The Danegeld Dilemma: Why Short-Term Financial Appeasement Spells Long-Term Economic Ruin

In the annals of history, few rulers have a more unfortunate moniker than Æthelred the Unready. His 10th-century reign over England is a timeless case study in flawed leadership, not because he was unprepared for battle, but because his primary strategy was one of costly appeasement. Faced with relentless Viking raids, Æthelred chose to buy peace, paying vast sums of silver—the infamous “Danegeld”—to persuade the invaders to leave. It was a strategy that, as a recent letter in the Financial Times astutely points out, has startling echoes in modern politics and economics.

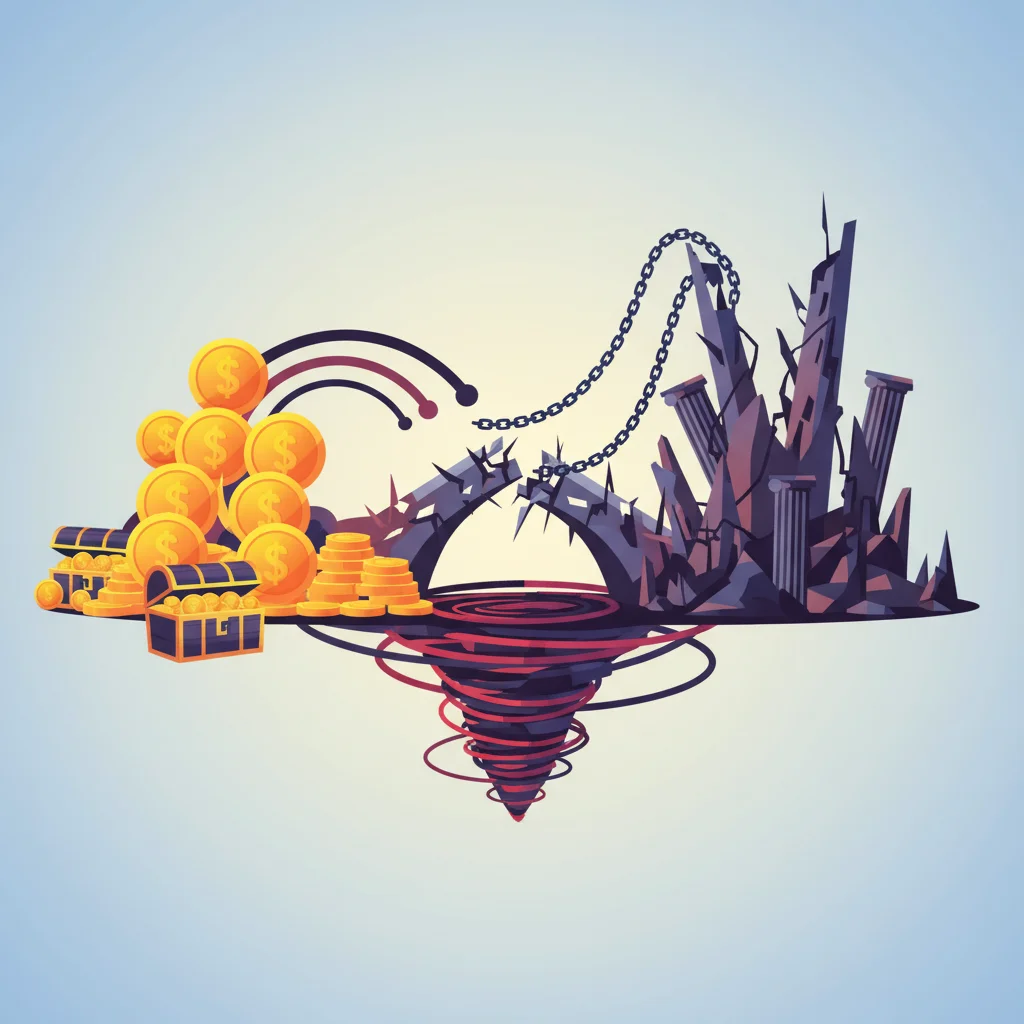

The author of that letter, Roger Steer, draws a provocative parallel between Æthelred’s Danegeld and the potential policies of leaders like the UK’s Keir Starmer and the US’s Donald Trump. This historical analogy is more than just a clever academic observation; it’s a critical warning for anyone involved in finance, investing, or business leadership. The principle of Danegeld—paying a recurring price to avoid a difficult, immediate confrontation—is a pattern of short-term thinking that permeates modern fiscal policy, geopolitical strategy, and even corporate finance. This approach inevitably leads to greater instability, erodes economic foundations, and creates significant long-term risks for the global economy and the stock market.

By examining this “Danegeld Dilemma,” we can uncover the hidden costs of financial appeasement and develop a more discerning eye for policies and strategies that favor sustainable strength over fleeting, expensive peace.

The Vicious Cycle of the Danegeld: A Historical Lesson in Economics

To understand the modern parallel, we must first appreciate the disastrous policy of the original Danegeld. During the late 10th and early 11th centuries, England faced terrifying and destructive raids from Danish Vikings. Æthelred’s response, beginning in 991 AD, was to levy a national tax to raise funds for tribute payments. The first payment was 10,000 Roman pounds of silver. It worked, but only temporarily.

The Vikings, realizing they had a lucrative source of income, simply returned a few years later, demanding more. The payments escalated dramatically: 16,000 pounds in 994, 24,000 in 1002, and a staggering 48,000 pounds in 1012 (source). This policy had several ruinous economic effects:

- It Incentivized Aggression: Rather than deterring the enemy, the payments proved that aggression was profitable, guaranteeing future attacks.

