The Rent Revolution: How Your Monthly Payment is About to Redefine Your Financial Future

For decades, one of the largest and most consistent monthly payments for millions of people has been conspicuously absent from their financial identity: rent. While mortgage payments have long served as a cornerstone for building a strong credit history, renters have been left in a financial paradox. They demonstrate consistent, responsible payment behavior month after month, yet this significant financial commitment has remained largely invisible to the institutions that determine their access to credit. That is all about to change.

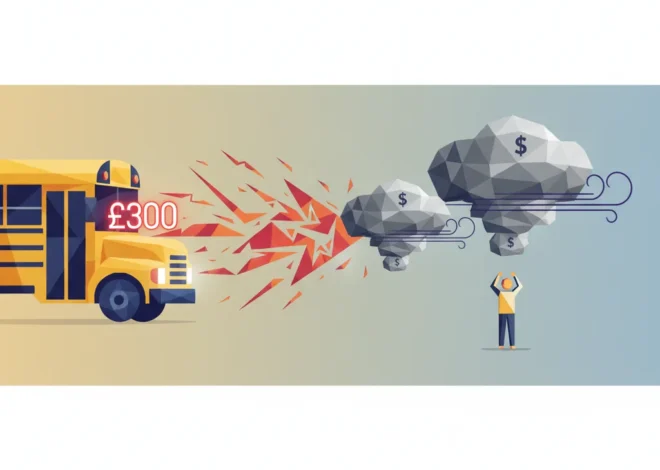

In a move poised to send ripples across the entire economy, credit agency Experian has announced it will now incorporate rental payment data into its credit scoring models. According to a report from the BBC, the agency stated this change will provide lenders with “a more complete view of borrower behaviour.” This seemingly simple administrative update is, in fact, a monumental shift in the world of personal finance, one that could unlock economic opportunities for millions and fundamentally alter the landscape of lending, investing, and banking.

Deconstructing the Credit Score: A System Built on Debt

To grasp the significance of Experian’s decision, one must first understand the traditional architecture of a credit score. Systems like FICO and VantageScore have historically been built on a simple premise: your ability to manage debt is the best predictor of your future financial reliability. The core components have remained largely unchanged for years:

- Payment History (35%): Do you pay your credit cards, loans, and mortgages on time?

- Amounts Owed (30%): How much of your available credit are you using (credit utilization)?

- Length of Credit History (15%): How long have your credit accounts been open?

- Credit Mix (10%): Do you have a healthy mix of different types of credit (e.g., credit cards, installment loans)?

- New Credit (10%): How many new accounts have you recently opened?

The glaring omission in this model is any recognition of regular, non-debt payments. This has created a significant portion of the population known as the “credit invisible.” These are individuals who may be financially responsible—paying rent, utilities, and phone bills diligently—but have little to no formal credit history. According to the Consumer Financial Protection Bureau (CFPB), approximately 26 million American adults are credit invisible, with millions more having “unscorable” credit files. This has locked them out of affordable financial products, from car loans to mortgages, forcing them into higher-cost alternatives or denying them access to capital altogether.

The Fintech Catalyst: Why This Change is Happening Now

The inclusion of rental data isn’t a new idea, but its widespread implementation has been held back by logistical and technological hurdles. The rise of financial technology (fintech) has been the primary catalyst for breaking down these barriers. Here’s how:

- Data Aggregation Platforms: Fintech companies have developed sophisticated platforms that can securely connect to bank accounts (with user permission) to verify and report rent payments directly to credit bureaus.

- Landlord-Tenant Portals: A growing number of property management companies now use digital platforms for rent collection, creating a clean, verifiable data trail that was previously unavailable with paper checks or cash.

- Demand for Financial Inclusion: There is increasing social and political pressure on the banking industry to create more equitable access to credit. As housing costs rise, a larger percentage of the population are renters for longer periods. A Pew Research Center analysis found that the number of U.S. households renting is at its highest point in 50 years, making the exclusion of rental data increasingly untenable.

This convergence of technology and societal need has created the perfect environment for this evolution in credit scoring. It represents a significant step away from a purely debt-based model towards a more holistic “financial health” score.

