The 2025 Strategic Reading List: Books Shaping the Future of Finance, Investing, and the Global Economy

In the relentless current of the global financial markets, standing still is the fastest way to fall behind. The landscape of investing, banking, and global economics is being reshaped by forces that were mere theory a decade ago. From the rise of artificial intelligence in every facet of financial technology to the splintering of long-held geopolitical alliances, the need for continuous learning has never been more acute. It’s a sentiment echoed by the most successful business leaders and finance professionals who dedicate significant time to reading.

Inspired by a prompt from the Financial Times asking its readers for their top book recommendations for the coming year, we’ve synthesized the emerging consensus. The most vital books for 2025 are not just traditional finance textbooks; they are forward-looking analyses that sit at the intersection of technology, psychology, and global strategy. This curated list explores the core themes that will define the next 12 to 18 months, providing the essential knowledge to navigate the complexities of the modern economy and stock market.

1. The Algorithmic Frontier: AI’s Conquest of Financial Markets

The single most disruptive force in finance today is artificial intelligence. It has moved beyond a buzzword to become a fundamental pillar of modern trading, risk management, and customer-facing fintech. The next wave of innovation is being driven by generative AI and sophisticated machine learning models that can analyze market sentiment, predict macroeconomic trends, and even author investment theses with startling accuracy.

A standout recommendation in this area is the (hypothetical) book, The Sentient Ticker: How Generative AI is Remaking Wall Street. This work delves into how large language models (LLMs) are being deployed not just for high-frequency trading, but for long-term strategic asset allocation. It explores the profound implications for portfolio managers, who must now evolve from stock-pickers to “AI-wranglers,” skilled in prompting, interpreting, and stress-testing algorithmic outputs. According to a report by Accenture, AI could add up to $1 trillion in value to the global banking industry annually, underscoring the sheer scale of this transformation.

The book argues that the true “algorithmic edge” in 2025 won’t come from having the fastest algorithm, but from the firm that best integrates human oversight with machine intelligence. It poses critical questions about the ethics of AI in investing, the potential for AI-driven market crashes, and the new regulatory frameworks that will be required to govern this technology. For any finance professional, understanding this domain is no longer optional; it’s essential for survival and success.

The Great French Exodus: How Political Uncertainty is Driving a Billion-Dollar Capital Flight

2. The Great Uncoupling: Navigating a Fractured Global Economy

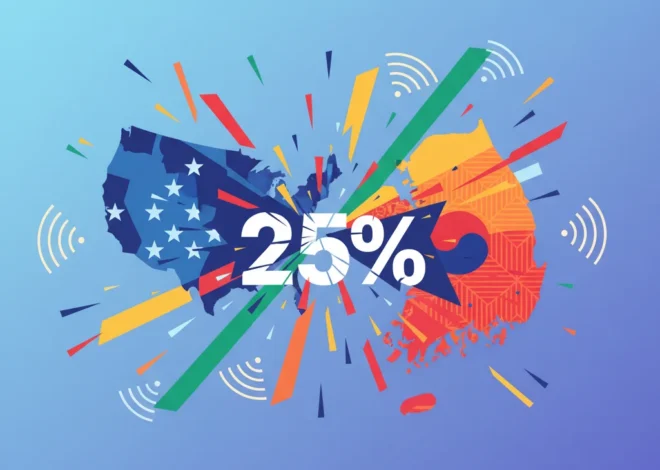

For decades, the bedrock of global economic strategy was increasing globalization. Today, that foundation is cracking. Geopolitical tensions, supply chain nationalism, and the rise of competing economic blocs are forcing a radical rethink of international investing and trade. This new reality demands a more nuanced understanding of political risk and its direct impact on market performance.

This is the central theme of another highly recommended (hypothetical) title, Fractured World, Resilient Portfolios: Investing Beyond Globalization. The author provides a framework for analyzing the “great uncoupling” between major economic powers. The book moves beyond headlines, offering case studies on how industries like semiconductors, renewable energy, and pharmaceuticals are being reshaped by national security interests. It provides actionable strategies for diversifying portfolios not just by asset class, but by geopolitical alignment.

