The Hidden Anchor on the U.S. Economy: Why Your Doctor’s Bill Matters More Than a Trade War

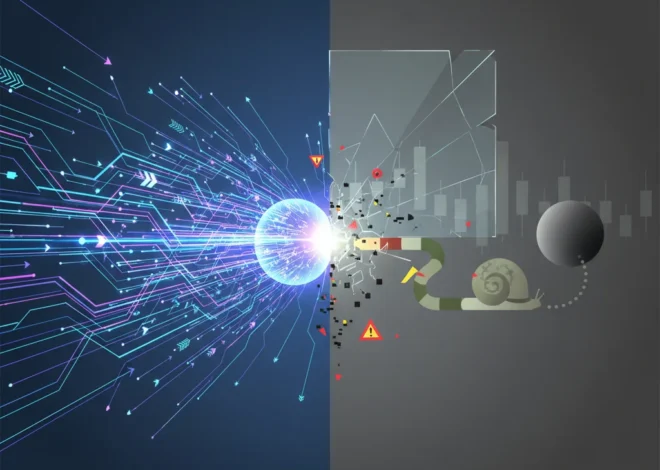

For years, headlines have been dominated by a singular narrative about the American economy: a grand battle of global competition. We hear endlessly about trade deficits with China, the race for technological supremacy, and the fight to keep manufacturing jobs on U.S. soil. While these are important issues, this focus on external threats obscures a far more significant, and arguably more dangerous, challenge—one that originates right here at home. It’s a problem that doesn’t show up in container shipping data but is felt in every household budget: the staggering inefficiency of America’s non-tradeable sectors.

In a compelling letter to the Financial Times, Karthik Sankaran of the Quincy Institute for Responsible Statecraft argues that the real drag on U.S. competitiveness isn’t its world-class tech giants or innovative manufacturers, but the bloated, uncompetitive domestic sectors like healthcare, education, and real estate (source). This is the hidden anchor on the U.S. economy. Understanding this two-speed system is crucial for investors, business leaders, and anyone seeking to navigate the complex world of modern finance and economics.

The Tale of Two Economies: Tradeable vs. Non-Tradeable

To grasp this argument, we first need to understand the fundamental split in the economy. Every developed nation has two broad types of sectors:

- The Tradeable Sector: This includes goods and services that can be sold across international borders. Think of Apple’s iPhones, Boeing’s aircraft, Hollywood movies, and sophisticated financial services from Wall Street. Companies in this sector face intense global competition. This pressure forces them to be relentlessly innovative, efficient, and price-competitive. The result is a hyper-productive engine that drives much of America’s global economic power.

- The Non-Tradeable Sector: This comprises services that are produced and consumed locally. You can’t import a doctor’s visit, a university degree from a local college, or a construction permit. This sector includes healthcare, K-12 and higher education, childcare, legal services, and much of the construction and real estate industry. Because these services are shielded from international competition, they don’t face the same pressures to innovate or control costs.

The U.S. tradeable sector is, by most measures, a world-beater. Its productivity and innovation are the envy of the world. However, it only represents a fraction of the total economy. The non-tradeable sector is far larger in terms of employment and its impact on the daily lives and budgets of average Americans. And it’s here that the problems begin.

The Great American Cost Disease

The core issue is that while the tradeable sector has seen decades of deflationary pressure—your flat-screen TV and laptop are exponentially more powerful and cheaper than 20 years ago—the non-tradeable sector has experienced the polar opposite. This phenomenon is often referred to by economists as “Baumol’s cost disease,” where sectors with low productivity growth see wages rise along with the rest of the economy, leading to a sharp increase in their relative costs.

The practical result is runaway cost inflation in the very services that are essential for a middle-class life. While the stock market celebrates the efficiency of tech and manufacturing, American families are being crushed by the inefficiency of everything else. The data paints a stark picture.

The following table compares the price changes of key items from both sectors over the last two decades, illustrating this dramatic divergence. The data, based on the U.S. Bureau of Labor Statistics, shows how costs for essential non-tradeable services have skyrocketed compared to tradeable goods.

| Sector | Item/Service | Approximate Price Increase (2000-2023) |

|---|---|---|

| Non-Tradeable | Hospital Services | +220% (source) |

| Non-Tradeable | College Tuition and Fees | +185% (source) |

| Non-Tradeable | Child Care and Nursery School | +145% |

| Tradeable | New Vehicles | +30% |

| Tradeable | Household Appliances | -25% |

| Tradeable | Televisions | -98% |

This isn’t just an issue of personal finance; it’s a macroeconomic powder keg. These relentless price hikes in essential services act as a powerful, underlying inflationary force within the U.S. economy.

