Beyond the Handshake: Decoding the New US-China ‘Positive Framework’ and Its Impact on Global Markets

A Glimmer of Hope in a High-Stakes Economic Rivalry

In the complex and often turbulent theater of global geopolitics, the relationship between the United States and China holds a starring role. For years, investors, business leaders, and policymakers have watched this dynamic with bated breath, knowing that even the slightest shift can send shockwaves through the global economy. Recently, a quiet but significant development emerged from talks in Malaysia: US and Chinese officials have reportedly agreed on a “positive framework” for a potential summit between Donald Trump and Xi Jinping. This news, first reported by the Financial Times, offers a potential thaw in a relationship that has grown increasingly frosty.

But what does a “positive framework” truly mean? Is this the prelude to a new era of cooperation, or merely a temporary truce in a long-term strategic competition? For anyone involved in finance, investing, or international business, understanding the nuances of this development is critical. This article delves deep into the context of these talks, analyzes the potential market implications, and explores the underlying technological and financial currents that will shape the future of US-China relations.

The Road to Malaysia: A Brief History of Trade Tensions

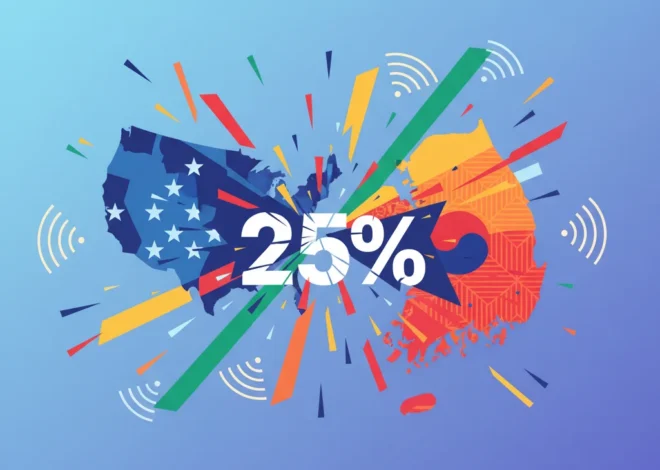

To appreciate the significance of this new framework, we must first understand the contentious path that led here. The US-China economic relationship, while deeply intertwined, has long been fraught with tension over issues like trade imbalances, intellectual property theft, and market access.

These simmering disputes boiled over into a full-scale trade war beginning in 2018. The Trump administration initiated a series of escalating tariffs on hundreds of billions of dollars worth of Chinese goods, prompting swift retaliatory measures from Beijing. The stated goal was to pressure China to change its “unfair trade practices” and reduce the substantial US trade deficit. The conflict roiled the stock market, disrupted global supply chains, and created a cloud of uncertainty that weighed on corporate investment decisions. According to analysis from the Peterson Institute for International Economics, the trade war ultimately had a negligible effect on the trade deficit but imposed significant costs on American consumers and businesses (source).

While the Biden administration has maintained many of these tariffs, its approach has also focused on strategic competition, particularly in high-tech sectors. This has included stringent export controls on advanced semiconductors and investments in domestic manufacturing to reduce reliance on China. This history of economic sparring forms the backdrop against which the Malaysia talks must be viewed. It is a landscape defined by deep-seated mistrust and strategic rivalry, making any positive step, however small, noteworthy.

High Stakes Showdown: Betfred's 7,500 Job Gamble Against Labour's Proposed Tax Hike

Deconstructing the “Positive Framework”

The recent breakthrough was announced by Scott Bessent, a key economic adviser to Donald Trump, who stated that a “positive framework” had been established. While details remain scarce, the agreement in principle signifies a mutual desire to de-escalate and find common ground ahead of a potential high-level summit. This is more than just diplomatic pleasantry; it’s a calculated signal to the world that both sides see value in stabilizing the relationship.

However, the ambiguity of the term “framework” is crucial. It suggests the establishment of ground rules and a shared agenda for future negotiations, rather than a substantive agreement on contentious issues. The core disagreements—over technology transfer, state subsidies, and national security—are unlikely to be resolved easily. This framework is the foundation, not the building itself. The real work of detailed negotiation on complex topics like financial technology regulations and market access for banking institutions still lies ahead.

