Beyond the Grid: What a Crossword Puzzle Teaches Us About Modern Finance

At first glance, the daily crossword puzzle seems a world away from the high-stakes, data-driven realm of finance. One is a leisurely pursuit of words and wit; the other, a relentless engine of global capital. Yet, the structured grid of the Financial Times Crossword offers a surprisingly powerful metaphor for understanding today’s intricate financial landscape. Each clue, whether running across or down, represents a critical component of our economy. And just as in a puzzle, these components are not isolated; they intersect, overlap, and influence one another in complex ways. A single correct answer can unlock a cascade of new possibilities, while a mistake can ripple through the grid, causing confusion and error.

For investors, finance professionals, and business leaders, navigating this landscape requires more than just focusing on a single clue. It demands a holistic understanding of how macroeconomic forces, technological disruptions, and market dynamics interlock to form the bigger picture. This article deconstructs the modern financial puzzle, examining the key “clues”—from the broad strokes of the global economy to the specific disruptions of financial technology—to reveal the complete solution for strategic success.

The “Across” Clues: Foundational Macroeconomic Forces

The “across” clues in a crossword are often the longest, setting the foundational structure for the entire grid. In finance, these are the sweeping macroeconomic trends that define the environment in which every business and investor operates. Understanding these is the first step to solving the puzzle.

1. The Global Economy: Navigating Inflation and Interest Rates

The global economy is the ultimate “across” clue. Its health dictates capital flows, consumer confidence, and corporate earnings. In recent years, the primary narrative has been the dual challenge of persistent inflation and the corresponding rise in interest rates by central banks. After a period of relative stability, global inflation surged, prompting aggressive monetary tightening. According to the International Monetary Fund’s April 2024 outlook, global growth is projected to hold steady at 3.2 percent, but the fight against inflation continues to shape policy. For investors, this means the cost of capital is higher, borrowing is more expensive, and the discount rate applied to future earnings has increased, putting pressure on stock market valuations, particularly for growth-oriented companies.

2. The Stock Market: A Barometer of Sentiment and Value

Interlocking with the economy is the stock market, a complex system that reflects both current reality and future expectations. It’s a puzzle within a puzzle. Market volatility has become a defining feature, driven by geopolitical tensions, supply chain disruptions, and the rapid evolution of technology. Leaders and investors must look beyond daily fluctuations to understand deeper trends, such as the rotation between value and growth stocks or the outperformance of specific sectors like technology and artificial intelligence. The challenge is deciphering whether market movements are based on solid fundamentals or speculative fervor—a crucial distinction for long-term investing strategy.

A Ticking Time Bomb: How a 15-Year-Old Boeing Flaw Shakes the Foundations of the Stock Market

The “Down” Clues: Vertical Disruptors and Technological Shifts

While macroeconomic forces set the stage, the “down” clues represent the specific, often disruptive, forces that create new opportunities and challenges. These are the technological and structural shifts that intersect with the broader economy, fundamentally changing the rules of the game.

1. Financial Technology (Fintech): Rewriting the Rules of Banking

Fintech is no longer a niche industry; it’s a powerful force reshaping everything from payments to lending. Traditional banking institutions are facing unprecedented competition from agile, tech-first companies offering seamless user experiences and lower costs. The global fintech market is a testament to this shift, with innovations in digital payments, robo-advisory services, and “Buy Now, Pay Later” (BNPL) platforms becoming mainstream. This disruption is forcing legacy institutions to accelerate their own digital transformations, leading to a new era of competition and collaboration in the banking sector.

2. Blockchain and Decentralized Finance (DeFi): Beyond the Hype

Perhaps no “clue” is more misunderstood than blockchain. Often conflated with the volatility of cryptocurrencies, the underlying distributed ledger technology holds transformative potential for finance. Blockchain offers a secure, transparent, and immutable way to record transactions, with applications far beyond digital currencies. It’s being explored for everything from streamlining supply chain finance to creating more efficient systems for clearing and settling trades. Its most radical application, Decentralized Finance (DeFi), aims to build an entirely new financial system without traditional intermediaries like banks. While still nascent and facing significant regulatory hurdles, DeFi’s potential to reduce costs and increase access to financial services makes it a critical trend to watch. A report by BCG estimates that the tokenization of global illiquid assets could be a $16 trillion opportunity by 2030, highlighting the immense scale of this potential shift.

