Beyond the Headlines: Decoding the September Jobs Report and What It Means for Your Investments

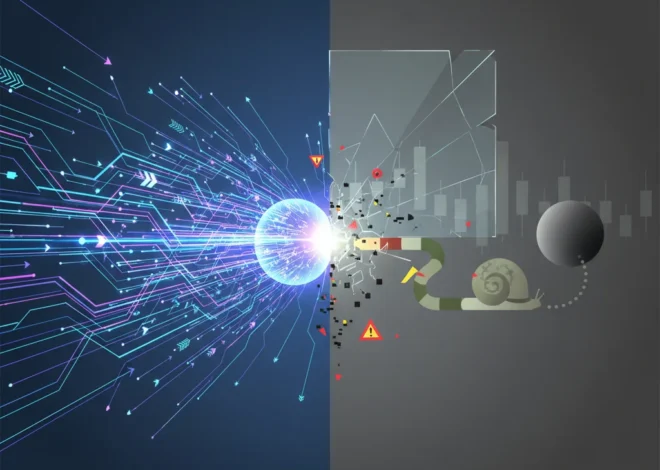

The world of finance and economics often feels like a puzzle, with each new piece of data offering a clue—or sometimes, a contradiction. The latest U.S. jobs report for September is a perfect example of this complexity. On the surface, the numbers seem to send mixed signals: the economy added a respectable 119,000 jobs, yet the unemployment rate unexpectedly ticked up to 4.4%. For investors, business leaders, and anyone with a stake in the economy, the key isn’t just knowing these numbers, but understanding the story they tell together.

This report is more than a simple scorecard; it’s a critical indicator for the Federal Reserve’s next moves, a barometer of the stock market’s mood, and a glimpse into the future of work in an era of rapid technological change. In this deep dive, we’ll move beyond the headlines to dissect what these figures truly mean for your financial strategy, the broader economy, and the evolving landscape of banking and investing.

Deconstructing the September Numbers: A Tale of Two Data Points

At first glance, the September employment data can be confusing. How can a country add over a hundred thousand jobs while also seeing its unemployment rate increase? The answer lies in the nuances of how these metrics are calculated and what they represent within the broader field of economics.

The Job Growth Figure: A Sign of Resilience

Employers added 119,000 jobs in September, a figure that, while modest, demonstrates continued resilience in the U.S. labor market. This sustained growth, even in the face of high interest rates and global economic uncertainty, suggests that businesses are still confident enough to expand their payrolls. To understand the full picture, it’s essential to look at which sectors are driving this growth.

Below is a hypothetical breakdown of where the jobs were added, which typically reveals underlying economic trends:

| Economic Sector | Jobs Added/Lost (September Estimate) | Implication |

|---|---|---|

| Leisure and Hospitality | +45,000 | Indicates continued strong consumer spending on services. |

| Healthcare and Social Assistance | +40,000 | Reflects long-term demographic trends and consistent demand. |

| Government | +25,000 | Often driven by hiring in local and state education. |

| Professional and Business Services | +15,000 | A key indicator of white-collar employment health. |

| Manufacturing | -6,000 | May signal a slowdown due to higher borrowing costs and shifting demand. |

This sector-by-sector analysis shows a service-driven economy that remains robust, even as goods-producing sectors like manufacturing begin to feel the pressure from the Federal Reserve’s policies.

The Unemployment Paradox: Why a Higher Rate Isn’t All Bad News

The most puzzling part of the report is the uptick in the unemployment rate from 4.3% to 4.4%. This occurred not because more people were fired, but because the labor force participation rate—the percentage of the population that is either working or actively looking for work—increased. According to data from the Bureau of Labor Statistics, when previously discouraged workers re-enter the job market, they are initially counted as “unemployed” until they find a position. A rising participation rate is often a sign of economic optimism, as it suggests people feel confident enough in their job prospects to start searching again. This is a crucial distinction that turns a seemingly negative headline into a potentially positive long-term indicator.

The Adoption Principle: A Human-Centric Model for Long-Term Value Investing

The Federal Reserve’s Tightrope Walk: Implications for Monetary Policy

Every piece of economic data is scrutinized by the Federal Reserve, and this jobs report is no exception. The Fed is currently walking a fine line: it wants to cool the economy enough to bring inflation down to its 2% target without triggering a deep recession—a scenario often called a “soft landing.”

