Is the AI Boom a Bubble? Why the IMF Is Sounding the Alarm on a Potential Market Crash

It’s impossible to ignore. From boardrooms to developer forums, artificial intelligence is the undeniable star of the global economy. Tech stocks are soaring, venture capital is flowing, and the promise of a productivity revolution powered by intelligent software feels more tangible than ever. The market is betting big on AI, and in many ways, this optimism has helped keep the global economy surprisingly resilient against inflation and geopolitical headwinds.

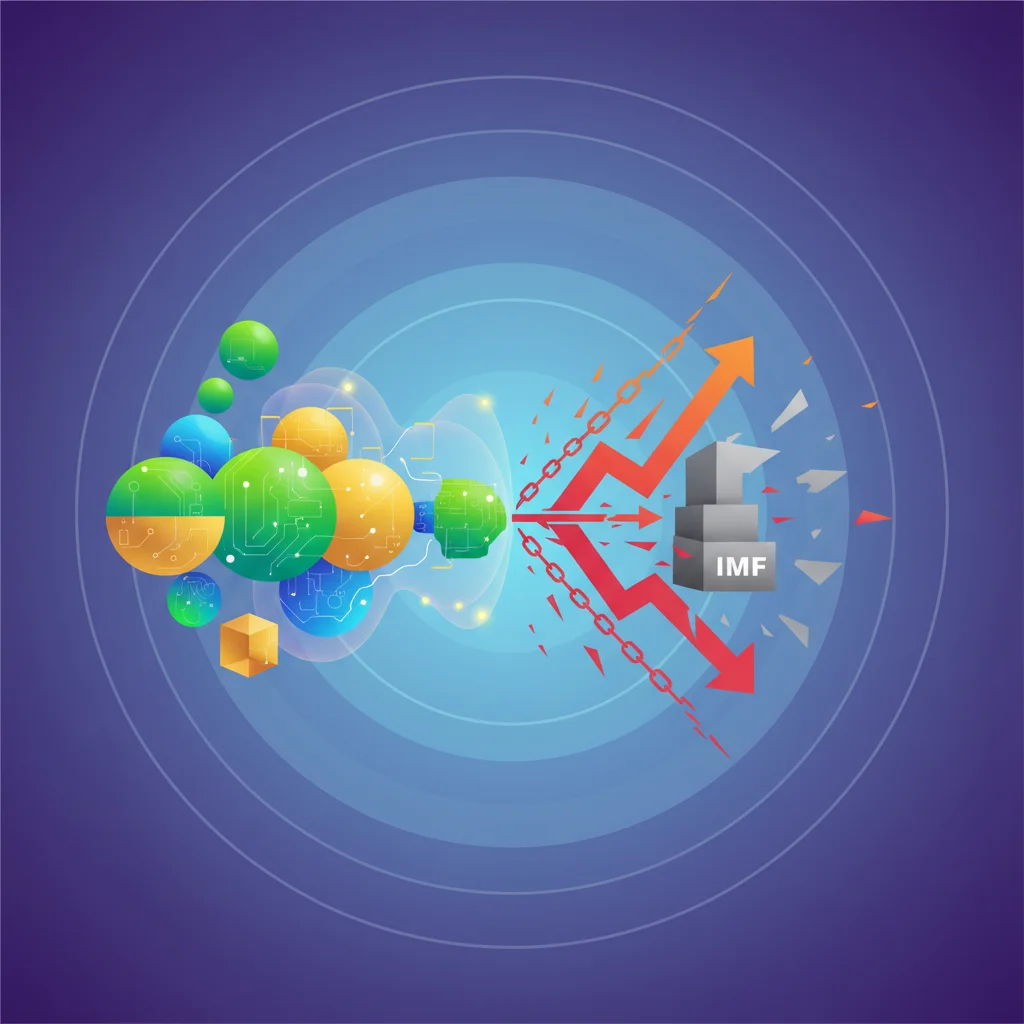

But what if this optimism is a double-edged sword? What if the entire structure is becoming dangerously dependent on a promise that’s taking too long to deliver? That’s the stark warning coming from a source that commands attention: the International Monetary Fund (IMF).

