A Decade of Doubt: Unpacking Ten Years of Negative UK Consumer Confidence

For a full decade, the mood of the British consumer has been steeped in pessimism. Not once in the last ten years has the UK’s primary measure of consumer sentiment tipped into positive territory. The latest figures from GfK’s long-running Consumer Confidence Index reveal a continuation of this trend, with the barometer rising by a marginal one point to minus 16 in January. While this is an improvement from the historic lows seen during the peak of the cost-of-living crisis, such as the minus 23 recorded in April of last year, it underscores a deeply entrenched sense of economic anxiety.

This isn’t just a statistic; it’s a narrative of a nation grappling with profound economic shifts, political uncertainty, and a persistent squeeze on household finances. For investors, business leaders, and anyone involved in the UK economy, understanding the drivers behind this decade of doubt is crucial. It’s a story that impacts everything from retail sales and the housing market to corporate earnings and the performance of the stock market. In this deep dive, we will dissect the anatomy of this pessimism, explore its far-reaching consequences, and consider what it might take to finally turn the tide.

The Anatomy of a Ten-Year Slump

To grasp the significance of a decade in negative territory, it’s essential to understand what the GfK index measures. It’s a composite score based on five key questions posed to thousands of households, asking about their personal financial situation over the past and next 12 months, the general economic situation over the past and next 12 months, and their propensity to make major purchases.

A score of zero is neutral. A positive score indicates optimism, while a negative score, which the UK has been locked into for ten years, signifies pessimism. The last time the index was positive was in early 2014. Since then, a relentless series of economic and political shocks have battered consumer sentiment:

- The Brexit Aftermath: The 2016 referendum and the subsequent years of uncertainty weighed heavily on both business and consumer sentiment, creating a prolonged period of economic ambiguity.

- The COVID-19 Pandemic: Global lockdowns, supply chain disruptions, and unprecedented government intervention created massive economic dislocations, sending confidence plummeting.

- The Inflationary Surge: The post-pandemic recovery, compounded by the war in Ukraine, unleashed a wave of inflation not seen in decades. Soaring energy bills and food prices directly eroded the purchasing power of every household in the country, a fact reflected in dismal confidence readings. According to the Office for National Statistics (ONS), inflation peaked at over 11% in late 2022, a primary driver of the confidence collapse.

- Monetary Policy Tightening: In response to rampant inflation, the Bank of England embarked on its most aggressive interest rate hiking cycle in recent history. While necessary to control prices, this dramatically increased mortgage costs and borrowing expenses, adding another layer of financial pressure on consumers.

This sustained pessimism is not just a reflection of feelings; it’s a barometer of real-world financial health. The persistent negative outlook on personal finances is a direct consequence of wage growth failing to keep pace with the cost of living for much of this period.

Beyond the Handout: Analyzing the UK's New Cash Payout Scheme as an Economic Strategy

