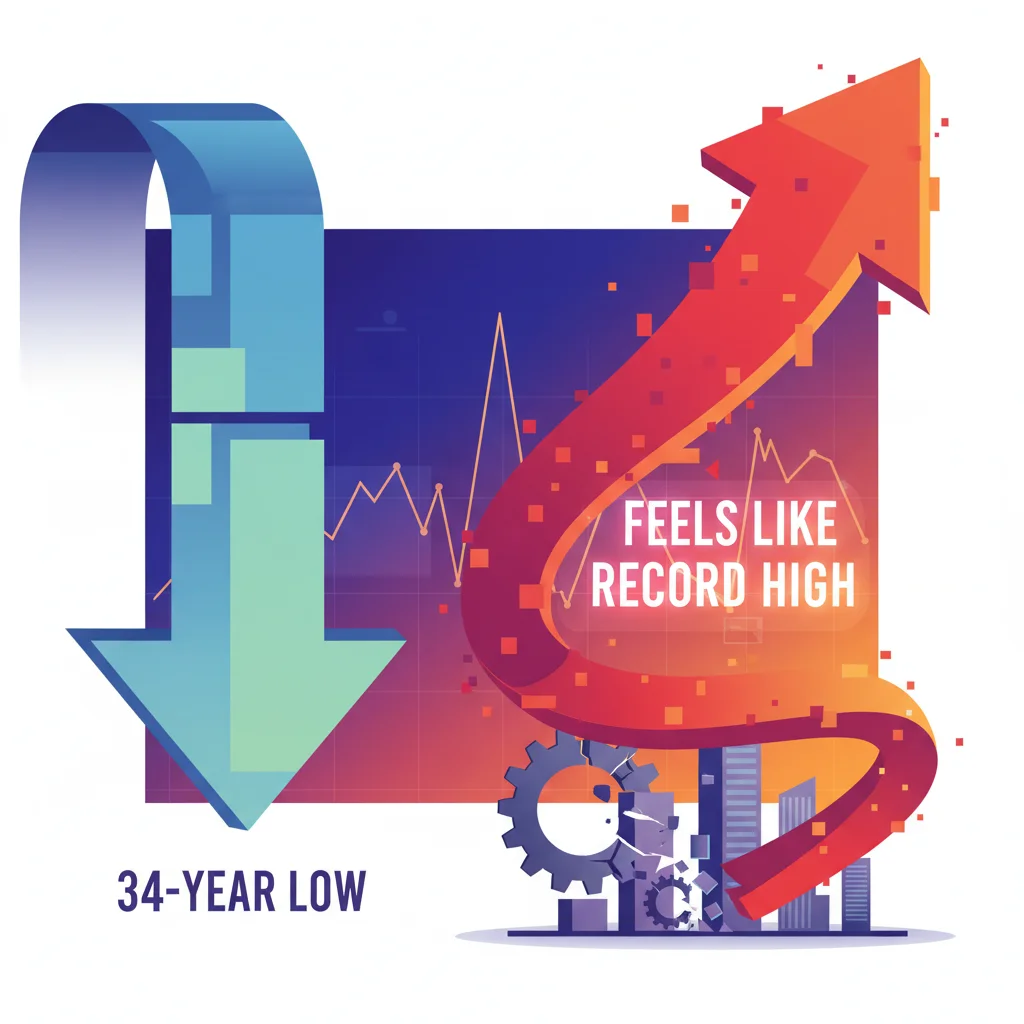

The Business Rates Paradox: Why a “34-Year Low” Feels Like a Record High for UK Businesses

The Widening Gulf Between Policy Headlines and Business Reality

In the complex world of finance and economics, government headlines often paint a picture of prosperity and relief. One such recent proclamation from the UK government is that business rates are at a “34-year low.” On the surface, this sounds like a significant victory for businesses, a welcome respite in a challenging economic climate. Yet, for those on the front lines—the entrepreneurs, the shop owners, the restaurateurs—this claim doesn’t just ring hollow; it feels like a distortion of their daily financial reality.

This stark disconnect was powerfully articulated in a letter to the Financial Times by Christian Oddono, the Managing Director of the beloved London-based Oddono’s Gelati Italiani. He lays bare a paradox that countless business leaders are grappling with: if rates are so low, why are their bills soaring? Mr. Oddono’s experience, far from being an anomaly, serves as a crucial case study into the intricate and often punishing mechanics of the UK’s commercial property tax system. This article will delve into this paradox, deconstruct the components of a business rates bill, and explore the profound implications for the UK economy, investing, and the future of our high streets.

A Tale of Two Multipliers: Deconstructing the Government’s Claim

To understand the frustration of business owners like Mr. Oddono, we must first understand how business rates are calculated. The system is built on two primary levers:

- Rateable Value (RV): An assessment of a property’s annual market rental value, determined by the Valuation Office Agency (VOA). This is reassessed periodically in a process known as a “revaluation.”

- The Multiplier (or Uniform Business Rate): A figure set by the central government, which is multiplied by the RV to determine the final bill before any reliefs are applied.

The government’s claim of a “34-year low” refers specifically to the small business multiplier. However, this statistic, when viewed in isolation, is profoundly misleading. As Christian Oddono points out in his letter, his business saw its rateable value jump by an astonishing 45% following the 2023 revaluation (source). This revaluation, the first since 2017, aimed to bring property values in line with the market of 2021—a market that had seen significant shifts, particularly for prime retail and hospitality locations.

