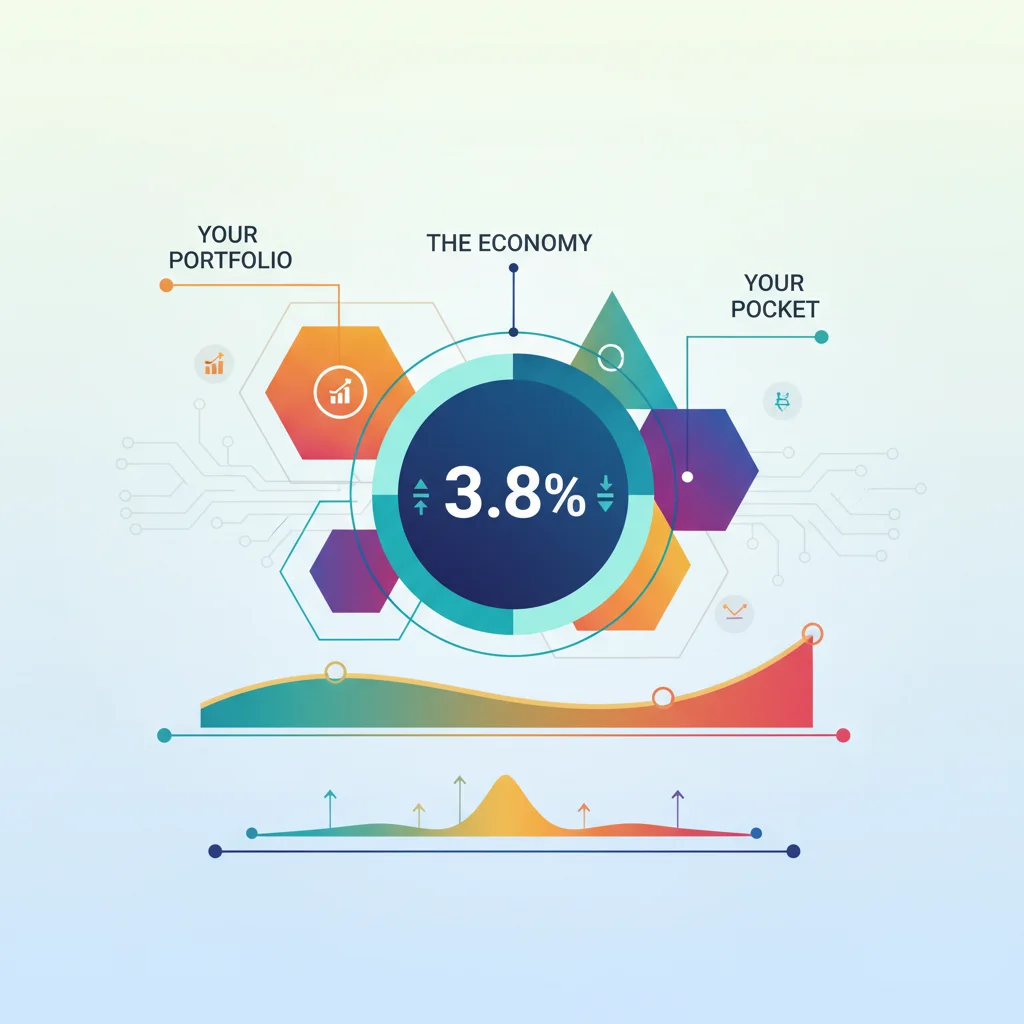

UK Inflation Holds at 3.8%: What This Number Really Means for Your Portfolio, Your Pocket, and the Economy

The latest figures are in, and they paint a picture of persistence. The UK’s inflation rate, as measured by the Consumer Prices Index (CPI), held steady at 3.8% in the year to September. While a stable number might seem unremarkable at first glance, it represents a complex economic reality that continues to challenge households, investors, and policymakers alike. This figure, far from being a simple statistic, is a powerful undercurrent shaping the entire UK economy, influencing everything from the price of your morning coffee to the long-term strategy of your investment portfolio.

In this comprehensive analysis, we will move beyond the headline number to explore the intricate forces at play. We’ll dissect what’s driving this persistent inflation, examine its wide-ranging impact on different segments of society, and outline actionable strategies to navigate this challenging financial landscape. For anyone involved in finance, investing, or simply managing their personal budget, understanding the nuances of this 3.8% figure is not just important—it’s essential.

Deconstructing the 3.8%: What Is Inflation and How Is It Measured?

At its core, inflation is the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. The 3.8% figure means that a basket of goods and services that cost £100 a year ago would cost you £103.80 today. The Office for National Statistics (ONS) calculates this figure primarily using the Consumer Prices Index (CPI), which tracks the prices of hundreds of everyday items.

However, not all prices rise equally. The overall CPI figure is an average, and the real story often lies in the details. Certain sectors contribute more to the headline rate than others. To understand the current inflationary pressures, it’s crucial to look at the breakdown of these contributions.

Below is a table illustrating how different sectors of the economy typically contribute to the overall inflation rate. While specific contributions vary month by month, this provides a clear picture of the key drivers.

| Category | Typical Inflationary Pressure | Impact on Consumers |

|---|---|---|

| Food & Non-alcoholic Beverages | High | Direct and immediate impact on weekly grocery bills. Often driven by global commodity prices and supply chain issues. |

| Housing & Household Services | High | Affects rent, mortgage payments (indirectly), and utility bills (gas, electricity). A major component of household expenditure. |

| Transport | Volatile | Mainly driven by fuel prices, which are subject to global oil market fluctuations. Also includes vehicle and public transport costs. |

| Restaurants & Hotels | Moderate to High | Reflects rising food costs, energy bills, and wage pressures in the hospitality sector. A key indicator of discretionary spending power. |

| Recreation & Culture | Moderate | Includes everything from electronics to package holidays. Can be influenced by both supply chain factors and consumer demand. |

This persistent rate remains significantly above the Bank of England’s official 2% target, a level considered optimal for sustainable economic growth. This deviation is the central challenge facing the UK’s monetary policymakers and has profound implications for the nation’s financial stability.

