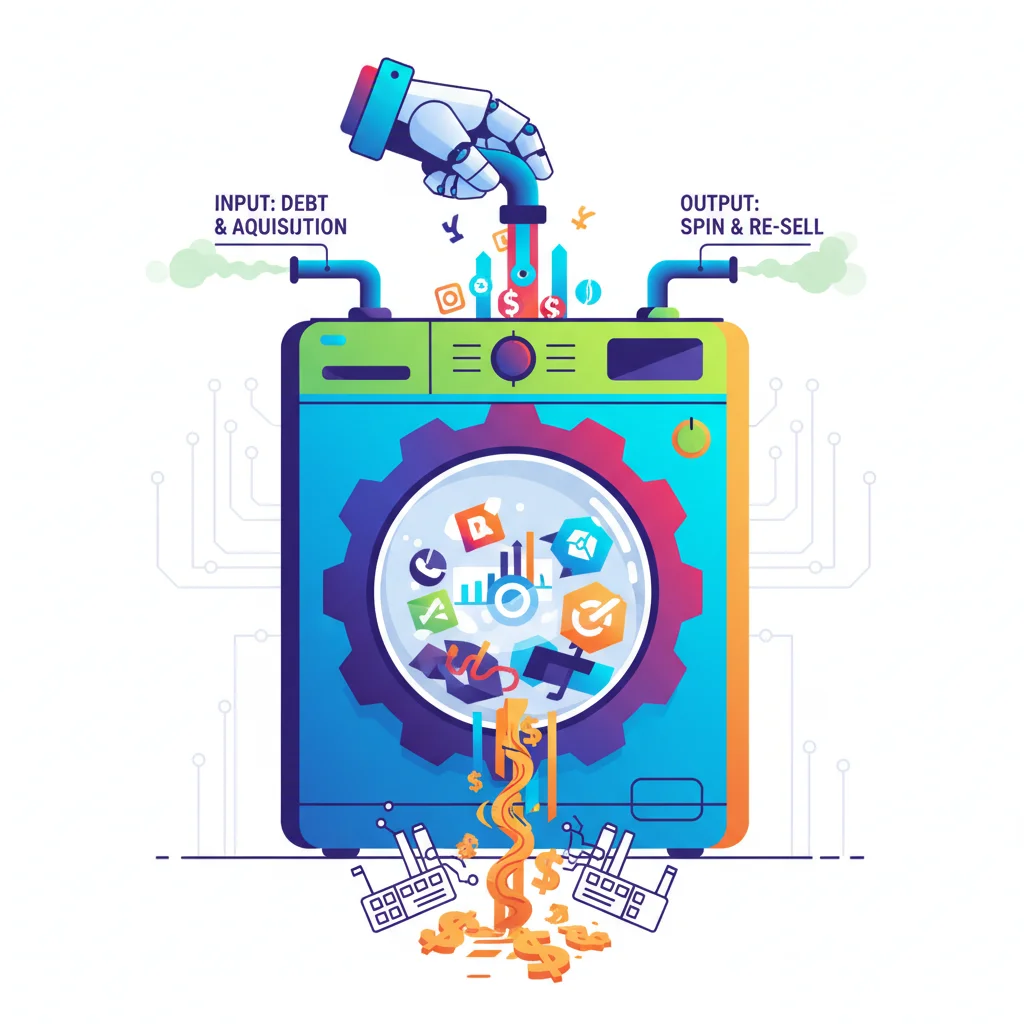

The Private Equity Laundromat: Is the “Rinse-and-Repeat” Cycle Wringing Companies Dry?

In the world of high finance, some strategies are as cyclical as a laundry machine. A company is acquired, loaded with debt, spun for a few years, and then passed on to the next owner, hopefully looking cleaner and more valuable than before. This is the essence of the private equity (PE) playbook. But what happens when a company goes through this spin cycle not once, but twice, or even three times? Is it emerging stronger, or is it being wrung dry of all its value?

This question is coming into sharp focus with the potential sale of Alliance Laundry Systems, a global leader in commercial laundry equipment. Its current owner, the Ontario Teachers’ Pension Plan (OTPP), is exploring a sale that could value the company at over $3 billion. If the deal proceeds with a rumored suitor, Asian private equity firm BPEA EQT, it would mark the third time Alliance has been owned by a buyout firm. This “tertiary” buyout serves as a perfect case study for a critical debate in modern finance: Does the rinse-and-repeat PE model genuinely create sustainable value, or is it a masterpiece of financial engineering that primarily benefits the dealmakers?

From Bain to OTPP: A Spin Through Private Equity Ownership

To understand the current situation, we need to look at Alliance Laundry’s journey. Headquartered in Wisconsin, the company is a titan in the world of commercial washers and dryers—the kind you see in laundromats, hotels, and hospitals. Its durable, essential nature makes it an attractive asset for investors seeking stable cash flows.

The company’s modern private equity story began with Bain Capital. After a period under their ownership, Alliance was sold in 2015 to the Ontario Teachers’ Pension Plan, one of the world’s most sophisticated institutional investors. While the purchase price was undisclosed, the strategy was classic PE. OTPP saw an opportunity to streamline operations, expand the company’s global footprint, and invest in new technology.

Fast forward to today, and OTPP is looking to cash in. The numbers are significant. Alliance currently generates around $350 million in annual earnings before interest, taxes, depreciation, and amortization (Ebitda). However, it also carries a heavy debt load of over $2 billion, which is more than six times its annual earnings. This high leverage is a hallmark of the leveraged buyout (LBO) model, where debt is used to finance the acquisition, amplifying returns for the equity owners.

Below is a simplified timeline of Alliance Laundry’s recent ownership and key financial milestones:

| Year | Event | Key Details |

|---|---|---|

| Pre-2015 | Bain Capital Ownership | Alliance’s first major cycle with a private equity owner. |

| 2015 | Acquisition by OTPP | Ontario Teachers’ Pension Plan acquires Alliance in a “secondary” buyout. |

| 2021 | Dividend Recapitalization | OTPP and management extracted a $450 million dividend by adding more debt to the company’s balance sheet. |

| Present |

|