A Toast to Economic Growth: Unpacking the Investment Potential of UK Pub Licensing Reforms

UK pub licensing reforms could unlock significant economic growth and new investment opportunities in the hospitality sector and related technology industries.

Market Crossroads: 5 Critical Signals for Investors to Watch This Week

A pivotal week awaits markets with key US inflation data, retail sales, a Bank of England decision, and Fed speakers set to drive major trading activity.

Beyond the Headlines: A Deep Dive into the New U.S.-China Trade Spat and Your Investment Strategy

Renewed U.S.-China trade tensions are causing market uncertainty. Discover the impacts on your investments and how to navigate this volatile environment.

The $5,000 Gold Prophecy: Decoding Bank of America’s Bold Bet on a New Commodity Supercycle

Bank of America’s bold $5,000 gold forecast signals a new commodity supercycle, driven by central bank buying, de-dollarization, and green energy demand.

Market Crosscurrents: Navigating Trump’s Tariff Threats, Fed Policy, and a Surge in Futures

U.S. stock futures surge despite Trump’s renewed China tariff threats and the Fed’s cautious stance on rate cuts. A deep dive into what’s moving markets.

Beyond the Box: Unpacking Tritax’s £1 Billion Wager on the Future of Logistics

Tritax Big Box’s £1.04bn logistics portfolio acquisition sends its stock soaring, signaling a major bet on the future of e-commerce and supply chains.

Trump’s Tariff Tremors: How a $19 Billion Crypto Crash Could Pave Bitcoin’s Path to $115k

A $19B crypto wipeout and a $115k Bitcoin prediction collide as Trump’s tariff proposal tests Bitcoin’s role as a digital safe haven.

The End of the Dip: Why Mortgage Rates Are Climbing Again and What It Signals for the UK Economy

For the first time since February, UK mortgage rates are rising, signaling lender caution amid economic uncertainty. Discover the reasons why and the impact.

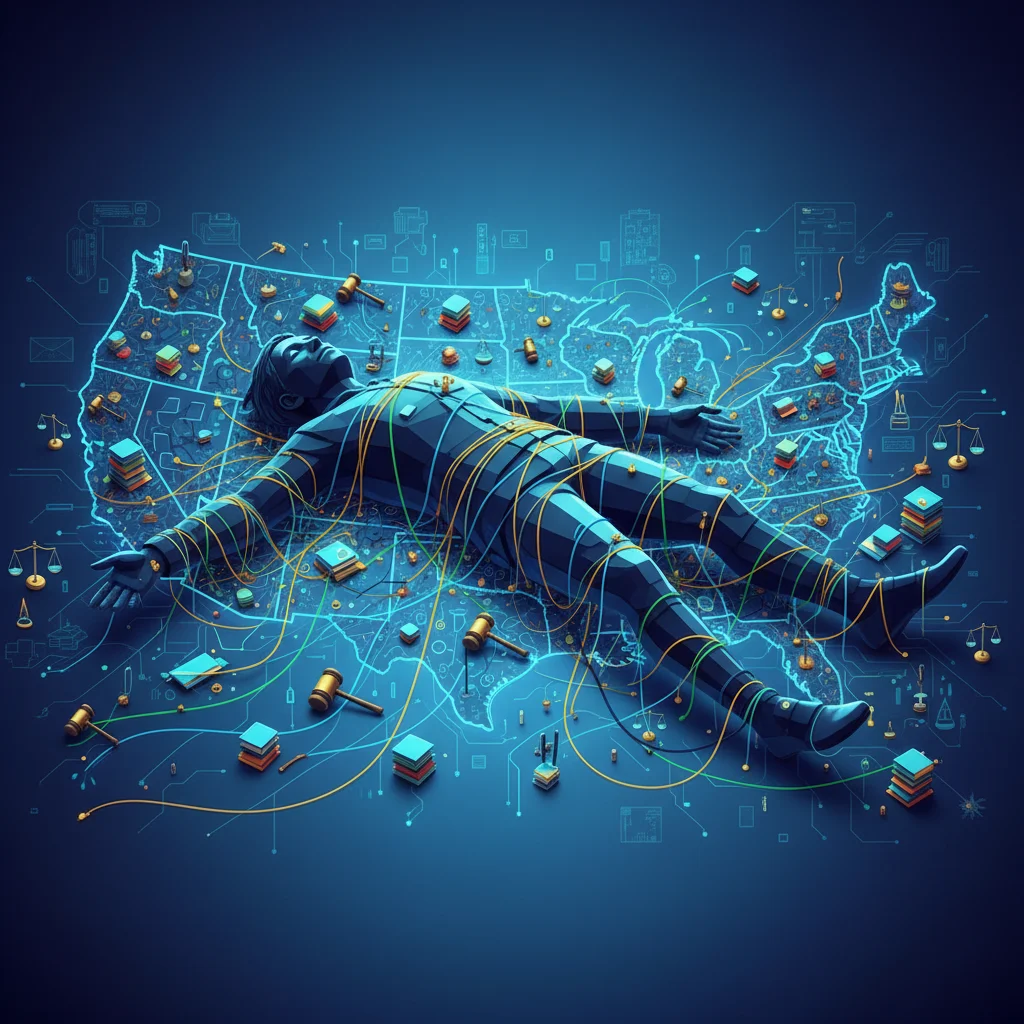

The Gulliver Effect: How a Thousand Legal Threads Could Tie Down the US Economy

A powerful metaphor for today’s economy: a political Gulliver tied down by a thousand legal threads. What does this mean for investors and the market?

The Ripple Effect: How a Discord Data Breach Exposes a Critical Flaw in the Global Financial Technology Ecosystem

In what has become an unnervingly common headline, the popular communication platform Discord recently announced a significant data security incident. At first glance, the news that ID photos of approximately 70,000 users may have been leaked seems like another isolated tech problem. However, for astute investors, finance professionals, and business leaders, this event is far […]

Tesla Under Scrutiny: What the NHTSA’s New FSD Probe Means for Investors

In the high-stakes world of technology and finance, few companies command the stock market’s attention like Tesla. A pioneer, a disruptor, and a perennial source of debate among investors, the electric vehicle giant once again finds itself in the regulatory spotlight. The U.S. government’s National Highway Traffic Safety Administration (NHTSA) has launched a new investigation […]

Flowing Capital: Why Your Rising Water Bill is a Bellwether for UK Infrastructure, Investing, and the Economy

For millions of households across the United Kingdom, the news of another impending price hike is a familiar, unwelcome development. This time, it’s the water bill. The UK’s water regulator, Ofwat, has given the green light for five major water companies to increase their charges, a decision that will ripple through the personal finances of […]