The Gekko Paradox: Why Silence is the New Most Valuable Commodity in Finance

In the pantheon of cinematic finance, one line echoes louder than any trading floor bell. It’s 1987. A slick-haired, suspender-clad Gordon Gekko, the apex predator of Wall Street, leans in and declares, “The most valuable commodity I know of is information.” For decades, this mantra defined an era. It was the gospel of an age where access to data—scarce, asymmetric, and jealously guarded—was the definitive key to unlocking wealth and power in the global economy.

Fast forward to today. The world Gekko dominated is almost unrecognizable. Information is no longer scarce; it’s a relentless, flooding torrent. In this new reality, a recent letter to the Financial Times by Andrew Vigar offers a stunningly simple yet profound counter-thesis: “Forty years on, the most valuable commodity is silence.” (source)

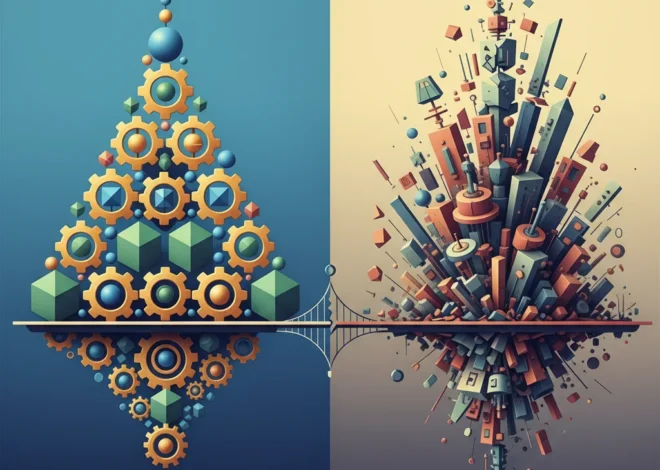

This isn’t just a clever inversion of a famous quote. It’s a fundamental reassessment of value in the digital age. The competitive advantage in finance, investing, and business leadership has shifted from the ability to *acquire* information to the discipline of *ignoring* it. The power now lies not in knowing everything, but in discerning the vital few signals from the deafening noise. This is the Gekko Paradox: in a world of infinite information, the true alpha is found in strategic silence.

From Information Scarcity to Digital Deluge

To appreciate the magnitude of this shift, we must first understand the world that made Gekko’s doctrine true. In the 1980s, the financial landscape was an ocean of information asymmetry. Data was analog, slow, and expensive. An investor in New York might have a significant edge over one in Omaha simply due to proximity to the stock market action. Corporate filings were physical documents, research reports were mailed, and breaking news traveled at the speed of a telephone call or a telex machine.

In this environment, possessing a piece of information before anyone else—an earnings leak, a rumored takeover—was a license to print money. The early pioneers of financial technology, like the Bloomberg Terminal, were revolutionary precisely because they aggregated and delivered this scarce data faster than the competition. Gekko’s philosophy was a direct product of this technological and economic reality. Information was the crude oil of the 20th-century economy, and those who could find and refine it best were the titans of industry.

Today, that paradigm has been completely inverted. We have moved from an economy of information scarcity to one of overwhelming abundance. The amount of data created, captured, copied, and consumed globally is staggering. In 2023 alone, the world was projected to generate 120 zettabytes of data, a figure expected to grow to 181 zettabytes by 2025, according to Statista. That’s 181 followed by 21 zeros. The firehose of data from 24/7 news channels, social media feeds, high-frequency trading algorithms, and endless expert commentary has created a new, far more complex challenge: separating the signal from the noise.

London's Gilded Cage: Why the Capital's Property Market Is Leading in Losses

The Economics of Noise: Why More Information Leads to Worse Decisions

The core problem is that while the volume of information (noise) has grown exponentially, the volume of genuinely useful, market-moving insight (signal) has not. This declining signal-to-noise ratio has profound and often negative consequences for investors. The constant bombardment of information triggers our most primal cognitive biases, leading to predictably irrational behavior in the stock market.

- Over-trading: A 24/7 news cycle creates the illusion that we must always be *doing* something. This pressure leads to frequent buying and selling, which has been shown to be detrimental to returns. A landmark study by Barber and Odean titled “Trading Is Hazardous to Your Wealth” found that the most active traders earned significantly lower returns, largely due to transaction costs and poor market timing (source).

- Emotional Reactivity: Frightening headlines about the economy or euphoric hype around a new technology can provoke fear and greed, the two great enemies of a sound investment strategy. This leads to selling at market bottoms and buying at market tops.

