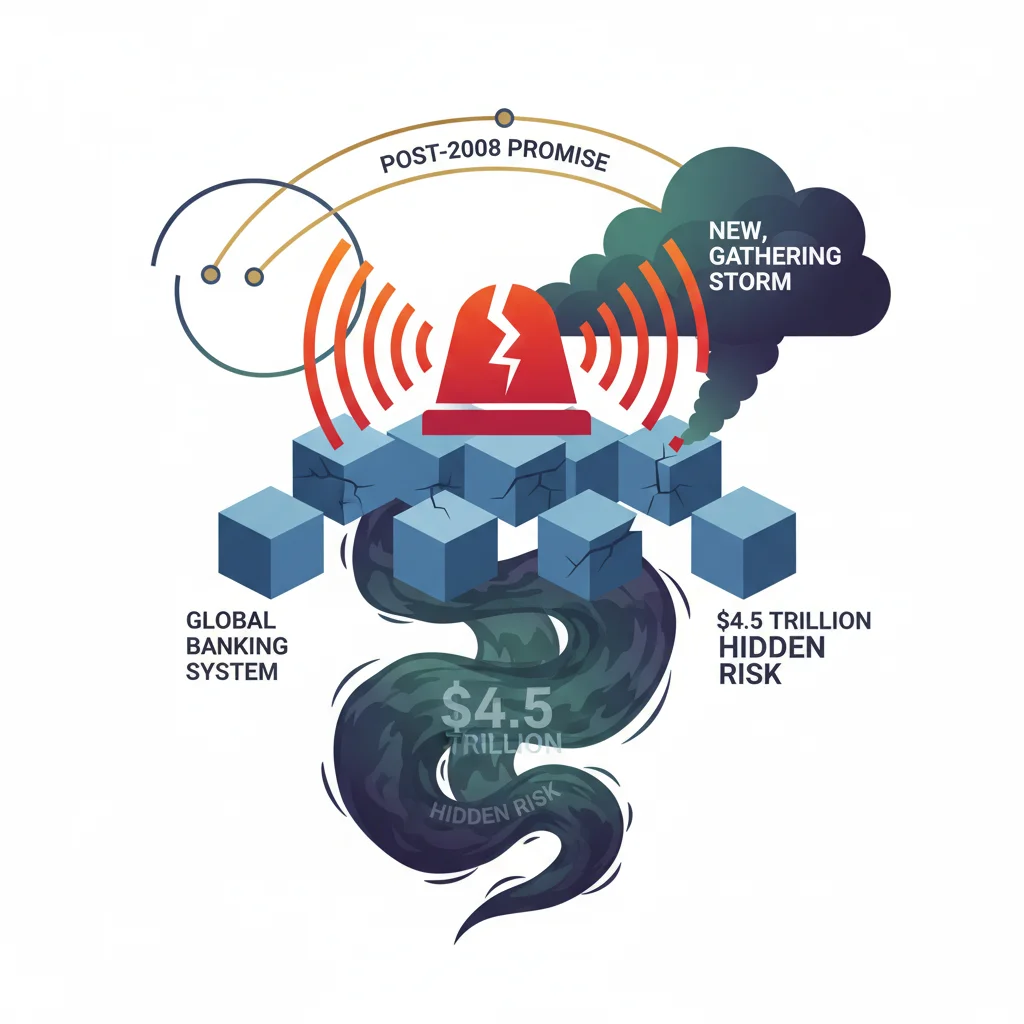

IMF Sounds the Alarm: A $4.5 Trillion Hidden Risk Looms Over the Global Banking System

The Post-2008 Promise and a New, Gathering Storm

Remember the 2008 financial crisis? It was a seismic event that exposed the deep cracks in the global banking system, fueled by reckless lending, opaque financial instruments, and a catastrophic failure of risk management. In the aftermath, a global consensus emerged: never again. Regulators worldwide erected towering walls of rules—like the Dodd-Frank Act and Basel III—designed to make traditional banks safer, more transparent, and less likely to bring the world’s economy to its knees.

For over a decade, it seemed the fortress was holding. Banks became better capitalized, and the riskiest activities were pushed to the fringes. But what if the danger didn’t disappear? What if it simply moved, shape-shifted, and found a new way back into the heart of the system? That’s the chilling warning shot just fired by the International Monetary Fund (IMF). In a recent report, the IMF revealed that global banks now have a staggering $4.5 trillion exposure to the opaque and less-regulated world of hedge funds and private credit. This vast, tangled web of financial obligations represents a new frontier of systemic risk, one that has been quietly growing in the shadows of the formal financial sector.

The Rise of the “Shadow” Giants: What Are NBFIs?

To understand this risk, we first need to understand the players. The IMF focuses on “non-bank financial intermediaries,” or NBFIs. This is the modern, more formal term for what was once popularly known as “shadow banking.” These are entities that provide credit and facilitate investing like banks but operate outside the stringent regulatory frameworks that govern traditional lenders. The two main players in this story are:

- Private Credit Funds: These funds raise capital from institutional investors (like pension funds and endowments) and lend it directly to companies, often those who can’t or don’t want to get loans from traditional banks. This market has exploded from a niche corner of finance to a multi-trillion dollar industry.

- Hedge Funds: These are private investment pools that use complex strategies and often significant leverage (borrowed money) to generate high returns for their wealthy clients. Their activities range from sophisticated stock market trading to betting on macroeconomic trends.

