The Dragon’s New Roar: How China’s Auto Export Surge is Reshaping the Global Economy

The global automotive landscape is undergoing a seismic shift, a tectonic realignment not seen since the rise of Japanese and South Korean manufacturers decades ago. At the epicenter of this transformation is China. Long known as the world’s factory, the nation is now rapidly evolving into the world’s showroom, unleashing a torrent of vehicles upon international markets. As its once-insatiable domestic market begins to cool, a new, aggressive export-oriented strategy is taking hold, with profound implications for international trade, the global economy, and the very structure of the automotive industry.

This isn’t just about selling more cars; it’s a calculated gambit for global influence, powered by a decade of strategic industrial policy, technological leapfrogging in electric vehicles (EVs), and an unparalleled dominance over the battery supply chain. For investors, business leaders, and finance professionals, understanding this shift is no longer optional—it’s critical for navigating the opportunities and risks that lie ahead. The roar of the dragon’s new automotive engine is getting louder, and the world is starting to listen.

The Domestic Engine Cools, The Export Engine Ignites

For years, the Chinese domestic auto market was a gold rush. Global automakers poured billions into joint ventures, chasing a seemingly endless pool of first-time car buyers. But the post-pandemic economic landscape has changed the calculus. A combination of a slowing economy, consumer uncertainty, and market saturation has led to a significant cooling of domestic sales.

This domestic slowdown, however, has not led to idle factories. Instead, it has acted as a powerful catalyst, forcing Chinese automakers to pivot and look outward. The result has been an explosive growth in exports. In the first quarter of the year alone, China’s vehicle exports surged by an astonishing 58% year-on-year, surpassing 1 million units (source). This pivot is not a temporary measure; it’s a fundamental reorientation of the industry’s focus, turning overcapacity into a formidable tool for global market penetration.

Charting New Territories: The Global Expansion

China’s export strategy is geographically diverse and strategically astute, targeting markets where legacy brands are either vulnerable or where new EV infrastructure creates a level playing field. According to recent data, key destinations are emerging across the globe, each presenting a unique opportunity.

The following table highlights some of the top destinations for Chinese vehicle exports, showcasing the global reach of this new automotive powerhouse.

| Region/Country | Strategic Importance | Key Chinese Brands Present |

|---|---|---|

| Mexico | A key nearshoring hub and a strategic gateway to North American markets. Less brand-loyal consumer base. | MG, BYD, Chery |

| Middle East | Strong demand for both affordable and high-tech vehicles, with growing interest in EVs. | Geely, Changan, Haval |

| Europe (e.g., Belgium) | A direct challenge to established giants on their home turf, primarily through competitive EVs. | NIO, XPeng, BYD, MG |

| Russia | A market largely vacated by Western and Japanese brands due to sanctions, creating a significant vacuum. | Haval, Chery, Geely |

| Australia & Southeast Asia | Growing markets with increasing demand for affordable, feature-rich vehicles and EVs. | BYD, MG, Great Wall Motor |

In Mexico, Chinese brands are rapidly gaining market share by offering compelling value propositions that appeal to a broad consumer base. In the Middle East, their blend of technology and competitive pricing is finding fertile ground. But it is the push into Europe that is most telling. By establishing beachheads in countries like Belgium—a major port and logistics hub—Chinese automakers are signaling their intent to compete directly with Volkswagen, Stellantis, and Renault in their own backyard.

The Boardroom in Your Basement: Why Your Flat's Management Could Be Your Biggest Financial Risk

This raises significant geopolitical and data privacy questions that Western governments are only now beginning to grapple with. The data collected by these vehicles—from driving habits to location tracking—could become a new front in the ongoing tech rivalry. As investors and analysts, we must look beyond the unit sales and consider the strategic implications of this platform-based approach to global expansion. This isn’t just an automotive play; it’s a long-term strategy for embedding Chinese financial technology and software standards into the daily lives of global consumers.

The Competitive Edge: Technology, Supply Chains, and State Support

How did China achieve this so quickly? The answer lies in a multi-pronged strategy executed over the past decade, creating a powerful competitive advantage that legacy automakers are struggling to counter.