- Short-Termism: The relentless focus on quarterly earnings reports and daily price movements obscures the long-term fundamentals that truly drive business value. It encourages a trading mentality rather than an ownership mentality.

Cultivating “silence” is the active antidote to this chaos. It’s the discipline of stepping back from the daily chatter to focus on a long-term strategy grounded in fundamental analysis. It’s the wisdom of Warren Buffett, who famously said he prefers to “be fearful when others are greedy and greedy when others are fearful”—a feat impossible for those swept up in the market’s daily emotional tides.

To illustrate the difference, consider these two approaches to investing:

| Attribute | Noise-Driven Investing | Signal-Driven Investing (Strategic Silence) |

|---|---|---|

| Primary Focus | Daily price movements, breaking news, social media trends | Underlying business fundamentals, long-term economic trends |

| Time Horizon | Days, weeks, or months | Years or decades |

| Key Information Sources | CNBC, Twitter/X, Reddit, trading forums | Annual reports (10-Ks), industry analysis, historical data |

| Decision Triggers | Emotional reactions (fear/greed), expert predictions | Valuation metrics, changes in competitive advantage |

| Typical Action | Frequent trading, chasing “hot” stocks | Patient accumulation, holding through volatility |

Silence as a C-Suite Superpower

The value of silence extends far beyond the trading desk; it is becoming a critical attribute for effective business leadership. CEOs and their leadership teams are under immense pressure to react to every market fluctuation, competitor announcement, and social media controversy. This reactive posture is the enemy of long-term strategy.

The leaders who build enduring companies are often those who master the art of tuning out the short-term noise to focus on a long-term vision. Jeff Bezos famously ran Amazon for years with a near-total disregard for quarterly profits, reinvesting every dollar back into the business to build an unassailable long-term competitive moat. This required an iron-willed discipline to ignore the chorus of Wall Street analysts demanding short-term profitability. This was a form of strategic silence—a commitment to a core mission in the face of immense external pressure to deviate.

In an era of activist investors and social media-fueled outrage, the ability to thoughtfully pause, analyze, and act deliberately—rather than react impulsively—is a superpower. It allows for more robust capital allocation, more resilient corporate culture, and a greater capacity for genuine innovation, which rarely happens on a quarterly timeline.

The Price of a Typo: Why a Single Correction Matters More Than a Thousand Reports in Modern Finance

Fintech and Blockchain: Amplifying the Noise or Engineering Silence?

Financial technology holds a paradoxical position in this new world. On one hand, fintech has democratized access to information and markets, which is a net positive. On the other, it has become a primary engine of noise. The gamified interfaces of retail trading apps and the speculative frenzy in many corners of the blockchain and crypto space are designed to maximize engagement, often at the expense of thoughtful decision-making.

However, the same technologies can be engineered to foster silence and clarity. The future of fintech may not be about more charts and faster alerts, but about better filters.

- AI-Powered Curation: Artificial intelligence can be used to sift through millions of data points to deliver only the most relevant, high-signal information tailored to an investor’s specific strategy, effectively creating a personalized zone of silence.

- Blockchain and Transparency: While often associated with speculative trading, the core technology of blockchain offers a “single source of truth.” A transparent, immutable ledger can reduce the noise of audits, reconciliation, and disputes in banking and supply chains, creating operational silence and efficiency.

- Analytical Platforms: The most valuable financial technology platforms of the future will be those that help users go deeper, not wider. They will provide tools for deep fundamental analysis and scenario modeling, encouraging users to think like business owners rather than short-term traders.

The challenge for the financial technology industry is to shift its business model from one that profits from user activity (noise) to one that profits from user success (signal).

The Iran Factor: Decoding the Economic Shockwaves of Potential US Military Action

Conclusion: The Active Pursuit of Quiet

Gordon Gekko was a product of his time, and in his time, he was right. But the landscape of economics, finance, and technology has shifted under our feet. Information is no longer a scarce commodity to be hoarded; it is a superabundant resource that must be ruthlessly filtered.

The wisdom in Andrew Vigar’s simple letter is that silence is not a void or a passive state. It is an active, strategic choice. It is the discipline to close the twenty open tabs, to ignore the talking heads on television, and to turn off the endless notifications. It is the space required for deep thought, for the development of conviction, and for the execution of a long-term plan. In the 21st-century economy, the ability to find and protect this silence is the most valuable commodity of all. It is the ultimate, and perhaps the only sustainable, competitive edge.