Beyond the Balance Sheet: Why Community ‘Warm Hubs’ Are the New ESG Frontier for Investors

In the quiet county of Surrey, a simple yet profound initiative is taking root. A local venue has opened its doors as a “Warm Welcome” space, one of more than 80 such hubs planned across the region. On the surface, it’s a heartwarming story of community spirit—a place for people to escape the cold and find companionship. For the astute investor, the finance professional, or the forward-thinking business leader, however, it represents something far more significant. This is not just charity; it’s a real-time data point on the health of our economy and a critical new frontier for evaluating corporate value.

These community spaces, emerging in response to economic hardship, are a direct reflection of deep-seated financial pressures. They are a bellwether for consumer distress and a tangible manifestation of the social fabric being tested. To dismiss them as mere local news is to miss the bigger picture. In an era where stakeholder capitalism is moving from a buzzword to a business imperative, understanding the ‘why’ behind these hubs is crucial for anyone involved in finance, investing, or strategic leadership. They represent a confluence of macro-economics, social responsibility, and future-focused investment strategy.

The Economic Thermometer: What Warm Hubs Tell Us About the Economy

The proliferation of ‘Warm Welcome’ spaces is not an isolated phenomenon; it’s a direct symptom of a strained economic environment. To understand their importance, we must first diagnose the underlying conditions. The primary driver is the persistent cost of living crisis, a multi-faceted issue that has eroded household purchasing power across the nation.

According to the Office for National Statistics (ONS), while the rate of inflation has cooled from its recent peaks, the cumulative impact on family budgets remains severe. Energy prices, in particular, have been a source of acute financial pain, forcing many to choose between heating their homes and other essentials. These hubs provide a literal lifeline of warmth, but their existence signals a systemic problem that affects the broader economy. When a significant portion of the population is under such duress, consumer spending contracts, economic confidence wanes, and the risk of recessionary pressures grows.

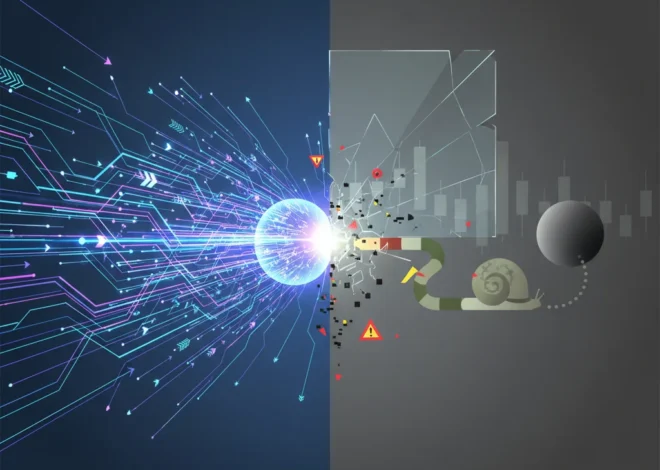

For those analyzing the stock market, this is a vital, ground-level indicator. While traditional economic data like GDP and unemployment figures are lagging indicators, the demand for community support services is a leading one. It provides a real-time pulse on consumer sentiment and disposable income, factors that directly impact the retail, hospitality, and service sectors. The principles of economics teach us that a healthy consumer base is the engine of growth; the need for these spaces suggests that engine is sputtering.

The Hidden Bull Market: Why UK Entrepreneurs Are Ignoring the Economic Gloom

The ‘S’ in ESG: Moving from Abstract to Actionable

For years, the ‘S’ (Social) in ESG (Environmental, Social, and Governance) has often been the most difficult component for corporations and investors to quantify and act upon. While environmental metrics (carbon emissions) and governance structures (board diversity) are relatively straightforward to measure, social impact can feel amorphous. Initiatives like the Warm Welcome campaign change that.

They offer a clear, tangible, and localized avenue for corporate social investment. Supporting these hubs is no longer about a generic line item in a CSR report; it’s about directly addressing a pressing need within the communities a business operates in. This has profound implications for how companies are valued and perceived.

Modern investing is increasingly driven by ESG mandates. A report by PwC highlights that ESG-oriented assets under management are projected to skyrocket in the coming years, with a majority of investors believing that ESG integration helps generate higher returns. Companies that demonstrate a genuine commitment to social well-being are not just building goodwill; they are building a more resilient business model. They attract and retain top talent, foster customer loyalty, and mitigate regulatory and reputational risks. In essence, strong social performance is becoming a proxy for strong management and long-term viability.

