The Sandwich Economy: Why the Middle Class is Being Squeezed and What it Means for Investors

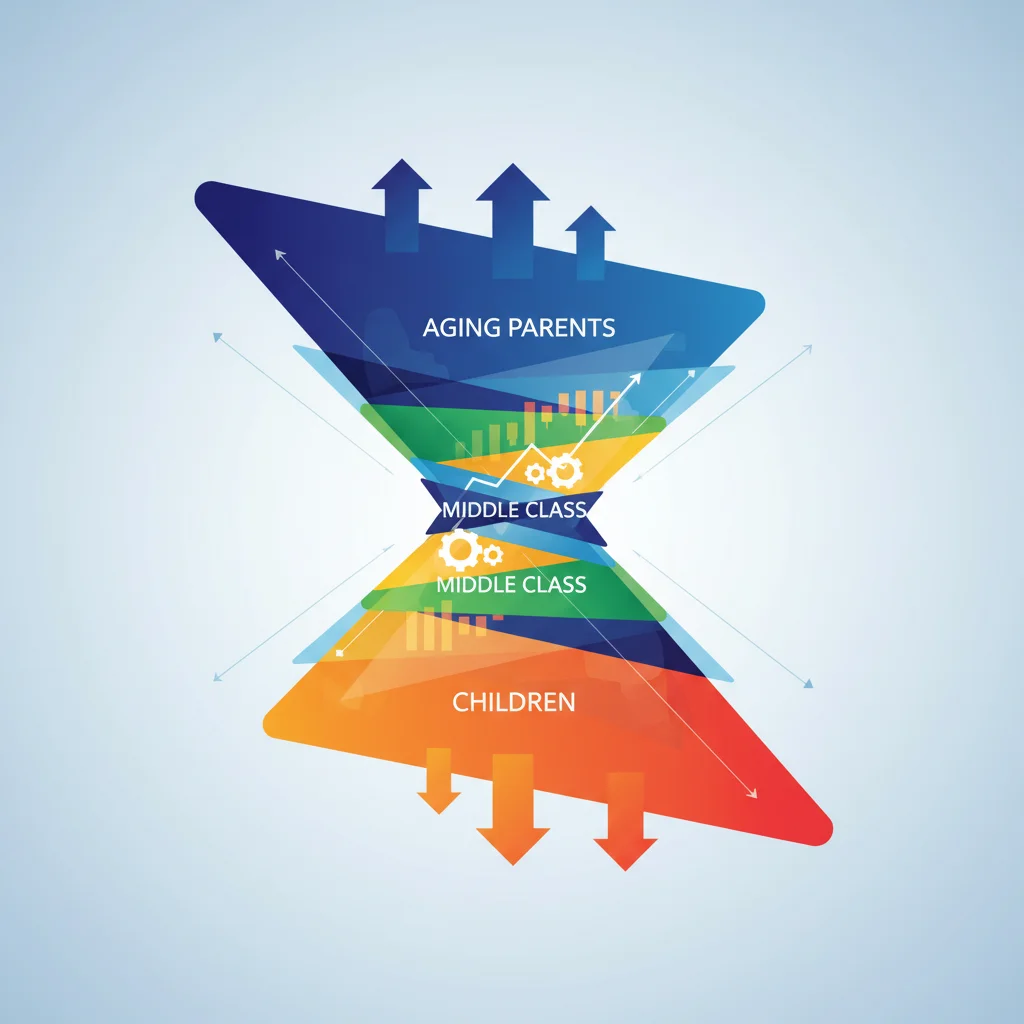

We often hear the term “sandwich generation” used to describe middle-aged adults who are simultaneously supporting their aging parents and their own children. It’s a powerful metaphor for being caught in the middle, squeezed by responsibilities from both sides. But what if this metaphor extends beyond personal family dynamics and perfectly describes the state of our entire modern economy?

In a succinct but profound letter to the Financial Times, Christina M. Storm of Madison, CT, proposed exactly that. She paints a picture of an economy structured like a sandwich, where the middle class is the filling, increasingly compressed by two ever-thickening slices of bread: the immense wealth of the top tier and the growing needs of those in poverty. This “Sandwich Economy” isn’t just a clever analogy; it’s a critical framework for understanding the deep structural shifts influencing everything from the stock market to consumer behavior and the future of investing.

This article will unpack the “Sandwich Economy” metaphor, exploring the economic forces creating this squeeze, the data that backs it up, and the profound implications for investors, business leaders, and anyone navigating the complex world of modern finance.

Deconstructing the “Sandwich Economy” Metaphor

To grasp the full weight of this concept, we must first examine each component of the sandwich. It’s a simple analogy that reveals a complex and challenging reality in our global economy.

The Top Slice: Concentrated Wealth and Asset Inflation

The top slice of bread represents the wealthiest segment of the population. In recent decades, this slice has become significantly thicker. This isn’t just about high salaries; it’s about the exponential growth of wealth through assets. The mechanisms of modern finance, particularly since the 2008 financial crisis, have disproportionately benefited capital owners. Policies like quantitative easing and prolonged periods of low interest rates inflated the value of assets like stocks, real estate, and private equity.

As a result, those who already owned these assets saw their net worth skyrocket. The wealthiest 1% of Americans now hold over 30% of the nation’s household wealth, a figure that has steadily climbed over the years (source: Federal Reserve). This concentration of capital creates a powerful, self-reinforcing cycle where wealth begets more wealth, thickening the top slice of the economic sandwich.