This report gives them ammunition for both hawks (who favor higher rates) and doves (who favor pausing or cutting rates).

- The Hawkish View: Persistent job growth and strong wage gains (assuming they accompanied this report) could be seen as inflationary, justifying another interest rate hike to further cool demand.

- The Dovish View: The rising unemployment rate and a moderating pace of job creation suggest that previous rate hikes are working as intended. This supports the case for a pause to allow the full effects of past policy to filter through the economy.

The market’s reaction often hinges on which narrative traders and algorithms believe the Fed will adopt. For now, this “Goldilocks” report—not too hot, not too cold—may encourage the Fed to hold rates steady at its next meeting, adopting a “wait and see” approach. This stability is a key factor for the stock market and overall financial planning.

What This Means for Your Investing and Trading Strategy

For investors and finance professionals, translating economic data into actionable strategy is paramount. A mixed report like this one requires a nuanced approach, not a knee-jerk reaction.

Navigating the Stock Market’s Mood Swings

In the short term, the stock market can be volatile following a jobs report. A “good news is bad news” scenario often plays out, where a surprisingly strong report fuels fears of Fed rate hikes, causing a market dip. Conversely, a weaker report can rally markets on hopes of a more accommodative Fed. This report’s ambiguity could lead to choppy trading as investors digest the implications.

Long-term investors, however, should focus on the underlying fundamentals. A resilient labor market, even if it’s cooling, is positive for corporate earnings and consumer spending. The key is to look at sector-specific trends. The continued strength in healthcare and hospitality might signal opportunities in those areas, while weakness in manufacturing could be a headwind for industrial stocks.

The Future of Finance: Fintech, Blockchain, and a New Job Market

The evolution of the labor market is inextricably linked to technological innovation, particularly in the finance sector. The rise of financial technology is reshaping traditional banking and investing. Automated trading algorithms, AI-powered financial advisors, and mobile banking platforms are changing both how consumers manage their money and the skills required to work in the industry.

Furthermore, disruptive technologies like blockchain are creating entirely new economic ecosystems. While still in its early stages, blockchain technology promises to decentralize finance, streamline supply chains, and create novel digital assets. This will, in turn, generate demand for new roles that didn’t exist a decade ago, from smart contract auditors to decentralized application developers. As investors look to the future, understanding the impact of these technological megatrends on the economy and the job market is just as important as analyzing monthly employment statistics. According to a report by Grand View Research, the global blockchain technology market is expected to expand significantly, highlighting its growing economic influence.

Beyond Gilts: Why Scotland's First Bond Issuance is a Game-Changer for Investors and the UK Economy

Actionable Takeaways for Different Audiences

This single jobs report has different implications depending on your role in the economy.

- For the General Public: A resilient job market is good news, but the rising unemployment rate due to more job seekers means competition might be slightly higher. It’s a great time to focus on upskilling, especially in tech-adjacent fields.

- For Investors: Avoid making drastic portfolio changes based on one report. Focus on diversification and the long-term health of the sectors you’re invested in. This report supports the case for a “soft landing,” which is generally positive for equities over the long run.

- For Business Leaders: The data suggests that while the labor market is no longer red-hot, finding and retaining talent remains competitive. Businesses should continue to invest in their employees and technology to boost productivity. The cooling in manufacturing is a signal to manage inventory and supply chains carefully.

UK's Economic Engine Sputters: Why a Car Production Slump is a Red Flag for the Entire Economy

Conclusion: Reading Between the Lines of a Complex Economy

The September jobs report, with its 119,000 new jobs and a slight rise in unemployment to 4.4%, is a masterclass in economic nuance. It paints a picture of an economy that is cooling but not collapsing, a labor market that is normalizing but not weakening, and a populace that is growing more confident about its economic prospects. It provides the Federal Reserve with the flexibility to remain patient, a sentiment that could bring a degree of calm to a volatile stock market.

For those engaged in finance, investing, and business, the ultimate lesson is the importance of looking beyond the headlines. By understanding the interplay between job growth, labor force participation, and the powerful undercurrents of technology like fintech and blockchain, we can build a more informed, resilient, and forward-looking financial strategy. The economy is not a simple machine, but a complex, dynamic system, and this report is one more fascinating piece of the puzzle.