The UK’s Economic Paradox: Why Consumer Confidence Reveals a Nation Divided

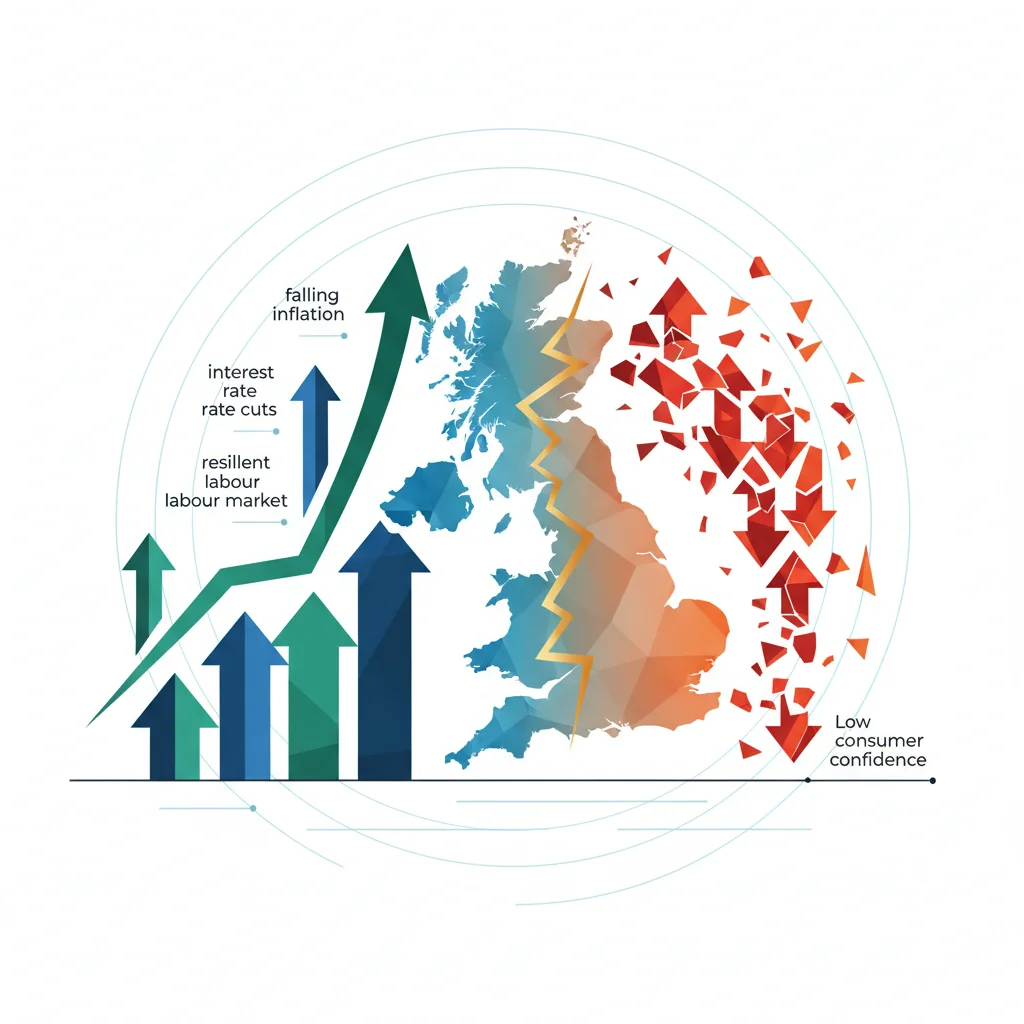

In the complex world of economics, headline figures can often be deceiving. We see reports of falling inflation, hints of interest rate cuts, and a resilient labour market. On the surface, it paints a picture of a recovering UK economy. One of the most telling barometers of public sentiment, the consumer confidence index, has even surged to its highest point in over two years. Yet, beneath this veneer of optimism lies a deep and troubling fracture—a generational divide in economic outlook that carries profound implications for investing, banking, and the future of the nation’s financial landscape.

While younger Britons are beginning to feel a renewed sense of hope, their older counterparts remain mired in pessimism. This isn’t just a minor statistical quirk; it’s a critical signal that traditional economic models may be failing to capture. Understanding this divergence is essential for investors, business leaders, and anyone seeking to navigate the intricate currents of the modern stock market and financial world.

The Glimmer of Hope: A Rebound in National Confidence

For months, the narrative surrounding the UK economy has been dominated by the cost of living crisis, stubborn inflation, and rising interest rates. However, recent data suggests the tide may be turning. The widely respected GfK consumer confidence index, a key measure of household sentiment, has shown a remarkable recovery. According to a report by the BBC’s Faisal Islam, the index reached its best reading since November 2021, indicating that, as a whole, the nation is feeling more secure about its financial future.

This upward trend is fueled by several positive macroeconomic factors:

- Slowing Inflation: The relentless rise in prices for everyday goods has finally begun to ease, taking pressure off household budgets.

- Anticipated Rate Cuts: The Bank of England has signaled that interest rate cuts could be on the horizon, which would lower borrowing costs for mortgages and loans.

- Real Wage Growth: For the first time in a long while, average wages are starting to outpace inflation, meaning many workers have more purchasing power.

This renewed optimism is theoretically great news. Confident consumers are more likely to spend, which drives business revenue, boosts corporate earnings, and can provide a tailwind for the stock market. But as we peel back the layers of this aggregate data, a more complicated and concerning picture emerges.

The Great Divide: A Tale of Two Generations

The true story lies not in the overall confidence score, but in its demographic breakdown. The same data reveals a stark and widening chasm between the economic outlook of the young and the old. While those under 30 are now reporting a net positive outlook on their financial future, older generations, particularly those over 60, remain deeply pessimistic.