In a recent statement, the IMF’s chief economist, Pierre-Olivier Gourinchas, voiced a concern that should send a ripple through the tech world. He suggested that the very force buoying the market could become its greatest vulnerability, warning of a potential “AI correction” if the technology fails to live up to its monumental hype. This isn’t just a casual observation; it’s a signal that the world’s top financial watchdog sees fragility in the foundations of the AI gold rush.

So, are we building the future on solid ground, or are we inflating a bubble destined to pop? Let’s break down the IMF’s warning, explore the growing gap between AI hype and economic reality, and analyze what it means for developers, startups, and entrepreneurs on the front lines of innovation.

The Global Economy’s AI-Powered Tightrope Walk

First, let’s set the stage. The global economy has been a puzzle lately. Despite predictions of recession, it has shown remarkable resilience. According to the IMF, this strength is partly fueled by strong consumer spending and, crucially, by market euphoria surrounding the potential of artificial intelligence. Investors are pouring money into companies at the forefront of AI, from chipmakers to cloud computing giants and innovative SaaS platforms.

This excitement has a real-world effect. It boosts stock valuations, encourages investment, and creates a positive feedback loop of economic confidence. However, Gourinchas points out the inherent danger: this enthusiasm is “predicated on AI delivering in terms of productivity gains in the near future.” (source)

In other words, the market has already priced in a future where AI supercharges our economies. The problem? We’re not there yet. This creates a precarious situation where the global economy is walking a tightrope, balanced by the promise of AI. If that promise wavers, the fall could be steep.

The Productivity Paradox 2.0: We See AI Everywhere But in the Numbers

This isn’t the first time we’ve faced this kind of conundrum. In the 1980s, economist Robert Solow famously quipped, “You can see the computer age everywhere but in the productivity statistics.” This became known as the productivity paradox. Today, we’re facing a similar, perhaps even more pronounced, version of this paradox with AI.

We see generative AI writing code, creating images, and answering complex queries. We hear about breakthroughs in machine learning for drug discovery and logistics automation. Companies are spending billions on AI infrastructure, talent, and R&D. Yet, on a macroeconomic level, the massive surge in productivity that markets are expecting has yet to materialize.

Why the disconnect? Several factors are at play:

- Implementation Lag: It takes years, not months, for transformative technologies to be fully integrated into business workflows. Companies need to retrain staff, overhaul legacy systems, and navigate complex data privacy and cybersecurity challenges.

- The Last Mile Problem: While AI can automate 80% of a task with relative ease, the remaining 20%—which often requires nuance, human judgment, and physical interaction—can be incredibly difficult and expensive to solve.

- Focus on Novelty, Not Necessity: Many early AI applications are focused on consumer-facing novelties or top-of-funnel marketing rather than deep, systemic enterprise automation that drives significant cost savings or revenue growth.

- Cost vs. ROI: Training and running large-scale AI models is incredibly expensive, requiring massive amounts of cloud computing power. For many businesses, especially smaller startups, the return on this investment is not yet clear or immediate.

This gap between investment and tangible, economy-wide returns is the central crack in the AI narrative that worries the IMF.

From Shipyards to Starships: How Glasgow is Powering the Global AI and Data Revolution

However, I believe this time *is* different in one crucial way. Unlike many dot-com era companies that were pure speculation, AI has undeniable, immediate utility. For a developer using a tool like GitHub Copilot, the productivity gain is real and measurable *today*. The same goes for scientists using AlphaFold for protein structure prediction. The technology works.

The danger isn’t that AI is vaporware. The danger is that the market’s *timeline* for universal, revolutionary economic impact is wildly out of sync with the messy, complex reality of enterprise adoption. The pressure this creates is immense, especially for startups that feel compelled to “AI-wash” their products to attract funding, rather than focusing on solving a real customer problem with a sustainable business model. The correction, if it comes, won’t be a verdict on AI itself, but a painful recalibration of our expectations.

A House of Cards? Decoding the Risks of an AI Correction

If market sentiment sours, the fallout could be significant. An “AI correction” wouldn’t just mean a dip in tech stocks; it could trigger a broader economic downturn by eroding investor confidence and tightening financial conditions globally. Let’s break down the potential chain reaction.