Below is a comparison of how direct community engagement, such as supporting a warm hub, stacks up against more traditional, passive CSR activities.

| Metric | Traditional CSR (e.g., Annual Corporate Donation) | Direct Social Impact (e.g., Sponsoring a Warm Hub) |

|---|---|---|

| Community Engagement | Low. Often a one-off, impersonal transaction. | High. Direct, visible, and localized impact. |

| Employee Involvement | Minimal. Often limited to a finance department transaction. | High potential for volunteering and direct engagement, boosting morale. |

| Brand Perception | Positive, but can be perceived as “check-the-box” philanthropy. | Authentic and deeply positive, demonstrating genuine community care. |

| Measurability | Simple to measure the financial input (e.g., $100,000 donated). | More complex but richer metrics: people supported, hours of operation, community feedback. |

| Investor Appeal (ESG) | Meets a basic criterion. | Provides a compelling, narrative-driven example of social commitment. |

For investors, a company’s decision to fund, staff, or host a warm hub becomes a powerful data point in their ESG analysis. It’s a clear signal that the leadership understands its role within the wider societal ecosystem.

The Role of Fintech and Modern Banking

The intersection of community need and corporate response creates a fertile ground for innovation, particularly in the realms of financial technology and banking.

Modern fintech platforms can be instrumental in scaling and managing the financial logistics of these initiatives. Crowdfunding platforms can be tailored for corporate-community partnerships, allowing for transparent fundraising and allocation of resources. Payment-processing fintechs can offer reduced-fee services for non-profits running these hubs, maximizing the impact of every donation. Furthermore, data analytics tools can help organizers understand usage patterns, predict demand, and report their social impact more effectively to stakeholders and investors.

There’s even a potential, albeit nascent, role for technologies like blockchain. Imagine a donation platform where a corporate sponsor can track its contribution on a distributed ledger, seeing in real-time how funds are used to buy supplies or pay for heating, ensuring complete transparency and accountability. This level of trust could unlock significantly more corporate funding.

For the traditional banking sector, these hubs present a unique opportunity for engagement and financial inclusion. Banks can:

- Host Hubs: Utilize excess space in branches to host a warm hub, reinforcing their image as a community pillar.

- Provide Financial Literacy: Offer free workshops within these spaces on budgeting, saving, and debt management, providing genuine value to vulnerable populations.

- Facilitate Access: Use these trusted spaces as a touchpoint to help unbanked or underbanked individuals open basic accounts, bridging a critical gap in financial inclusion.

By engaging in this way, banks move beyond their transactional role and become integral partners in building community resilience, an invaluable asset in a volatile economic climate.

The Investor's Blueprint: What an Artist's 18th-Century Home Teaches Us About 21st-Century Finance

From Social Safety Net to Strategic Insight

Perhaps the most powerful reframing for business leaders and finance professionals is to view the network of Warm Welcome spaces not just as a social safety net, but as a source of strategic insight. The individuals using these spaces are a microcosm of the economic pressures facing a large segment of the population. Their struggles are a leading indicator of future market trends.

For a professional involved in trading or market analysis, monitoring the growth, geographic spread, and user demographics of these hubs could offer an alternative dataset for predicting consumer confidence. A surge in demand in a particular region could signal impending distress for local businesses. Conversely, a decline in their necessity could be one of the earliest signs of a genuine economic recovery, long before it appears in official government statistics.

This is about connecting the dots between Main Street and Wall Street. The social health of a nation is inextricably linked to its economic health. Ignoring the clear signals being sent by the rise of community support initiatives is a strategic blind spot. They provide a narrative and a human face to the abstract data points that drive financial markets, offering a depth of understanding that a spreadsheet alone cannot provide.

The End of an Era: How Khaleda Zia's Death Reshapes Bangladesh's Economic Future

Conclusion: The ROI of Human Connection

The story of a single Warm Welcome venue in Surrey is a microcosm of a global economic and social shift. It’s a story about inflation and energy costs, but it’s also about the increasing demand for corporate accountability and the evolving nature of investing. What began as a community’s response to a crisis has become a powerful symbol of the new business landscape.

For business leaders, the message is clear: your company’s value is no longer measured solely by its profit and loss statement. It is also measured by its contribution to the resilience and well-being of the communities it serves. For investors and finance professionals, the takeaway is equally stark: the most valuable economic indicators are not always found in financial reports. Sometimes, they are found in the quiet warmth of a community hall, where the true state of the economy is on full display. Investing in these social structures is not just an act of corporate citizenship; it is a strategic investment in a stable, prosperous, and sustainable economic future.