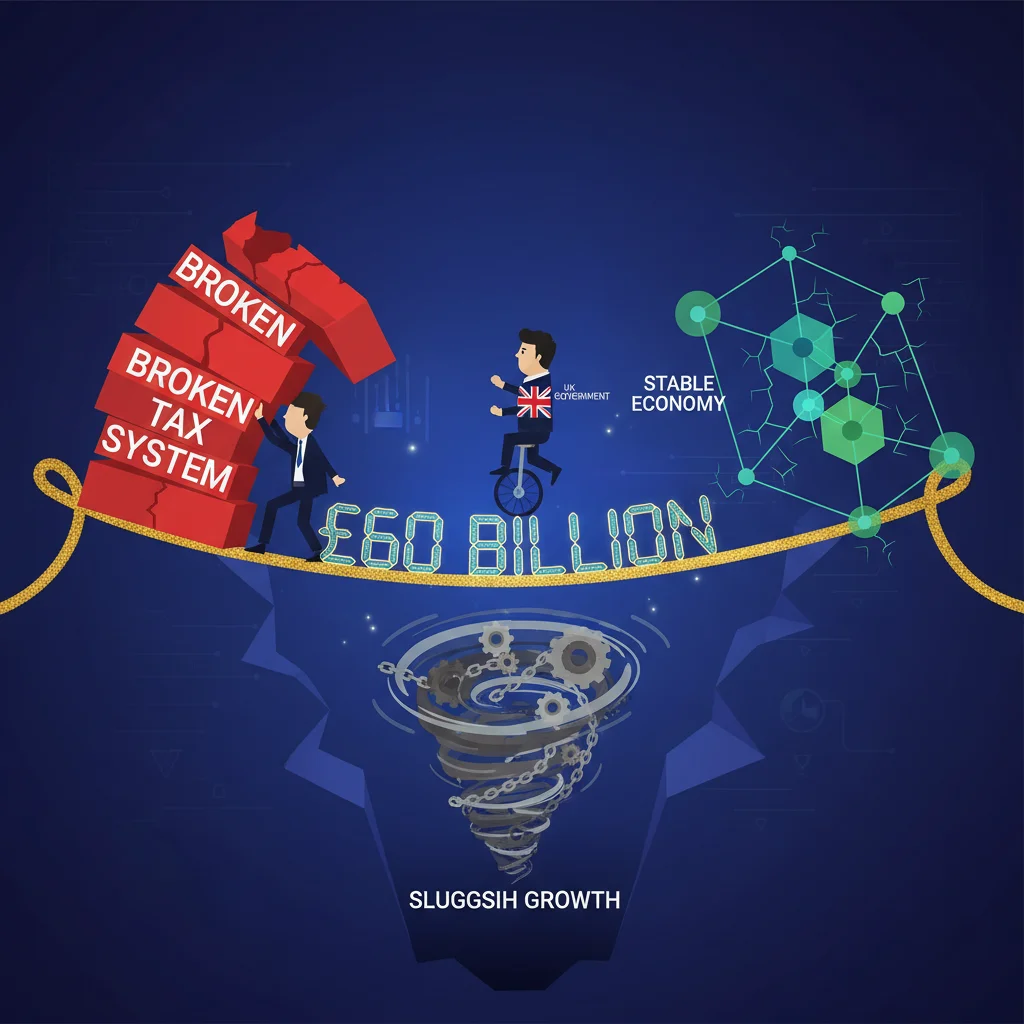

The £60 Billion Tightrope: Can the UK’s Next Government Fix a Broken Tax System Without Breaking the Economy?

The United Kingdom stands at a fiscal precipice. For the incoming government, the keys to Number 11 Downing Street come with a poisoned chalice: a national economy grappling with sluggish growth, strained public services, and a mountain of public debt. The old levers of economic policy—a tweak to income tax here, a nudge to corporation tax there—are no longer sufficient. According to a stark warning from the highly respected Institute for Fiscal Studies (IFS), nothing short of a radical, once-in-a-generation overhaul of the UK’s tax system will suffice to raise the tens of billions of pounds needed to avoid severe damage to public services and the broader economy.

With Labour’s shadow chancellor, Rachel Reeves, having ruled out increases to the headline rates of income tax, national insurance, and VAT, the challenge intensifies. The government-in-waiting finds itself in a political and economic straitjacket. The solution, the IFS argues, isn’t to pull harder on the same old ropes but to re-weave the entire fiscal net. This is no longer a simple matter of economics; it’s a profound test of political courage and a pivotal moment for the future of UK finance, investing, and economic stability.

The Fiscal Black Hole: Why the Status Quo is Unsustainable

To understand the urgency of the IFS’s call to action, one must first appreciate the scale of the problem. The UK’s public finances are in a precarious state. Years of low growth, compounded by the economic shocks of Brexit, the COVID-19 pandemic, and the energy crisis, have left public services from the NHS to education creaking at the seams. At the same time, national debt remains at levels not seen in decades, and the tax burden is already at a 70-year high.

The political promises made during an election campaign often collide with this harsh reality. The commitment to not raise the main tax rates is a politically astute move to reassure voters, but it severely limits the new government’s room for manoeuvre. Paul Johnson, director of the IFS, put it bluntly, stating that the next government will either have to cut public spending, raise taxes, or see debt “marching ever upwards” (source).

<