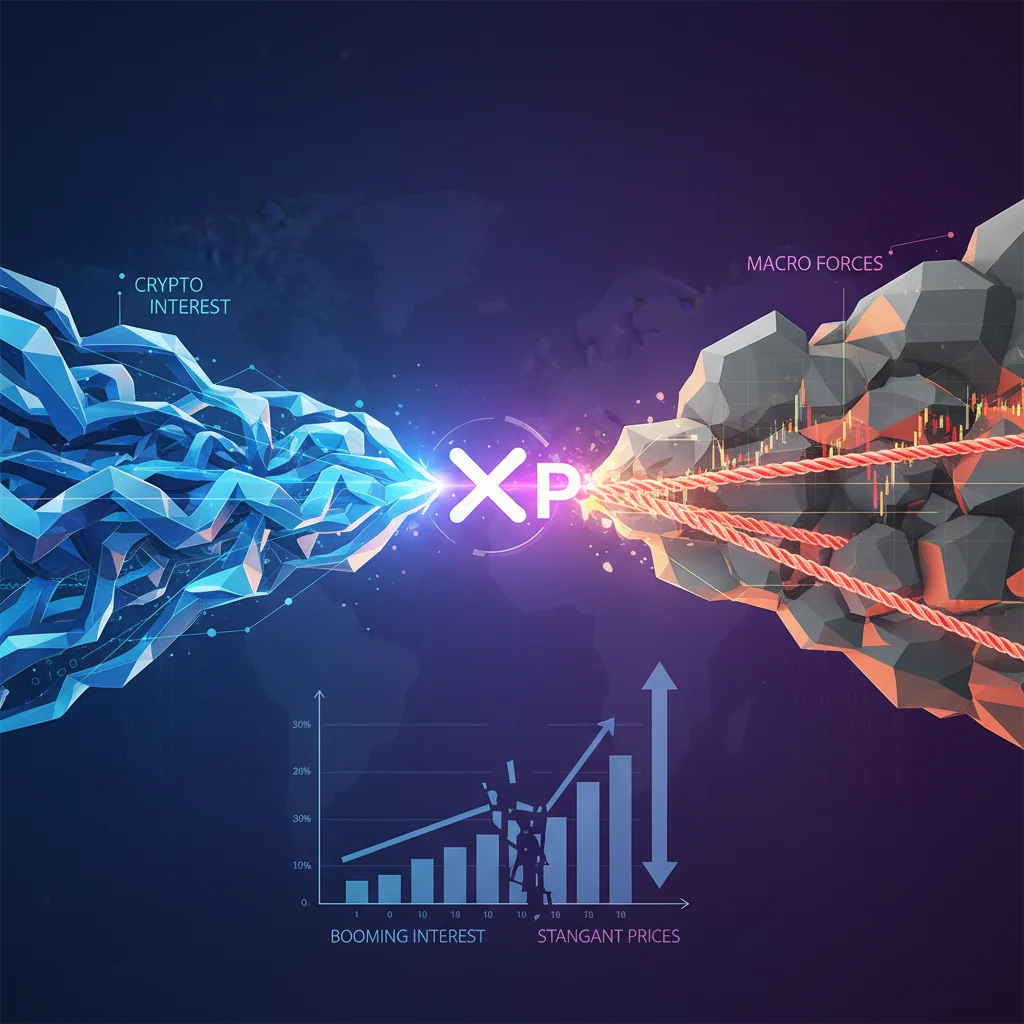

XRP’s High-Stakes Tug-of-War: Why Macroeconomic Forces Are Overpowering Crypto Hype

The Crypto Paradox: Booming Interest, Stagnant Prices

In the dynamic world of finance and investing, a curious paradox is unfolding. On one side, we witness a torrent of institutional capital pouring into cryptocurrency Exchange-Traded Funds (ETFs), signaling a new era of mainstream acceptance. On the other, key digital assets like XRP are struggling to gain traction, weighed down by forces far beyond the crypto ecosystem. XRP/USD is currently “trading heavy,” a market term for an asset that struggles to rise and is susceptible to falling. This isn’t due to a lack of faith in blockchain technology but rather a testament to a powerful, unyielding opponent: the global macroeconomic environment.

This situation creates a complex puzzle for investors, business leaders, and anyone involved in financial technology. Why is the enthusiasm surrounding crypto ETFs not translating into a broad market rally? The answer lies in a classic tug-of-war between crypto-specific optimism and the sobering realities of global economics. To truly understand XRP’s current position, we must look beyond its own chart and examine the larger financial landscape that is currently calling the shots.

The Macroeconomic Maelstrom: When Global Economics Dictates Crypto’s Fate

For years, many crypto proponents argued that digital assets were a hedge against traditional market forces. The current climate, however, tells a different story. Digital assets, now a multi-trillion dollar asset class, are deeply intertwined with the global financial system. Consequently, they are subject to the same “macro headwinds” that affect the stock market and other risk assets. Three primary forces are currently exerting immense pressure on assets like XRP.

1. The Federal Reserve’s Hawkish Stance

The U.S. Federal Reserve, the central bank of the United States, plays a pivotal role in global finance. When it adopts a “hawkish” stance, it signals a commitment to keeping interest rates higher for longer to combat inflation. This has a direct cooling effect on investment appetite. With government bonds offering attractive, low-risk yields, the incentive to speculate on higher-risk assets like cryptocurrencies diminishes significantly. As market analysis indicates, this restrictive monetary policy creates a challenging environment for assets that thrive on liquidity and risk-taking.