How Domestic Costs Distort Global Finance

This is where the story connects back to global trade and the U.S. dollar. As Sankaran points out in his letter, this persistent domestic inflation forces the Federal Reserve to maintain higher interest rates than it otherwise would need to (source). The Fed’s mandate is to control overall inflation, and it cannot ignore the massive price increases in healthcare and education.

Here’s the chain reaction:

- High Domestic Costs → High Structural Inflation: Inefficient non-tradeable sectors create a constant upward pressure on the overall price level.

- High Inflation → Hawkish Monetary Policy: The Federal Reserve responds by keeping interest rates relatively high to cool the economy and keep inflation in check.

- High Interest Rates → Stronger U.S. Dollar: In a world of globalized finance, capital flows to where it can get the best return. Higher U.S. interest rates make dollar-denominated assets (like U.S. Treasury bonds) more attractive to foreign investors. This increased demand for dollars pushes up its value relative to other currencies.

- Stronger Dollar → Larger Trade Deficit: A strong dollar makes U.S. exports more expensive for foreign buyers and makes imports cheaper for American consumers. The result? The U.S. exports less and imports more, widening the very trade deficit that politicians so often decry.

In a stunning paradox, the primary driver of the U.S. trade deficit isn’t unfair competition from abroad, but rather the uncompetitive nature of its own domestic service sectors. We are essentially importing deflation (cheap goods) to counteract our homegrown inflation (expensive services).

Looking forward, I believe the most potent disruptive force will come from technology. The rise of fintech and financial technology is just beginning to scratch the surface of these ossified industries. Think of telemedicine platforms reducing healthcare overhead (HealthTech), online learning models challenging the high-cost university system (EdTech), or even blockchain applications creating transparent and efficient credentialing systems. These innovations represent a massive opportunity for both economic progress and savvy investing. However, technology alone is not a panacea. It will face immense resistance from incumbents who benefit from the status quo. Real, lasting change will require a combination of technological disruption and bold policy reform.

Implications for Investing and the Stock Market

Understanding this dynamic is critical for anyone involved in finance, banking, or investing. It reframes where the risks and opportunities truly lie.

- Rethinking Inflation and Interest Rates: If a significant portion of U.S. inflation is structural and resistant to Fed rate hikes (raising rates doesn’t make university administration more efficient), it may mean we are in for a prolonged period of higher-than-average interest rates. This has profound implications for bond valuations, growth stock multiples, and the cost of capital for all businesses.

- The “Strong Dollar” Trade: Investors must account for a persistently strong U.S. dollar in their trading and investment strategies. This benefits U.S. importers and companies with primarily domestic costs, but it acts as a headwind for large U.S. multinational exporters whose foreign earnings translate back into fewer dollars.

- Finding Growth in Inefficiency: The greatest investment opportunities often lie in solving the biggest problems. The non-tradeable sectors, while problematic for the economy, are ripe for disruption. Companies using technology to bring transparency, efficiency, and lower costs to healthcare, education, and real estate could be the big winners of the next decade. This is where the worlds of fintech and venture capital are intensely focused.

- A New Lens for Economic Analysis: When analyzing the health of the U.S. economy, look beyond the headline trade numbers. Pay closer attention to the Consumer Price Index (CPI) components for services. Progress in taming healthcare and education inflation is a far more bullish long-term signal than a temporary narrowing of the trade deficit.

Audit Overhaul: Is the SEC Loosening the Leash on Corporate Watchdogs?

The Path Forward: A Call for Internal Reform

The conclusion is as clear as it is challenging: America’s economic destiny will not be decided in trade negotiations with Beijing, but in the policy debates over healthcare reform, university accreditation, and local housing zoning laws. Focusing on tariffs while ignoring the rot within is like meticulously polishing the brass on the Titanic as it takes on water.

Addressing the cost disease in the non-tradeable sectors requires a multi-pronged approach: fostering competition, embracing technological disruption, and enacting smart regulatory reforms that prioritize efficiency and consumer value over protecting incumbent interests. It is a politically difficult and complex task, but it is the central economic challenge of our time.

For investors, business leaders, and citizens, the message is to look inward. The future health of the American economy, the stability of our financial markets, and the prosperity of its people depend not on winning a battle against the world, but on having the courage to fix what is broken at home.