The explosive growth of NBFIs wasn’t an accident; it was a direct consequence of post-2008 reforms. As regulations tightened on banks, the demand for credit and sophisticated financial products didn’t vanish. It simply migrated to these more nimble, less-regulated entities. For years, this was seen as a feature, not a bug—a way to keep risk outside the core banking system. But the IMF’s latest findings suggest the firewall between these two worlds is far more porous than anyone believed.

The $4.5 Trillion Handshake: Deconstructing the Hidden Connections

The core of the IMF’s warning is the deep, symbiotic relationship that has formed between the regulated banking giants and the “shadow” NBFIs. Banks are no longer just competing with them; they are actively financing them. This creates a dangerous feedback loop where the health of one is inextricably linked to the other. According to the IMF, this multi-trillion-dollar exposure is creating “hidden leverage” and amplifying risk across the entire financial system.

Let’s break down the primary ways banks are connected to this shadow world. The table below outlines the key channels of exposure and the potential risks involved.

| Type of Exposure | Description | Potential Risk Example |

|---|---|---|

| Prime Brokerage | Banks provide services to hedge funds, including clearing trades, custody of assets, and, most importantly, lending them money to leverage their bets. | The collapse of Archegos Capital in 2021, where banks lost billions because they didn’t have a full picture of the fund’s total leveraged exposure across multiple prime brokers. |

| Direct Lending & Credit Lines | Traditional banks lend directly to private credit funds, providing the capital those funds then use to make their own loans. They also offer liquidity backstops. | If a private credit fund’s portfolio sours (e.g., its corporate borrowers default), it could default on its loan from the bank, causing direct losses. |

| Securitization & Asset Purchases | Banks buy loans that have been originated and packaged by NBFIs, or they help structure and sell these packages to other investors. | A bank could be left holding complex, illiquid debt securities whose true value plummets during a market downturn, reminiscent of the mortgage-backed securities of 2008. |

| Counterparty Risk | Engaging in derivatives and other complex trades with NBFIs. If the NBFI fails, the bank is left with a worthless contract and potential losses. | A hedge fund making a large, wrong-way bet on interest rates could collapse, leaving its banking counterparties with significant, unexpected losses. |

The fundamental problem is a lack of transparency. A bank might know its own direct exposure to a single hedge fund, but it has little to no visibility into that fund’s total leverage or its entanglements with other banks. This information asymmetry is what allows systemic risk to build up undetected, just as it did with subprime mortgages before 2008.

Imagine a scenario where a downturn in the economy causes a spike in defaults within private credit portfolios. These funds, suddenly facing losses and investor redemptions, draw down their credit lines from banks all at once. The banks, surprised by the sudden demand for liquidity and spooked by the hidden risks, slam the brakes on all lending—not just to NBFIs, but to everyone. The result? A credit freeze that starves businesses of capital, sends the stock market tumbling, and throttles economic growth. This “contagion” risk is precisely what keeps regulators up at night. The system’s plumbing is far more interconnected than the public-facing architecture suggests.

The Domino Effect: Why This Matters Beyond Wall Street

A $4.5 trillion problem in the abstract world of high finance can feel distant, but its consequences are very real for everyone. The interconnectedness highlighted by the IMF creates vulnerabilities that can cascade through the entire economy.

- For Investors: Your portfolio is more exposed than you think. A crisis in the private credit market wouldn’t stay there. It would trigger a flight to safety, causing broad sell-offs in the public stock market and bond markets. The institutions you invest with, from mutual funds to pension plans, are themselves invested in this ecosystem, creating another layer of indirect risk.

- For Business Leaders: The rapid growth of private credit has been a crucial source of funding for thousands of companies. If banks are forced by regulators (or fear) to pull back their financing for NBFIs, that firehose of capital could slow to a trickle. This would make it harder and more expensive for businesses of all sizes to get loans, invest in growth, and create jobs.

- For the General Public: Major financial shocks have real-world consequences. A severe credit crunch can lead to a recession, job losses, and a tightening of consumer credit, making it harder to get a mortgage or a car loan. As the IMF’s report implies, the stability we’ve taken for granted for the past decade may be resting on a shakier foundation than we realize.

Navigating the Regulatory Blind Spot

The IMF’s prescription is clear: regulators need to wake up and close this gap. The fund is calling for “tighter regulation of the financing activities” between banks and NBFIs. This could involve several measures:

- Enhanced Transparency: Forcing banks and NBFIs to disclose more information about their interconnections, giving regulators a complete map of the system’s hidden leverage.

- Higher Capital Requirements: Requiring banks to hold more capital against their exposures to less-regulated entities, creating a buffer to absorb potential losses.

- Comprehensive Stress Testing: Expanding bank stress tests to explicitly model what would happen if a major hedge fund or a segment of the private credit market were to collapse.

However, regulation is easier said than done. The world of NBFIs is global and notoriously difficult to pin down. Overly aggressive regulation in one jurisdiction could simply push the activity to another with laxer rules. Furthermore, the relentless pace of financial technology and innovation, including the potential for DeFi and blockchain-based systems, threatens to create new, even more opaque channels for leverage that regulators can’t yet see.

A Wake-Up Call for a New Financial Era

The IMF’s warning is not a prediction of imminent doom, but it is an urgent wake-up call. The post-2008 reforms successfully reinforced the walls of the traditional banking castle, but they also created a sprawling, unregulated kingdom just outside its gates. We now find that the castle’s inhabitants have been quietly building secret bridges and tunnels to that kingdom, re-integrating the very risks they sought to expel.

The $4.5 trillion question is whether regulators can draw a comprehensive map of this new landscape and enforce new rules of the road before the next storm hits. The stability of the global financial system and the health of the real economy depend on it. The focus can no longer be just on the banks themselves, but on the entire, intricate ecosystem in which they operate.