The second part of the equation is the multiplier. While the government did freeze the multiplier, preventing it from rising with inflation, it was frozen at an already high level. For businesses that saw their RV skyrocket, a frozen multiplier on a much larger base value still results in a crippling increase in their tax liability. This is the crux of the issue: a modest tweak to one part of the formula is being presented as a major tax cut, while the other, more impactful part, is quietly driving bills to unsustainable levels.

The Christmas Ledger: Unpacking the Hidden Economic Impact of Holiday Gender Roles

The On-the-Ground Impact: A Numbers Game

Let’s visualize the scenario faced by many businesses using a simplified comparison. The table below illustrates how a massive RV increase can completely negate the “benefit” of a frozen multiplier, leading to a higher overall bill.

| Component | Pre-2023 Revaluation (Hypothetical) | Post-2023 Revaluation (Mr. Oddono’s Example) | Analysis |

|---|---|---|---|

| Rateable Value (RV) | £50,000 | £72,500 (a 45% increase) | Reflects a sharp rise in perceived property market value, penalizing businesses in successful locations. |

| Small Business Multiplier | 49.9p (2022-23 rate) | 49.9p (Frozen for 2023-24) | The government’s “tax cut” is merely a freeze, not a reduction, at a historically high level. |

| Estimated Gross Bill (RV x Multiplier) | £24,950 | £36,177.50 | A 45% increase in the final bill, despite the multiplier being at a supposed “low.” |

This table clearly shows that the revaluation is the dominant factor. According to the Valuation Office Agency, the 2023 revaluation saw the total rateable value of commercial properties in England and Wales increase by 7.1% (source). However, this national average masks huge regional and sectoral disparities, with retail and industrial sectors seeing significant hikes that place immense pressure on their financial models.

The Macroeconomic Consequences of a Microeconomic Burden

The struggles of a single gelato shop are a microcosm of a much larger economic issue. When businesses face unpredictable and escalating fixed costs, it has a chilling effect on the entire ecosystem of investing, growth, and innovation.

Firstly, it directly impacts capital allocation. A business leader forced to earmark an extra £10,000 or £20,000 for property taxes is one who cannot invest that capital into hiring new staff, upgrading equipment, or developing new products. This starves the business of the resources needed to compete and grow, creating a drag on productivity. For investors looking at the retail or hospitality sectors, high and volatile business rates represent a significant operational risk, potentially steering investment away from the UK high street and towards less tax-intensive sectors or regions.

Secondly, it creates an uneven playing field. The current system disproportionately burdens businesses with a physical footprint, while online-only retailers face significantly lower overheads. This structural imbalance has been a key driver in the decline of traditional high streets. A report from the Centre for Cities highlights that business rates represent a far heavier burden for businesses in less productive parts of the country, potentially exacerbating regional inequalities (source). This has knock-on effects for the banking sector, as businesses with thin margins and high fixed costs are often seen as higher-risk borrowers, limiting their access to the capital needed for expansion.

The Renminbi's Silent Slide: Is China Waging a Stealth Currency War?

The Path to Reform: Can Technology Offer a Solution?

For years, calls to reform or replace the business rates system have grown louder, yet meaningful change remains elusive. Proposals range from a complete shift to a capital value tax, a tax on online deliveries, or simply more frequent revaluations to avoid the dramatic shocks businesses are currently experiencing.

This is where financial technology (fintech) could play a transformative role. Imagine a system where, instead of relying on outdated property valuations, local taxes were linked to a business’s real-time turnover. Modern fintech platforms and open banking APIs make this technologically feasible. Such a system would be more responsive to the economic realities of a business—in a slow month, the tax bill would be lower; in a boom month, it would be higher. This would provide greater stability, reduce the risk of viable businesses being pushed into insolvency by a tax bill they cannot afford, and create a fairer system that taxes economic activity rather than physical presence.

While the transition to such a system would be complex, it represents the kind of innovative thinking needed to create a tax environment that fosters, rather than hinders, economic growth. It shifts the focus from penalizing property to taxing prosperity, aligning the interests of the government with the success of its businesses.

Key Takeaways for Investors and Business Leaders

Navigating this environment requires vigilance and strategic planning. For those leading or investing in UK-based businesses, the business rates paradox offers several crucial lessons:

- Scrutinize the Headlines: Always look beyond the top-line political statements. A “tax cut” may be a freeze, and a “low rate” might be offset by other factors. Diligence is paramount.

- Understand Your RV: Business owners must understand the basis of their rateable value and be prepared to challenge it through the VOA’s “Check, Challenge, Appeal” process if it seems inaccurate.

- Factor in Tax Volatility: For investors, particularly in the commercial property, retail, or hospitality sectors, business rates are a major variable. When analyzing a company’s performance or a stock’s potential, factor in the risk of future revaluation shocks. This is as critical as analyzing their position on the stock market.

- Advocate for Change: The current system is a collective problem. Business leaders should engage with trade bodies and local government to advocate for a fairer, more transparent, and modern system of business taxation.

The 0 Billion Question: Can a "Reparation Loan" Revolutionize Finance and Heal Historical Wounds?

In conclusion, the story of Oddono’s Gelati is more than just a complaint about a tax bill. It is a clear signal that the foundational principles of UK business taxation are misaligned with the needs of a modern economy. The government’s claim of a 34-year low, while technically true in a narrow sense, masks a painful reality of rising costs and stifled growth. For the UK to foster a vibrant and competitive business environment, it must move beyond clever statistics and engage in genuine, structural reform that supports the very businesses that form the backbone of our communities and our economy.