A New Era of Financial Data: A Comparative Look

The table below illustrates the conceptual shift from a traditional credit model to a more modernized one that includes alternative data like rental payments.

| Financial Behavior | Traditional Credit Model Assessment | Modernized Credit Model Assessment |

|---|---|---|

| Credit Card Payments | Primary Indicator: Heavily weighted as a core measure of reliability. | Core Indicator: Remains a key data point for debt management. |

| Mortgage Payments | Primary Indicator: A powerful factor in building a strong credit history. | Core Indicator: Continues to be a significant measure of financial stability. |

| Rental Payments | Not Included: Largely invisible to lenders, offering no benefit to the payer. | Emerging Core Indicator: Now recognized as a key measure of consistent financial responsibility. |

| Utility & Telecom Bills | Not Included (unless in collections): Only negative information is typically reported. | Potential Future Indicator: Increasingly being considered as another form of alternative data. |

The Ripple Effect: Broader Implications for the Economy and Markets

The decision by Experian is not an isolated event; it is a bellwether for a much larger transformation with far-reaching consequences.

Impact on Banking and Lending

For lenders, this is a treasure trove of new data. A more comprehensive picture of a borrower’s financial habits allows for more nuanced risk assessment. This could lead to:

- An Expanded Customer Base: Millions of previously “unscorable” individuals will now become viable candidates for loans, credit cards, and mortgages.

- More Competitive Rates: With a clearer view of risk, lenders may be able to offer better interest rates to responsible renters who were previously considered high-risk due to a thin credit file.

- Innovation in Underwriting: This will accelerate the shift towards using alternative data, pushing the industry further into the realm of advanced analytics and AI-driven lending models.

Impact on Investing and the Stock Market

Astute investors should take note of the potential market shifts this will create. Several sectors stand to benefit:

- Fintech Companies: Businesses that specialize in rent reporting and alternative data aggregation are now positioned for significant growth.

- Financial Institutions: Banks and lenders that are quick to adapt their models to this new data could see an increase in their loan portfolios and market share.

- Real Estate: Property management companies and large landlords may see lower turnover as tenants are incentivized to stay in one place to build a consistent payment history. This could add stability to Real Estate Investment Trusts (REITs).

This is a clear example of how a regulatory and data-driven change can create new opportunities in the stock market for those who understand the underlying economics.

The Riyadh Reroute: Why Global Finance Talent is Chasing Trillions in Saudi Arabia

Impact on Renters and Financial Empowerment

For the first time, renters can have their largest monthly expense work for them, not against them. This empowers individuals to build a financial identity through actions they are already taking. It levels the playing field slightly between renters and homeowners, acknowledging that a consistent rent payment is a powerful indicator of financial discipline. However, it also introduces a new pressure: a late rent payment could now have the same credit-damaging consequence as a late credit card payment.

Navigating the New Financial Landscape

This change requires a proactive approach from all parties involved.

For Renters: It’s crucial to understand if and how your landlord reports payments. You may need to opt-in to a service or use a third-party platform to ensure your responsible payments are being counted. This transforms the act of paying rent into an active credit-building strategy.

For Landlords: Offering rent reporting can become a significant competitive advantage. It can attract more responsible tenants and potentially reduce delinquencies, as tenants will have a strong incentive to pay on time.

For Finance Professionals and Traders: Risk models for consumer credit must be updated. Financial advisors should be educating their clients, especially younger ones, on how to leverage this new tool. Those involved in trading financial stocks should analyze which institutions are best positioned to capitalize on this expanded pool of potential borrowers.

The £4 Brush Incident: A Micro-Crisis Exposing Macro Risks in Temu's Business Model

The Future is Holistic: What’s Next for Credit Scoring?

Including rental data is likely just the beginning. The trend is moving inexorably towards a more comprehensive, 360-degree view of an individual’s financial life. In the near future, we can expect to see other data points integrated into creditworthiness assessments, such as:

- Utility and telecommunications payments

- Subscription service payments (e.g., streaming services)

- Regular deposits into savings and investment accounts

The ultimate goal is to create a financial identity that reflects an individual’s complete financial behavior, not just their relationship with debt. This evolution, powered by financial technology, promises a more inclusive and accurate financial system, but it also raises important questions about data privacy and consumer protection that must be addressed along the way.

Conclusion: A Foundation for a Fairer Financial Future

Experian’s decision to incorporate rental history into credit scores is far more than a technical adjustment. It is a landmark recognition that financial responsibility comes in many forms. By finally making one of the largest and most consistent payments visible, the financial industry is taking a critical step towards a more equitable and accurate system. This move will redefine pathways to credit, create new opportunities for investors, and reshape the strategies of the entire banking and finance sector. The rent revolution is here, and it’s building a new foundation for the future of our economic lives.