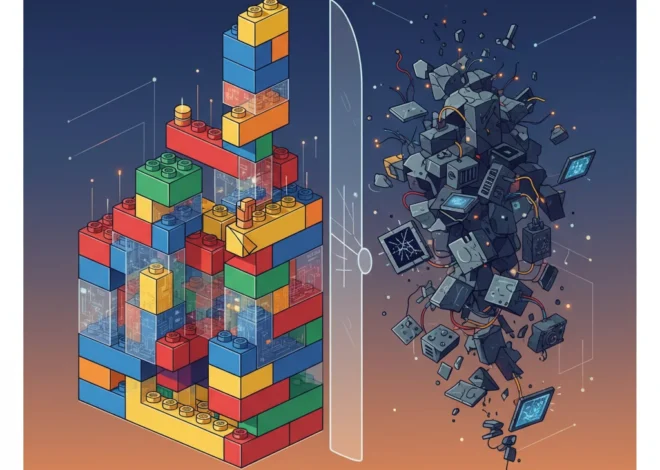

1. Supply Chain Dominance: China’s most significant advantage is its commanding control over the EV battery supply chain. From the mining and refining of critical minerals like lithium and cobalt to the manufacturing of battery cells and packs, Chinese companies dominate at nearly every stage. This vertical integration provides a massive cost and scale advantage, allowing them to produce EVs more cheaply and reliably than many competitors. Any serious investing analysis of the auto sector must now account for this supply chain reality.

2. Technological Leapfrogging: While Western automakers were refining the internal combustion engine, Chinese firms, backed by government mandates, went all-in on electrification. Companies like BYD (backed by Warren Buffett’s Berkshire Hathaway) are now global leaders in battery technology, with their “Blade Battery” setting new standards for safety and efficiency. This focus has allowed them to leapfrog legacy players in the EV space, which is increasingly seen as the future of mobility.

3. Government Industrial Policy: The rise of China’s auto industry was not an accident. It is the result of a deliberate, long-term industrial strategy involving massive subsidies, favorable banking and loan conditions for domestic champions, and policies designed to foster a hyper-competitive domestic market that honed these companies into formidable global players.

Navigating the New Economic Chapter: Opportunities in Finance and Technology for the Year Ahead

Implications for Investors and the Global Economy

This structural shift carries profound consequences for global finance and investment portfolios. Ignoring it is no longer an option for anyone involved in the stock market, international trade, or corporate strategy.

Investment Opportunities and Risks

For those engaged in trading and long-term investing, the rise of Chinese auto giants presents a complex picture. On one hand, companies like BYD, Geely, and NIO represent a direct play on this global expansion. Their growth potential is immense, but so are the risks. Geopolitical tensions could lead to tariffs or outright bans in Western markets, and the intense competition could pressure profit margins. A nuanced approach is required, perhaps focusing not just on the automakers themselves but also on the broader ecosystem, including battery manufacturers like CATL and the network of parts suppliers.

Conversely, legacy automakers in the US, Europe, Japan, and South Korea face an existential threat. Their stock market valuations could come under sustained pressure as they grapple with lower-cost competition. The challenge for them is to accelerate their own EV transitions while defending their market share, a difficult and capital-intensive balancing act.

Broader Economic Impact

From a macroeconomic perspective, this export wave could have a deflationary effect on global car prices, benefiting consumers but squeezing industry profits. It will also reshape global trade flows and could exacerbate trade imbalances, potentially leading to increased protectionism. The intricate dance of global economics will be heavily influenced by the flow of these vehicles across borders.

Furthermore, the integration of advanced technology in these cars, from autonomous driving features to in-car digital payments, represents the next frontier of financial technology. The potential for using technologies like blockchain for secure vehicle identity and supply chain verification could also emerge, creating new avenues for innovation and investment.

The Crossroads of Capital: Why Protecting Old Tech Threatens Europe's Economic Future

The Road Ahead: A New World Order in Motion

The global automotive industry is at a crossroads. The era of unchallenged dominance by a handful of Western and Japanese companies is over. China’s emergence as an automotive export superpower is not a cyclical trend but a permanent reshaping of the industry. This is a story of ambition, strategic planning, and technological prowess that has been decades in the making.

The key takeaway for investors and business leaders is that this is just the beginning. The strategies employed by Chinese automakers today will serve as a blueprint for other industries tomorrow. As this new world order takes shape, the ability to understand the intricate connections between industrial policy, technological innovation, and global finance will be the ultimate key to success. The dragon has awakened, and its roar is now being heard in every major market around the world.