- It Drained the National Economy: The immense tax burden stifled economic activity, drained the kingdom of its silver reserves, and weakened its ability to fund its own defenses.

- It Signaled Weakness: The policy projected an image of a kingdom unable or unwilling to defend itself, inviting further predation not just from the Danes but other potential adversaries.

This historical episode is a perfect illustration of moral hazard—a situation where one party gets involved in a risky event knowing that it is protected against the risk and the other party will incur the cost. The Vikings took the risk of invasion, knowing the English would bear the financial cost. This is the fundamental flaw in any strategy of appeasement, whether on the battlefield or in the boardroom.

The Boardroom in Your Basement: Why Your Flat's Management Could Be Your Biggest Financial Risk

Geopolitical Danegeld: The Economics of Alliance and Protection

The FT letter astutely applies the Danegeld analogy to former President Trump’s stance on NATO. His assertion that the U.S. might not defend allies who fail to meet the 2% of GDP defense spending target can be interpreted as a demand for “protection money.” While the goal of equitable burden-sharing is a valid topic of debate in international relations, framing it as a transactional arrangement carries profound economic risks.

This approach transforms a security alliance into a fee-for-service model, introducing a level of uncertainty that financial markets despise. Global stability, which underpins the entire modern economy, relies on predictable alliances. When these are questioned, the risk premium on investments across the board increases. Investors must price in the potential for regional conflicts to escalate without a unified response, disrupting supply chains, energy markets, and international trading.

Below is a look at the defense expenditures of NATO countries as a percentage of their GDP. The data highlights the disparity that fuels this debate and underscores the economic scale of the commitments involved.

| Country | Defence Expenditure (% of GDP) |

|---|---|

| Poland | 3.90% |

| United States | 3.49% |

| Greece | 3.01% |

| United Kingdom | 2.07% |

| Germany | 1.57% |

| France | 1.90% |

| Canada | 1.38% |

| Spain | 1.26% |

| Source: NATO Public Diplomacy Division, July 2023. Table shows a selection of countries for illustration. | |

For investors and business leaders, the takeaway is clear: geopolitical instability driven by transactional foreign policy is a direct threat to portfolio stability. It forces a re-evaluation of sovereign risk, currency valuations, and the long-term viability of investments in regions that may suddenly be perceived as less secure.