Key Areas of Contention and Potential Compromise

To visualize the scope of the economic relationship and the imbalances that fuel these tensions, consider the US-China trade data over the past several years. The following table illustrates the persistent trade deficit that has been a central point of US policy.

| Year | U.S. Exports to China | U.S. Imports from China | Trade Balance |

|---|---|---|---|

| 2020 | $124.6 | $434.7 | -$310.2 |

| 2021 | $151.1 | $504.9 | -$353.8 |

| 2022 | $153.8 | $536.3 | -$382.4 |

| 2023 | $147.8 | $427.2 | -$279.4 |

Source: U.S. Census Bureau data, as of early 2024 (source). Figures are for goods only and may be subject to revision.

This data highlights the scale of the economic relationship and the challenge negotiators face. The slight narrowing of the deficit in 2023 reflects a combination of shifting supply chains, moderated consumer demand, and the lingering effects of tariffs. Any new agreement will need to address the structural factors behind these numbers.

The Ripple Effect: Implications for the Economy and Your Portfolio

For investors and business leaders, the most pressing question is: what does this mean for the markets? The immediate reaction to de-escalation is typically positive. Uncertainty is the enemy of investment, and a stable US-China relationship removes a major source of global economic anxiety.

Several sectors are particularly sensitive to this dynamic:

- Technology: Companies like Apple, Qualcomm, and Nvidia have significant exposure to the Chinese market for both sales and manufacturing. A reduction in tensions could ease supply chain concerns and mitigate the risk of further tech-focused restrictions.

- Agriculture: American farmers are major exporters of soybeans, pork, and other goods to China. The trade war saw these exports become a political tool, and a more stable relationship is a significant boon for the sector.

- Manufacturing and Retail: US companies that rely on Chinese manufacturing or sell to its vast consumer market would benefit from lower tariffs and a more predictable business environment.

Beyond specific stocks, a lasting truce could have a broader macroeconomic impact. It could help ease inflationary pressures by lowering the cost of imported goods and stabilizing supply chains. According to the World Bank, escalating trade fragmentation poses a significant risk to global growth, and steps to reverse this trend could provide a much-needed boost to the global economy (source).

The Absurdist's Edge: Why Acknowledging Workplace Nonsense is a Winning Investment Strategy

Beyond Tariffs: The New Frontiers of Competition

The narrative of the US-China rivalry is increasingly being written in the language of technology and finance. While tariffs grab headlines, the more profound and lasting competition is taking place in areas that will define the future economic order.

One of the key battlegrounds is financial technology, or fintech. China has rapidly developed a world-leading digital payments ecosystem through giants like Alipay and WeChat Pay. Simultaneously, its development of a central bank digital currency (CBDC), the e-CNY, represents a potential challenge to the dominance of the US dollar in global trading and finance. The underlying blockchain technology and the data it generates are seen as strategic assets.

From a US perspective, maintaining leadership in the global banking system and setting the standards for future financial innovation is paramount. Therefore, any comprehensive talks will inevitably have to touch upon data security, cross-border data flows, and the regulatory environment for financial services—complex issues that go far beyond simple trade balances.

What Should Investors and Business Leaders Do Now?

While the “positive framework” is a welcome development, it is also a reminder of the geopolitical volatility inherent in today’s markets. This is not a time for complacency, but for strategic positioning.

- Monitor the Details: The substance of the framework and the agenda for the summit will be critical. Watch for official statements and policy shifts, not just headlines. Pay attention to whether talks focus on narrow trade issues or broaden to include technology and investment.

- Review Supply Chain Resilience: The trade war taught businesses a painful lesson about the risks of concentrated supply chains. The trend of diversification (“China+1” strategies) will likely continue regardless of a trade truce, as companies seek to mitigate long-term geopolitical risk.

- Focus on Portfolio Diversification: For investors, this news underscores the importance of a globally diversified portfolio. While a detente could boost certain sectors, the underlying tensions mean that risks remain. Hedging against currency fluctuations and understanding the specific geopolitical exposure of your investments is more important than ever.

India's Trillion-Dollar Tech Dilemma: Can It Innovate Its Way Out of China's Shadow?

A Tentative Step on a Long Journey

The agreement on a “positive framework” between US and Chinese officials is a significant and hopeful development in a strained relationship. It signals a mutual recognition that unchecked escalation serves neither nation’s interests and opens the door for more productive dialogue. For the global stock market and the broader economy, it offers a welcome reprieve from the relentless drumbeat of geopolitical tension.

However, this is just one step on a very long and complex journey. The fundamental disagreements on economics, technology, and national security are deep-seated and will not disappear overnight. The path forward will require masterful diplomacy and a willingness to compromise on both sides. For those of us watching from the worlds of finance and business, the key is to remain informed, agile, and prepared for a future where the interplay between Washington and Beijing will continue to be one of the most powerful forces shaping our world.