To better understand the shift, consider the core differences between the old and new paradigms:

| Feature | Traditional Finance (TradFi) | Decentralized Finance (DeFi) |

|---|---|---|

| Intermediaries | Relies on banks, brokers, and clearinghouses | Peer-to-peer via smart contracts on a blockchain |

| Accessibility | Often restricted by geography and wealth | Open and permissionless, accessible with an internet connection |

| Transparency | Opaque; transactions are private to the institutions | Radically transparent; all transactions are publicly verifiable on the blockchain |

| Operating Hours | Limited to standard business hours and weekdays | 24/7/365, always-on markets |

| Settlement Speed | Can take days (T+2 settlement for stocks) | Near-instantaneous to minutes |

3. Trading and Investing: The Rise of Algorithms and Retail Access

The very act of trading and investing has been revolutionized. High-frequency trading (HFT) firms now use complex algorithms to execute millions of orders in fractions of a second, accounting for a significant portion of daily trading volume. At the same time, financial technology has democratized market access for retail investors. Commission-free trading apps have empowered a new generation of market participants, but have also introduced new risks related to “gamification” and speculative behavior. This dual evolution—sophisticated institutional algorithms on one end and mass retail participation on the other—has created a more complex and dynamic market structure.

Solving the Puzzle: A Strategic Framework for the Modern Investor

Recognizing the clues is only half the battle. Solving the puzzle requires a coherent strategy that accounts for how the pieces fit together. For professionals navigating this environment, a few core principles are essential.

Embrace Diversification as the Master Key

In a crossword, you can’t solve the grid by only knowing answers related to a single topic. You need a breadth of knowledge. Similarly, in investing, relying on a single asset class, industry, or geographic region is a recipe for vulnerability. True diversification means spreading investments across stocks, bonds, real estate, and alternative assets like commodities or even digital assets (with appropriate risk management). It also means diversifying across different economic sectors and global markets to insulate a portfolio from localized shocks. This principle is the financial equivalent of ensuring that a mistake in one corner of the grid doesn’t derail the entire puzzle.

Commit to Continuous Learning

The financial puzzle is not static; it’s a dynamic challenge where new clues and even new rules emerge constantly. Ten years ago, DeFi, BNPL, and AI-driven trading were fringe concepts. Today, they are central to the conversation. Professionals must adopt a mindset of continuous learning, staying informed about emerging technologies, regulatory changes, and shifting economic paradigms. Complacency is the greatest risk in a rapidly evolving market. The commitment to education is what separates those who can adapt and thrive from those who are left behind by the next big shift.

Prioritize Robust Risk Management

Just as a single incorrect letter can invalidate multiple intersecting words in a crossword, a single unmanaged risk can have cascading consequences in a portfolio or business. Robust risk management goes beyond simple diversification. It involves understanding and hedging against various risks: market risk (broad downturns), credit risk (defaults), liquidity risk (inability to sell an asset quickly), and operational risk (failures in systems or processes). In an era of high volatility and black swan events, a proactive and multi-faceted approach to managing risk is not just prudent; it’s essential for survival and long-term success.

The True Cost of Corporate Collapse: A Lesson in Finance, Risk, and Responsibility

The Finished Grid: A Picture of Interconnectedness

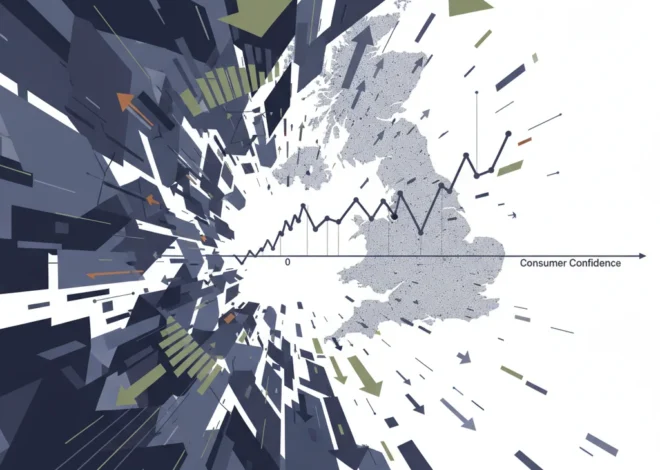

The world of finance, like a completed crossword, is a tapestry of interconnected ideas. The broad “across” clues of the economy and stock market provide the context, while the specific “down” clues of fintech, blockchain, and trading innovations introduce dynamism and change. To see the full picture is to appreciate that no single element exists in a vacuum.

Interest rate decisions affect tech valuations. Blockchain innovations challenge traditional banking models. The democratization of trading influences market volatility. By embracing this interconnectedness, professionals can move beyond a narrow, single-clue focus and develop the strategic vision needed to not only solve the puzzle but to capitalize on the opportunities it reveals. The grid is complex, but for those who understand how the pieces fit together, the solution is clear.