Domestic Danegeld: Public Finance and the Peril of Unsustainable Promises

The second parallel drawn in the letter relates to the UK’s domestic politics, suggesting that a potential Labour government under Keir Starmer might appease public sector unions with large pay settlements to avoid strikes and disruption. This represents a domestic form of Danegeld, where the “invaders” are not external threats but internal pressures on the national budget.

The economics of this are straightforward and perilous. Awarding significant, across-the-board pay increases that are not funded by corresponding gains in productivity or economic growth must be paid for through one of three means: higher taxes, more government borrowing, or cuts to other public services. All three have negative consequences.

- Higher Taxes: Can stifle investment and consumer spending, slowing the overall economy.

- Increased Borrowing: Raises the national debt, leading to higher interest payments that crowd out other spending. It can also spook bond markets, raising the government’s borrowing costs and potentially destabilizing the currency, as seen during the UK’s 2022 “mini-budget” crisis (source).

- Service Cuts: Simply shifts the financial pain to other parts of the public sector, often leading to long-term social and economic costs.

For those in investing, a government that consistently chooses the Danegeld route of appeasing fiscal pressures rather than enacting structural reforms is a major red flag. It signals a lack of fiscal discipline that can lead to inflation, currency devaluation, and a downgrade in sovereign credit ratings. This directly impacts the value of government bonds, equities, and the overall attractiveness of a country for foreign investment.

Navigating the New Economic Chapter: Opportunities in Finance and Technology for the Year Ahead

The Investor’s Playbook for a Danegeld World

So, how can investors, finance professionals, and business leaders protect themselves from the consequences of short-term appeasement? The key is to learn to identify the warning signs and adjust strategies accordingly.

- Scrutinize Fiscal and Political Rhetoric: Look beyond the headline promises. When a political leader or CEO promises an easy solution to a complex problem, be skeptical. True solutions often involve difficult trade-offs and long-term investment, not quick cash payments. Look for detailed plans funded by credible economic projections.

- Monitor Key Economic Indicators: Keep a close watch on metrics like debt-to-GDP ratios, budget deficits, and inflation rates. A country or company that is consistently “paying Danegeld” will see these indicators worsen over time, signaling future instability.

- Diversify Geopolitically: The rise of transactional foreign policy underscores the importance of not being overly concentrated in any single country or region. A well-diversified portfolio can better withstand the shock of a sudden shift in alliances or a regional conflict.

- Favor Companies with Strong Balance Sheets: In an uncertain world, companies with low debt, strong cash flow, and a history of disciplined capital allocation are better equipped to weather the storms of economic and political instability. They are the opposite of the Danegeld payers; they have built their own defenses.

Beyond Appeasement: Investing in True Economic Strength

The antidote to the Danegeld strategy is not austerity for its own sake, but a commitment to long-term value creation and structural strength. For a nation, this means investing in education, infrastructure, and technology—including innovations in fintech and blockchain that can make government and finance more efficient and transparent. It means fostering a competitive and productive private sector that generates the wealth needed to fund high-quality public services sustainably.

For a company, it means investing in R&D, employee training, and sustainable business models rather than engaging in short-sighted stock buybacks fueled by debt to appease shareholders temporarily. For investors, it means rewarding this long-term thinking through patient capital and looking for fundamental value rather than chasing momentum driven by fleeting political promises.

From Post to Pixels: Is the Digital Economy a Return to Hieroglyphics?

The lesson of Æthelred the Unready, amplified over a millennium, is a powerful reminder for the modern world. Paying a threat to go away is not a strategy; it is a subscription to your own decline. Whether on the world stage or in domestic policy, the Danegeld approach merely postpones the day of reckoning and ensures that the final bill will be far higher. For those navigating the complex world of modern finance and investing, the ability to distinguish between a genuine investment in the future and a costly payment to appease the present is the most critical skill of all.