2. Soaring U.S. Treasury Yields

Directly related to the Fed’s policy are the yields on U.S. Treasury bonds. These are often called the “risk-free rate of return” because they are backed by the full faith and credit of the U.S. government. When these yields rise, they set a higher benchmark for all other investments. An investor might ask, “Why should I take on the volatility of XRP when I can get a guaranteed return from a Treasury bond?” This competition for capital pulls money away from speculative markets, including crypto, and into the relative safety of government debt.

3. The Reign of the Strong U.S. Dollar

The U.S. Dollar Index (DXY) measures the dollar’s strength against a basket of other major currencies. A strong dollar, fueled by high U.S. interest rates, makes assets priced in USD, like XRP/USD, more expensive for foreign investors. This can dampen international demand. More importantly, a strong dollar often signals a “risk-off” sentiment in global markets, where investors flee to the perceived safety of the world’s primary reserve currency, selling off assets like stocks, commodities, and cryptocurrencies in the process.

These three factors create a powerful trifecta of headwinds that are currently offsetting much of the positive, industry-specific news. The ROI of a Fish and Chip Supper: Deconstructing the Economics of Corporate Goodwill

The ETF Boom: A Rising Tide That Isn’t Lifting All Boats

Despite the gloomy macroeconomic picture, the world of fintech has seen a monumental development: the successful launch and staggering demand for spot Bitcoin and Ethereum ETFs. These products provide a regulated, accessible bridge for institutional and retail investors to gain exposure to digital assets without the complexities of direct ownership. The demand has been undeniably strong, representing a major validation for the crypto industry.

However, this wave of institutional cash has been highly concentrated. The capital is flowing primarily into Bitcoin and, to a lesser extent, Ethereum—the two largest and most established cryptocurrencies. This positive momentum has not cascaded down to other digital assets, or “altcoins,” like XRP. There are several reasons for this disparity:

- Regulatory Focus: Regulators were most comfortable approving ETFs for assets with established futures markets and a clearer (though still debated) classification, like Bitcoin as a commodity. XRP’s long and complex legal battle with the SEC, while yielding partial victories, still casts a shadow of regulatory uncertainty.

- Investor Psychology: Large institutions and conservative investors entering the space for the first time are naturally drawn to the “blue chips” of the crypto world. Bitcoin is seen as “digital gold,” a store of value, while Ethereum is the foundational layer for decentralized finance and Web3.

- Divergent Narratives: XRP’s primary use case is centered on revolutionizing banking and cross-border payments through its blockchain infrastructure. While a powerful narrative, it is a different investment thesis than the store-of-value or smart-contract platform narratives that are currently attracting the bulk of ETF-related capital.

Decoding the Charts: A Technical Look at XRP/USD

Beyond the fundamental factors of economics and ETF flows, the price chart for XRP/USD tells its own technical story. For those involved in active trading, these levels provide a roadmap of potential future price action. Currently, the technical picture aligns with the bearish macroeconomic sentiment.

One of the most significant indicators is the 200-day Simple Moving Average (SMA). This is a long-term trend indicator that smooths out price data over the past 200 days. When an asset trades consistently below its 200-day SMA, as XRP is currently doing, it is widely considered to be in a long-term downtrend (source). This technical weakness reinforces the bearish case built by the macro headwinds.

The key price levels that traders are watching are clear zones of supply and demand, which act as barriers or floors for the price.

| Level Type | Price (USD) | Significance |

|---|---|---|

| Major Resistance | $0.5500 | A strong ceiling where selling pressure is expected to be significant. A break above this level would be a major bullish signal. |

| Minor Resistance | $0.5000 | A psychological and technical barrier. The price has struggled to hold above this level, indicating a lack of buying momentum. |

| Major Support | $0.4500 | A critical floor where buying interest has previously stepped in. A break below this level could trigger a more substantial price decline (source). |

Understanding these levels is crucial for managing risk. The battle between buyers at support and sellers at resistance is a visual representation of the larger conflict between crypto-specific hope and macroeconomic reality. Beyond the Bet: Deconstructing Denise Coates' £280M Payday and the Economics of a Gambling Empire

Conclusion: Navigating the New Era of Interconnected Markets

The story of XRP/USD is more than just the price action of a single digital asset; it’s a microcosm of the entire crypto market’s maturation. The industry is no longer an isolated island. It is a significant component of the global financial landscape, and with that integration comes exposure to the powerful currents of monetary policy and economic cycles. The strong demand for crypto ETFs is a long-term bullish sign for the entire financial technology space, but it cannot, on its own, defy the gravity of a hawkish Federal Reserve and a risk-averse market.

For investors, business leaders, and financial professionals, the key takeaway is the necessity of a dual-focus approach. It is no longer enough to analyze blockchain developments and tokenomics in a vacuum. A comprehensive understanding of global economics, central banking policies, and their impact on market sentiment is now essential for navigating the volatile but promising world of digital asset investing. The tug-of-war continues, and for the foreseeable future, the macro team appears to have the stronger grip. The Blackpool Food Bank and the Canary in the Coal Mine: What a £9,000 Donation Reveals About Our Economy