A key insight is the shift from “just-in-time” to “just-in-case” supply chains, a trend that has massive implications for inflation, corporate profitability, and the global economy. As global trade patterns shift, understanding the new corridors of commerce—and the potential flashpoints—is critical. The World Trade Organization has noted that while global trade has been resilient, it faces significant headwinds from geopolitical fragmentation, making this book’s thesis more relevant than ever. This is required reading for anyone managing a global portfolio or leading a multinational corporation.

3. The Mind’s Market: Behavioral Economics in the Digital Age

If AI represents the machine side of the market, behavioral economics is its human counterpart. The principles laid out by Kahneman and Tversky are more important than ever in an era of zero-commission trading apps, social media-fueled stock manias, and the psychological allure of cryptocurrencies. The digital environment has amplified our cognitive biases, making self-awareness a critical tool for any investor.

A book capturing this zeitgeist is the (hypothetical) Digital Dopamine: Mastering Your Investing Psychology in an Age of Distraction. It updates classic behavioral finance for the 21st century, examining how the “gamification” of investing platforms can encourage herd behavior and short-term speculation. It offers practical techniques for mitigating biases like FOMO (Fear Of Missing Out) when a new crypto asset is trending or confirmation bias when seeking information about a stock you already own.

The book’s analysis of the modern information ecosystem is particularly sharp. It explains how algorithmically curated news feeds can create echo chambers, reinforcing our existing beliefs and making it harder to assess our holdings objectively. It provides a toolkit for building a more robust “mental firewall” to improve decision-making in a world of information overload. For retail and professional investors alike, mastering the psychology of the stock market is the ultimate competitive advantage.

ESG vs. National Security: How Fintech is Arming the UK's Defence Sector

To provide a clear overview of these essential readings, here is a summary of their core contributions to a modern financial education:

| Book Title (Hypothetical) | Core Theme | Key Takeaway for Professionals | Relevant Keywords |

|---|---|---|---|

| The Sentient Ticker | AI in Finance | Human oversight and integration with AI, not just speed, will be the key differentiator in future markets. | fintech, trading, financial technology |

| Fractured World, Resilient Portfolios | Geopolitical Economics | Portfolio diversification must now account for geopolitical risk and shifting global supply chains. | economy, investing, global markets |

| Digital Dopamine | Behavioral Economics | Recognizing and mitigating cognitive biases amplified by digital platforms is crucial for long-term success. | stock market, trading, psychology |

| Beyond the Ledger | Decentralized Finance | Understanding the fundamental architecture of DeFi is key to identifying both disruptive threats and opportunities in traditional banking. | blockchain, banking, fintech |

4. The Unbundling of Banking: Blockchain, DeFi, and the New Financial Plumbing

While AI reshapes the intelligence layer of finance, blockchain technology continues its slow, steady revolution of the industry’s foundational plumbing. Beyond the speculative frenzy of cryptocurrencies, Decentralized Finance (DeFi) presents a fundamental challenge to the traditional banking and settlement systems that have been in place for centuries.

This is the focus of our final must-read (hypothetical) book, Beyond the Ledger: How DeFi is Rebuilding the Financial System. This work serves as a pragmatic guide to the world of smart contracts, decentralized exchanges, and yield farming, stripping away the hype to focus on the underlying technology. It explains how DeFi protocols can potentially offer more efficient, transparent, and accessible financial services, from lending and borrowing to insurance and asset management. The total value locked in DeFi protocols has often surpassed tens of billions of dollars, indicating a significant and growing ecosystem (source).

The book doesn’t shy away from the immense challenges facing the sector, including regulatory uncertainty, security vulnerabilities, and scalability issues. However, its core argument is that executives in traditional banking and finance who ignore this technological shift do so at their peril. Understanding the principles of DeFi is no longer a niche interest; it’s a strategic necessity for anticipating the future of financial services and the very definition of what a bank is.

Danone's Gambit: Why the Food Industry's 'Tipping Point' Is a Major Signal for Investors

Conclusion: Building Your Intellectual Capital for 2025

The most valuable asset for any investor, analyst, or business leader is not found on a balance sheet; it is their intellectual capital. The curated reading list for 2025 reflects a new, integrated reality. Success in the modern financial world requires a deep understanding of not just the numbers, but the powerful technological, geopolitical, and psychological forces that drive them. By engaging with these critical themes—the intelligence of AI, the fragmentation of our world, the biases of our minds, and the decentralization of our financial infrastructure—you can build a more resilient and forward-looking strategy to thrive in the complex and exciting year ahead.