The following table compares the soaring market expectations with the current state of AI development, highlighting the risks identified by observers like the IMF.

| The Hype (Market Expectation) | The Reality (Current State) | The Risk (Potential Fallout) |

|---|---|---|

| Immediate, Exponential Productivity Gains: Markets expect AI to instantly unlock massive efficiency across all industries, leading to higher corporate profits. | Incremental & Uneven Adoption: Productivity gains are currently isolated to specific tasks and tech-forward companies. Widespread integration is slow and costly. | If gains don’t materialize broadly, profit forecasts will be missed, leading to a sharp market sell-off as valuations are reassessed. |

| Autonomous Systems Revolutionizing Labor: The belief is that full-scale automation will drastically cut labor costs and reshape industries overnight. | Human-in-the-Loop Is Still Key: Most AI systems are powerful assistants, not autonomous agents. They require human oversight, training, and management. | The cost-saving narrative proves false in the short-term, causing companies that over-invested in pure automation to struggle with ROI. |

| Infinite Growth & Untapped Markets: Valuations are based on the idea that AI creates entirely new, trillion-dollar markets out of thin air. | AI as an Enabler, Not a Market: AI is mostly enhancing existing products and services (e.g., better SaaS features, smarter analytics). Truly new markets are rare. | Valuations built on speculative future markets collapse when revenue growth is merely incremental, not exponential. |

| Seamless Tech Integration: The assumption is that new AI tools can be plugged into existing infrastructure with minimal friction. | Massive Technical & Security Debt: Integrating AI requires huge overhauls of data infrastructure, programming practices, and cybersecurity protocols. | A major AI-related security breach or system failure could shatter public and corporate trust, causing a rapid retreat from the technology. |

The potential for a major cybersecurity event cannot be overstated. As we rush to connect everything to AI models, we create new vulnerabilities. A significant breach that manipulates a widely used AI system could trigger a crisis of confidence far greater than a typical data leak.

Grok Blocked: Why Two Nations' Stand Against AI Deepfakes is a Global Wake-Up Call for Tech

A Guide for the Builders: Navigating the Hype for Developers and Entrepreneurs

This cautionary tale from the IMF isn’t a reason to abandon innovation. It’s a call for a more deliberate, value-focused approach. For those of us building the future, here’s how to interpret this warning:

For Developers & Tech Professionals:

The pressure is on to move beyond “cool” and deliver “critical.” While experimenting with the latest machine learning models is exciting, the most valuable skills will be in applying AI to solve concrete business problems. Focus on building robust, secure, and efficient software that delivers a clear ROI. Expertise in MLOps, AI ethics, and integrating AI into legacy systems will be in higher demand than ever. Your ability to connect your programming skills to a business’s bottom line is your best insurance against a market downturn.

For Startups & Entrepreneurs:

The era of “growth at all costs” fueled by AI hype may be nearing its end. If a correction comes, capital will become scarce and investors will prioritize profitability over promises.

- Solve a Real Problem: Don’t just sprinkle AI on an existing idea. Start with a genuine customer pain point that your solution, powered by AI, can solve 10x better than the alternative.

- Focus on Sustainable Economics: Understand your unit economics from day one. An expensive AI model that delights but doesn’t drive revenue or cut costs is a liability.

- Build a Moat: Your AI model is not a moat; a competitor can use the same APIs. Your unique dataset, your deep integration into a customer’s workflow, and your exceptional user experience are your true differentiators.

While PwC’s Global AI Study projects that AI could contribute up to $15.7 trillion to the global economy by 2030, the path to that reality is not a straight line. The journey will be paved by companies that deliver real value, not just hype.

Grok's Deepfake Debacle: Why Two Nations Banned Musk's AI and What It Means for Tech's Future

Conclusion: From a Bubble of Hype to a Foundation of Value

The IMF’s warning is not a prophecy of doom for artificial intelligence. It’s a crucial and timely reality check. The technology’s long-term potential remains immense and transformative. However, the global economy cannot run on potential alone.

The incredible resilience we’ve seen may be partially built on a speculative fever that is disconnected from the current pace of technological integration. A correction wouldn’t mean AI has failed; it would mean our expectations have been recalibrated.

For everyone in the tech ecosystem, the message is clear. The future of innovation lies not in chasing the hype but in patiently, deliberately, and securely building the tools that will deliver on AI’s profound promise. The challenge now is to close the gap between market narrative and economic reality—before the market decides to close it for us.