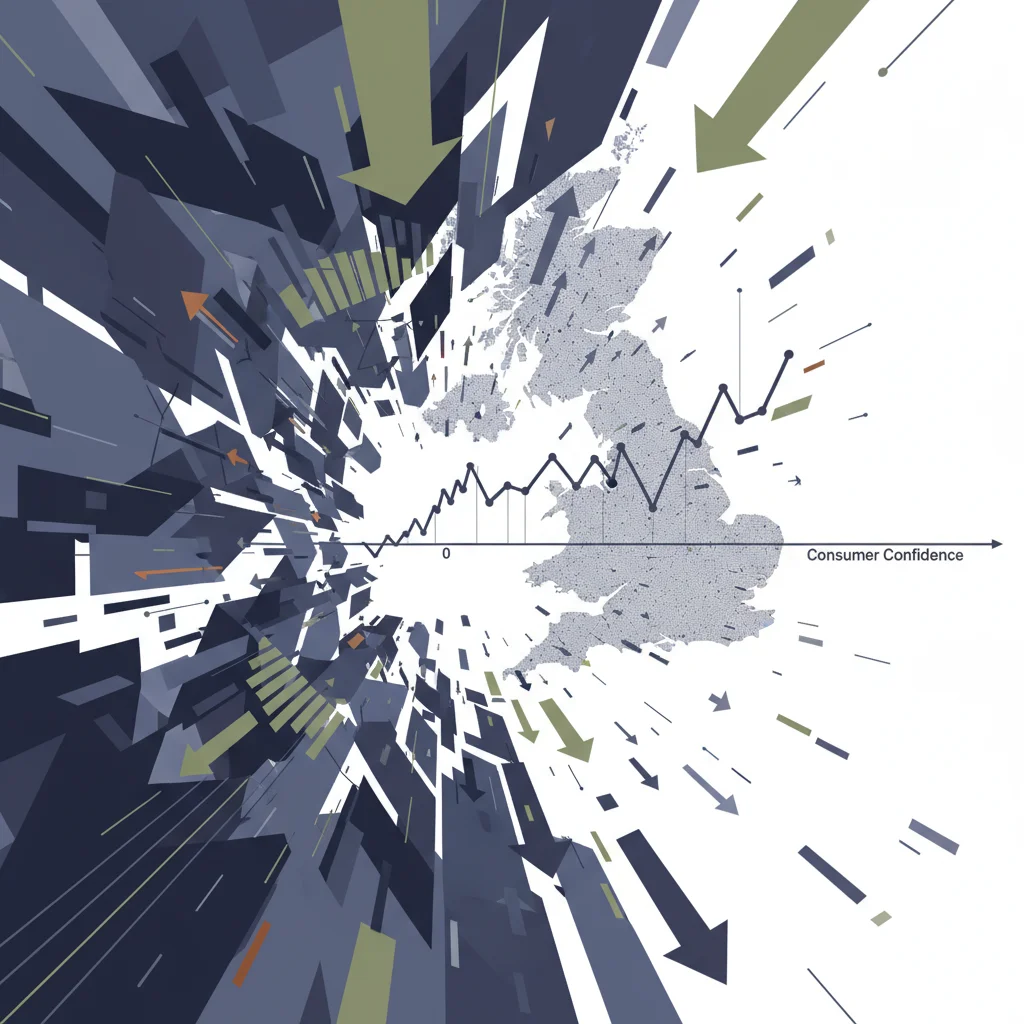

A Visual Look at a Decade of Consumer Sentiment

To put this trend into perspective, the table below highlights the GfK Consumer Confidence Index at several key moments over the past decade, illustrating the persistent negativity and the sharp downturns following major economic shocks.

| Time Period | GfK Index Score | Key Economic Context |

|---|---|---|

| January 2014 | -1 | Approaching the last positive reading; post-financial crisis recovery. |

| July 2016 | -12 | Sharp drop immediately following the Brexit referendum result. |

| May 2020 | -34 | Height of the first COVID-19 lockdown and peak uncertainty. |

| September 2022 | -49 | Record low amidst the “mini-budget” crisis and peak inflation fears. (source) |

| January 2024 | -16 | Gradual recovery from historic lows but still deeply negative. (source) |

The Ripple Effect: From High Street to the Stock Market

Consumer confidence is more than just an economic indicator; it’s a powerful force that shapes economic reality. When consumers are pessimistic, they change their behaviour in ways that have profound implications across the entire landscape of finance and investing.

Impact on the Real Economy

The most direct impact is on consumer spending, which accounts for roughly 60% of the UK’s GDP. A lack of confidence, particularly in the “major purchase index” sub-component, leads to deferred spending on big-ticket items like cars, appliances, and holidays. This directly hits retailers, hospitality, and manufacturing sectors. Businesses, in turn, become more cautious, delaying investment and hiring plans, which can create a self-reinforcing cycle of slow growth.

The housing market is also highly sensitive to sentiment. Higher interest rates have already cooled the market, but a persistent lack of confidence in personal finances makes potential buyers hesitant to take on large mortgages, further dampening activity.

Implications for Investing and the Stock Market

For investors, a pessimistic consumer base presents a complex picture. On one hand, it’s a clear headwind for UK-focused companies, especially in the consumer discretionary sector. Stocks of retailers, travel companies, and restaurant groups may underperform when households are tightening their belts. This requires a more discerning approach to stock market investing, focusing on companies with strong balance sheets, pricing power, and resilient demand.

However, it can also present opportunities. A climate of pessimism can lead to undervalued assets, where the market has priced in an overly bearish scenario. Contrarian investors may see this as a chance to buy into solid UK companies at a discount, betting on a long-term recovery. Furthermore, it reinforces the importance of diversification, encouraging investors to look beyond the domestic market to regions with stronger growth and more optimistic consumer outlooks.

Paving the Path to Positivity: Can Technology and Policy Change the Narrative?

Breaking a decade-long cycle of pessimism requires more than just a single month’s uptick. It demands a fundamental shift in the economic environment. The most significant factor will be the trajectory of inflation and the subsequent response from the Bank of England. As inflation continues its downward trend towards the 2% target, the central banking authority will have room to cut interest rates, providing tangible relief to mortgage holders and borrowers.

Beyond monetary policy, the role of innovation, particularly in fintech, cannot be overstated. The financial services industry is undergoing a radical transformation. Neobanks are offering more transparent and user-friendly services, while investment platforms are democratizing access to the stock market and other asset classes. Some forward-thinking investors are even exploring decentralized finance (DeFi) and blockchain applications as alternative systems, though this remains a niche and volatile area.

This wave of financial technology helps on two fronts. Practically, it provides tools for better financial management. Psychologically, it fosters a sense of agency and control, which is a powerful antidote to the helplessness that can fuel economic pessimism.

Leon's Strategic Retreat: A Masterclass in Corporate Restructuring for a Turbulent Economy

Political stability and a clear, long-term industrial strategy from the government would also be instrumental in rebuilding both consumer and business confidence. A predictable policy environment allows households and companies to plan for the future with greater certainty, encouraging both spending and investment.

From Leaky Pipes to Leaky Portfolios: The Investment Drain of the UK Water Crisis

Conclusion: A Critical Juncture for the UK Economy

The UK stands at a critical juncture. A decade of negative consumer confidence is a stark reminder of the economic scars left by a series of unprecedented shocks. The slight improvement in the latest GfK reading offers a glimmer of hope, but the road to a sustained recovery in national mood is long and fraught with challenges.

For business leaders, the message is clear: the cautious consumer is here to stay. Value, resilience, and trust are the new currencies of success. For investors, the UK market requires a nuanced approach, balancing the risks of a fragile consumer base against the potential for undervalued opportunities. And for policymakers, the task is to create an environment of stability and growth that allows confidence—the lifeblood of a modern economy—to finally be restored. The story of the next decade will be determined by whether the UK can finally leave its decade of doubt behind and enter a new era of sustainable optimism.