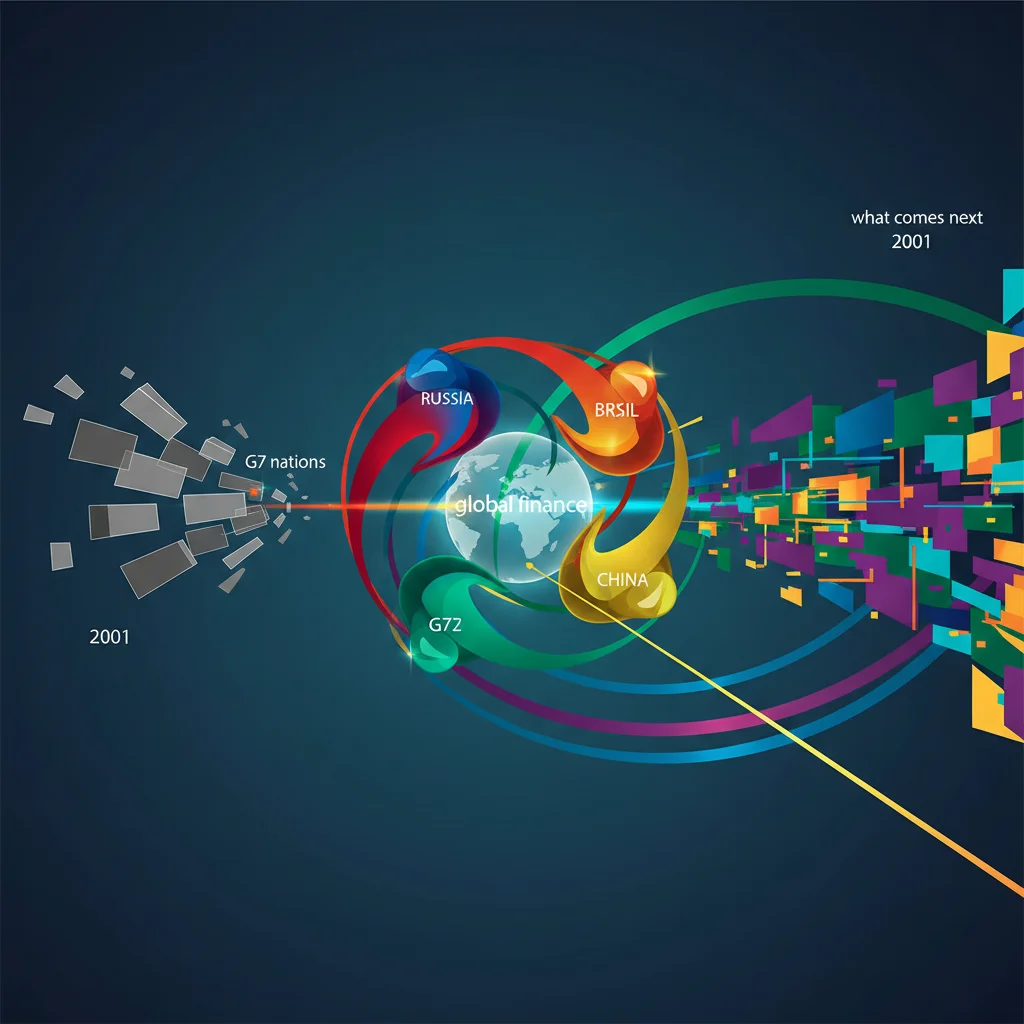

The BRIC Prophecy: How a 2001 Report Redefined Global Finance and What Comes Next

In the autumn of 2001, the world of global finance was operating on a familiar script. The G7 nations—the United States, Japan, Germany, the UK, France, Italy, and Canada—were the undisputed titans of the global economy. They set the rules, dominated international institutions, and were the primary destination for serious capital. The dot-com bubble had […]

Solving the Financial Crossword: A Strategic Guide for Modern Investors

Every morning, enthusiasts around the world settle in with their coffee and a fresh crossword puzzle, like the latest challenge from the Financial Times. They face a grid of empty white squares, a web of clues—some straightforward, others infuriatingly cryptic. The goal is to transform this void of uncertainty into a cohesive whole, where every […]

Decoding the Economy: What a Cryptic Crossword Reveals About Modern Finance

For many, the daily crossword is a cherished ritual—a cup of coffee, a sharpened pencil, and a grid of empty squares promising a gentle mental workout. But when the crossword in question is the Financial Times’ notoriously challenging Polymath, the puzzle becomes more than a pastime. It transforms into a mirror, reflecting the complex, ever-evolving […]

From Super Dry to System Down: How a Cyberattack Forced a Beer Giant Back to Pen and Paper

Picture this: you’re enjoying a crisp, cold Asahi Super Dry, arguably Japan’s most iconic beer. You’re thinking about the taste, the refreshment, the complex brewing process. What you’re probably not thinking about is the intricate web of software, cloud infrastructure, and automation that brought that bottle to your hand. But last month, that intricate web […]

HSBC’s $13.6 Billion Wager: A Masterstroke for Hong Kong’s Revival or a High-Stakes Gamble?

In the high-stakes world of global finance, some moves are so audacious they command the entire market’s attention. HSBC’s recent decision, spearheaded by CFO Georges Elhedery, to inject a colossal US$13.6 billion (HK$106.6bn) into its Hong Kong-based subsidiary, Hang Seng Bank, is one such move. This isn’t just a routine capital shuffle; it’s a powerful, […]

The Doubting Thomas Principle: Why Ancient Skepticism is the Most Valuable Asset in Modern Investing

In the fast-paced world of high finance, where deals are closed in minutes and fortunes are made on fleeting data points, it’s easy to believe that the most valuable assets are speed, aggression, and a relentless focus on the future. Yet, a recent letter to the Financial Times by a reader named Joe Keaney offers […]