The Bottom Slice: Stagnation and the Rising Cost of Survival

The bottom slice of bread represents individuals and families living in or near poverty. This slice is also thickening, not through wealth, but through the sheer number of people struggling to get by. Decades of wage stagnation for low-income workers, coupled with the erosion of purchasing power due to inflation, have made economic mobility more difficult than ever.

While headline inflation numbers might fluctuate, the costs of non-discretionary essentials—housing, food, healthcare, and energy—have consistently outpaced wage growth for the bottom quintile. This segment of the population has minimal exposure to the appreciating assets of the stock market and is often more reliant on wage income, which has not kept pace. They are squeezed by the rising cost of simply existing.

The Filling: The Over-Stuffed, Under-Nourished Middle Class

This brings us to the filling: the middle class. Traditionally the engine of consumer spending and economic stability, the middle class is now feeling the pressure from both sides. They face the aspirational pressures and soaring asset prices driven by the top, while also shouldering a growing societal and tax burden to support the bottom. Their wages have grown modestly, but not nearly enough to keep up with the explosive costs of the cornerstones of a middle-class life: housing, higher education, and healthcare.

This immense pressure means less disposable income, higher debt loads, and a diminished capacity to save and invest for the future. The “filling” is being spread thinner and thinner, threatening the stability of the entire structure.

The £60 Billion What-If: How Joining the Euro Could Have Funded the NHS and Reshaped the UK Economy

The Data Behind the Squeeze

The “Sandwich Economy” is not just a feeling; it’s a reality reflected in decades of economic data. The widening gap between wage growth and the cost of essential goods and services tells a powerful story. While productivity and corporate profits have soared, the financial benefits have not been evenly distributed.

The following table illustrates the dramatic divergence between the growth in median household income and the costs of key middle-class pillars over the past few decades in the U.S.

| Metric | Change (approx. 1980 – 2022) | Implication for the Middle Class |

|---|---|---|

| Median Household Income | +45% (Inflation-Adjusted) | Modest growth in earning power over four decades. |

| Average Home Price | +120% (Inflation-Adjusted) | Housing affordability has plummeted, making a key asset for wealth-building inaccessible. |

| Cost of College Tuition (Public, 4-Year) | +180% (Inflation-Adjusted) | Higher education, a traditional path to upward mobility, now often requires crushing student debt. |

| Family Health Insurance Premiums | +250% (Inflation-Adjusted) | Healthcare costs consume an ever-larger portion of household budgets, reducing disposable income. |

Note: Figures are approximate and compiled from various sources, including the Economic Policy Institute and federal data, to illustrate the long-term trend.

This data starkly visualizes the squeeze. While income has inched forward, the major expenses required to maintain a middle-class lifestyle have galloped ahead. The result is a generation that is often more educated but financially less secure than its predecessors.

The Role of Financial Technology (Fintech)

The rise of financial technology, or fintech, presents a fascinating duality in the context of the Sandwich Economy. It acts as both a potential solution and a potential accelerant of the underlying trends.

Fintech as an Equalizer

On one hand, fintech has democratized access to financial tools previously reserved for the wealthy.

- Investing: Apps offering fractional shares and zero-commission trading allow individuals with limited capital to participate in the stock market.

- Banking: Neobanks and digital payment platforms offer low-fee banking services, helping people avoid the punitive fees often associated with traditional banks.

- Lending: Peer-to-peer lending and AI-driven credit scoring can provide capital to individuals and small businesses overlooked by legacy institutions.

Fintech as an Accelerant

On the other hand, the most sophisticated elements of fintech can exacerbate inequality. High-frequency trading algorithms can generate profits in milliseconds, a game inaccessible to the average retail investor. The ‘winner-take-all’ dynamics of the tech world, where a few companies achieve massive valuations, can further concentrate wealth. Furthermore, while blockchain holds the promise of a decentralized and more transparent financial system, its current application is often speculative and can be a high-risk arena for unsophisticated investors.

Investment Strategies for a Divided Economy

For investors and finance professionals, recognizing the “Sandwich Economy” is essential for developing resilient strategies. A polarized consumer base requires a polarized investment approach.

- The “Barbell” Strategy: This involves focusing on companies that serve the two ends of the economic spectrum. This could mean investing in luxury goods companies that cater to the affluent top slice, as well as discount retailers and essential goods providers that serve the price-sensitive bottom slice. Companies targeting the squeezed middle may face headwinds as their customer base has less discretionary income.

- Focus on Non-Discretionary Sectors: Industries like healthcare, utilities, and essential consumer staples tend to be more resilient to economic downturns and the erosion of middle-class spending power. People will cut back on vacations and new cars before they cut back on medicine and electricity.

- Identify Enablers of Frugality: Invest in companies that help consumers save money. This includes not just discount retail but also DIY-related businesses, private-label brands, and technology that increases efficiency and lowers costs.

Conclusion: Is the Sandwich Sustainable?

Christina M. Storm’s simple metaphor of sandwiches and bookends provides a powerful lens through which to view our current economic landscape. The “Sandwich Economy” is one defined by a widening chasm between the asset-rich and the wage-dependent, with a once-thriving middle class caught in the cross-pressure. This dynamic is reshaping economics, politics, and society.

The long-term stability of this model is highly questionable. An economy overly reliant on a shrinking middle class for consumption is an economy on precarious footing. For investors, understanding this structural shift is no longer optional—it is fundamental to navigating the risks and opportunities of the coming decade. The most pressing challenge for policymakers and business leaders will be to find a recipe that re-balances the ingredients, ensuring the filling is as robust and healthy as the bread that surrounds it. Failure to do so could see the whole sandwich fall apart.