This generational split in sentiment is a crucial piece of the economic puzzle. To illustrate the contrast, let’s examine the differing perspectives and the factors driving them.

| Demographic Group | Reported Confidence Level (Illustrative) | Primary Economic Drivers & Concerns |

|---|---|---|

| Under 30s | Net Positive | Benefitting from strong wage growth in a competitive job market; less likely to have large mortgages exposed to high interest rates; more digitally native and comfortable with modern financial technology (fintech) for managing money and investing. |

| Over 60s | Significantly Net Negative | Fixed incomes (pensions) being eroded by past inflation; value of savings diminished; higher exposure to volatility in traditional investment portfolios; concerns over the cost of energy, food, and healthcare. Based on trends noted in the BBC analysis. |

Why does this matter so much? The older generation holds a disproportionate amount of the nation’s wealth, primarily in property and savings. Their pessimism translates directly into cautious behaviour. They are less likely to spend on big-ticket items, less inclined to invest new capital into the UK stock market, and more focused on capital preservation. This “wealth inertia” can act as a significant drag on economic growth, counteracting the nascent optimism of the younger, less capital-rich generation.

This dynamic challenges the very foundations of how we measure economic health. A single confidence number is no longer sufficient; we need a more nuanced understanding of who feels confident and why. Venezuela's 0 Billion Default: Deconstructing the Most Complex Debt Restructuring in History

The Ripple Effect: What a Divided Sentiment Means for Finance and Investing

This generational confidence gap isn’t merely an academic curiosity; it has tangible, real-world consequences across the entire financial ecosystem, from institutional banking to individual trading strategies.

1. Investing and the Stock Market

A pessimistic older demographic, which typically holds the bulk of investment capital, can lead to a risk-off environment. These investors may favour lower-risk assets like bonds or high-interest savings accounts over equities. This can starve the stock market of the capital needed for growth and innovation. Conversely, younger investors, while more optimistic, may have less capital to deploy and a higher appetite for risk, potentially gravitating towards speculative assets, cryptocurrencies, or thematic ETFs through modern fintech platforms. This creates a fragmented and potentially volatile market dynamic where capital allocation doesn’t necessarily follow the most productive economic path.

2. The Banking and Financial Technology (Fintech) Sector

The divide presents both a challenge and an opportunity for the financial services industry. Traditional banking institutions must cater to their core client base of older, wealthier individuals. This means emphasizing security, reliability, and wealth preservation. Their product offerings and marketing will need to reflect an understanding of this demographic’s anxieties.

Meanwhile, the fintech sector is perfectly positioned to capture the optimistic younger generation. Digital-first banks, commission-free trading apps, and robo-advisors appeal to their tech-savviness and growth-oriented mindset. We may see an acceleration of the trend where traditional banks serve as wealth custodians while fintechs capture the transactional and investment activities of the next generation. The potential integration of technologies like blockchain for secure and transparent transactions could further appeal to a demographic looking for alternatives to legacy systems. A key question is how these two worlds will converge or compete in the coming decade. With inflation trends stabilizing, the focus will shift from preservation to growth, but each generation will define “growth” differently.

3. Economic Policy and Governance

For policymakers, this data is a minefield. A government might celebrate the headline rise in consumer confidence as a victory, while failing to address the deep-seated economic anxiety among a significant portion of the electorate. Policies aimed at stimulating broad-based growth, such as tax cuts, may not be effective if the wealthiest demographic simply saves the extra cash due to a pessimistic outlook. Targeted policies, such as adjustments to pension credits or specific support for retirees, may become more critical. The Bank of England’s decisions on interest rates will also be viewed through two very different lenses: younger borrowers will cheer for cuts, while older savers who have finally seen a decent return on their cash will be dismayed.

The Lego Principle: What "Smart" Toys Teach Us About Dumb Investments

Navigating the Future: Strategies for a Bifurcated Economy

The key takeaway is that a single, monolithic view of the UK consumer is no longer viable. To succeed in this environment, stakeholders must adopt a more granular and demographically-aware approach.

- For Investors: Look beyond the FTSE 100. Analyze which sectors and companies cater to the different generational spending patterns. Companies focused on value and security may appeal to the older cohort, while those in technology, experiences, and sustainable goods may capture the spending of the younger generation. Portfolio construction should account for this economic bifurcation.

- For Business Leaders: Customer segmentation is more important than ever. Marketing messages, product development, and pricing strategies must be tailored. A luxury car brand and a budget airline are not just selling to different income levels; they are now selling to different psychological states of economic confidence.

- For Finance Professionals: The era of one-size-fits-all financial advice is over. A 25-year-old’s financial plan, focused on aggressive growth and leveraging financial technology, will look radically different from a 65-year-old’s plan, which must prioritize capital preservation and predictable income streams in the face of economic uncertainty.

The one measure of consumer confidence, it turns out, tells us not one, but two very different stories. One is a tale of cautious recovery and budding optimism. The other is a story of entrenched anxiety and the fear that the worst is not yet over. The UK’s economic future will be defined by which of these stories becomes dominant, and whether the gap between them can ever be bridged.

The Great Retail Divide: Why Food Feasted and Fashion Famished in the UK's Christmas Showdown

Ultimately, this isn’t just about numbers on a chart. It’s about the lived experience of millions of people. A truly sustainable economic recovery cannot be built on the optimism of one generation while another is left behind. Acknowledging and addressing this divide is the first and most critical step toward building a more resilient and equitable economic future for all.