Cross-Border Clash: Why Canada is Drawing a Red Line with Stellantis Over Its North American Future

The Ripple Effect: How 3.8% Inflation Impacts Everyone

A single inflation number sends ripples across the entire financial ecosystem, affecting individuals and institutions in vastly different ways. Understanding these specific impacts is key to making informed decisions.

For Savers and Households

For the average person, inflation is a silent tax on savings. If your savings account offers an interest rate below 3.8%, your money is losing purchasing power over time. This “negative real return” discourages saving and erodes wealth. Furthermore, the rising cost of essentials like food, energy, and housing puts a direct strain on household budgets, forcing difficult choices and reducing discretionary income.

For Investors and the Stock Market

The impact on the stock market is more nuanced. Persistent inflation creates an environment of uncertainty, which markets dislike. It can lead to:

- Pressure on Corporate Profits: Businesses face higher costs for raw materials, energy, and labour, which can squeeze profit margins unless they can pass these costs on to consumers.

- Sector Rotation: Investors often shift their capital. Companies in sectors like energy, commodities, and consumer staples, which can more easily pass on price increases, may perform better. In contrast, high-growth technology stocks, whose future earnings are worth less in today’s money due to higher discount rates, may underperform.

- Monetary Policy Response: The primary impact comes from the central bank’s reaction. The threat of higher interest rates to combat inflation can make borrowing more expensive for companies and can cool economic activity, creating headwinds for equities. Navigating this requires sophisticated trading strategies and a deep understanding of economics.

For Business Leaders

Businesses are on the front line of the inflation battle. They must manage rising input costs, navigate supply chain disruptions, and handle increasing wage demands from employees whose own cost of living is rising. This environment forces difficult strategic decisions about pricing, investment in new projects, and resource allocation, directly impacting the health of the broader economy.

The Central Bank’s Gambit: Monetary Policy in an Inflationary Era

The primary institution tasked with controlling inflation is the Bank of England. Its main tool is the Bank Rate—the interest rate it charges to commercial banks. By raising the Bank Rate, it aims to make borrowing more expensive and saving more attractive, thereby reducing demand in the economy and pulling prices down.

The Monetary Policy Committee (MPC) has already enacted a series of aggressive rate hikes over the past two years. However, the decision-making process is a delicate balancing act. As analysis from the IMF suggests, the global fight against inflation is not over. Central banks worldwide must remain vigilant. A premature pivot to lowering rates could reignite inflationary pressures, while holding them too high for too long could trigger a painful recession. Every data point, from inflation figures to employment statistics, is now intensely scrutinized as markets try to predict the Bank’s next move.

High-Stakes Showdown: Canada Draws a Line in the Sand with Jeep-Maker Stellantis

Future-Proofing Your Finances: Strategies for a High-Inflation World

While we cannot control macroeconomic forces, we can adapt our financial strategies to mitigate their impact. Proactive management is crucial for protecting and growing wealth in the current climate.

Investment Strategies for Inflation Hedging

A standard portfolio may not be sufficient. Investors should consider assets that have historically performed well during inflationary periods. The table below compares several options.

| Asset Class | Inflation Hedging Potential | Key Considerations |

|---|---|---|

| Inflation-Linked Bonds (Gilts) | Direct | Principal and/or interest payments are indexed to inflation, providing explicit protection. Considered a very safe hedge. |

| Equities (Specific Sectors) | Indirect | Companies with strong pricing power (e.g., dominant brands, essential services) can pass on costs and protect margins. Focus on value and quality. |

| Real Estate / Infrastructure | Strong | Physical assets tend to appreciate in value with inflation. Rental income can also be adjusted upwards over time. |

| Commodities (e.g., Gold, Oil) | Strong | Raw material prices are often a primary driver of inflation, so holding them can provide a direct hedge. Can be volatile. |

The Role of Financial Technology (Fintech)

The rise of fintech has provided individuals with powerful new tools for managing their finances. Modern financial technology can help in several ways:

- High-Yield Savings: Fintech platforms and challenger banks often offer more competitive interest rates on savings than traditional banking institutions, helping to close the gap with inflation.

- Robo-Advisors: Automated investment services can build and manage diversified, low-cost portfolios tailored to specific goals, including hedging against inflation.

- Budgeting Apps: These tools provide real-time insight into spending, helping users identify areas where they can cut back as prices rise.

There is also ongoing debate about the role of assets like Bitcoin and other cryptocurrencies, facilitated by blockchain technology, as a potential inflation hedge. Proponents argue their decentralized nature and fixed supply make them a digital version of gold. However, their extreme volatility and nascent regulatory landscape make them a high-risk proposition that is not suitable for most investors seeking stability.

UK Economy's Tightrope Walk: A 0.1% Growth in August – Relief or Red Flag?

Conclusion: Beyond the Number, A Call for Vigilance

The UK’s 3.8% inflation rate is far more than a statistic on a news report. It is a reflection of a complex and challenging economic environment that demands attention and action. It is eroding the value of savings, reshaping corporate strategy, and testing the resolve of our central bank.

For individuals, investors, and business leaders, the key takeaway is the need for proactive and informed decision-making. This means re-evaluating budgets, stress-testing investment portfolios, and adopting strategies that build financial resilience. In an era defined by economic uncertainty, understanding the forces behind the numbers is the first and most critical step toward navigating the path ahead successfully.