Behavioral Economics

The VAR Paradox: Why We Forgive Human Error But Despise Flawed Algorithms in Finance

The backlash against VAR in football reveals a critical lesson for finance: we are far less tolerant of machine errors than human ones.

Solving for Alpha: The Hidden Financial Lessons in Your Daily Crossword

Discover how the daily crossword puzzle hones critical thinking and pattern recognition skills essential for navigating the complexities of modern finance.

The £40,000 Freeloader: What a Serial Fare Evader Reveals About Systemic Risk, the Economy, and the Fintech Revolution

A man’s 112 unpaid train tickets reveal deep truths about systemic risk, behavioral economics, and the future of finance and fintech.

Beyond the Ticker: What John Maynard Keynes’s Wine Cellar Teaches Us About Modern Investing

John Maynard Keynes’s contrarian wine-investing strategy offers timeless lessons that challenge today’s data-driven, fintech-obsessed financial world.

The 3 AM Alpha: Is Sleep Deprivation the Newest, Riskiest Bet in Finance?

Is insomnia a productivity hack? This post explores the “3am club” concept in finance, revealing the high cognitive cost and advocating for smarter work.

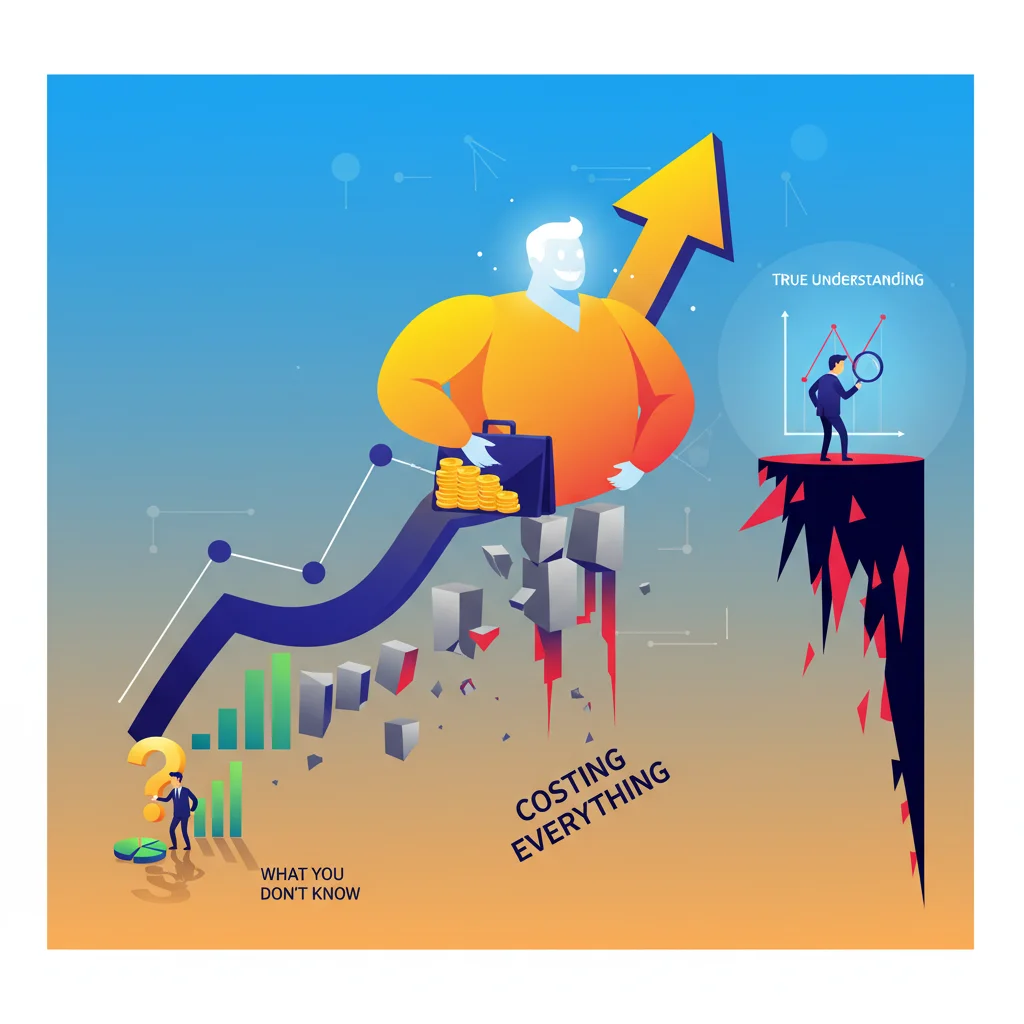

The Dunning-Kruger Effect in Your Portfolio: Why What You Don’t Know Can Cost You Everything

Cognitive blind spots and overconfidence are the biggest risks in finance. Learn why knowing what you don’t know is the key to successful investing.

The Brussels Sprout Effect: Why Seemingly Small News Can Trigger a Stock Market Stampede

A short letter to the FT about sprouts serves as a perfect metaphor for how minor, unpalatable news can trigger oversized, irrational stampedes in finance.

The Sleepless Leader: Why ‘Hustle Culture’ is a High-Risk Investment in Today’s Economy

The political fetishization of sleeplessness has infiltrated corporate culture, posing a significant risk to the economy, investing, and financial markets.

The Unwanted Gift Portfolio: An Investor’s Guide to Managing Misallocated Holiday Assets

Unwanted holiday gifts are a microcosm of a core financial challenge: managing misallocated assets. Learn to apply professional investing strategies to your gifts.

The Unwanted Gift Economy: A Financial Guide to Post-Holiday Asset Recovery

Transform unwanted holiday gifts from liabilities into assets. Our financial guide explores strategies from resale markets to impact investing.

The Sentimental Value Portfolio: Balancing Art and Science in Modern Investing

A film’s themes of sentimental value and generational divides offer a powerful allegory for modern finance, from stock market valuation to fintech disruption.

The Unwanted Gift Economy: Turning Holiday Liabilities into Financial Assets

Unwanted holiday gifts represent a multi-billion dollar market inefficiency. Learn how to turn these liabilities into assets using a strategic financial framework.