Navigating the Noise: The “Unflattering Flynn Quote” and the Perils of Financial Prophecy

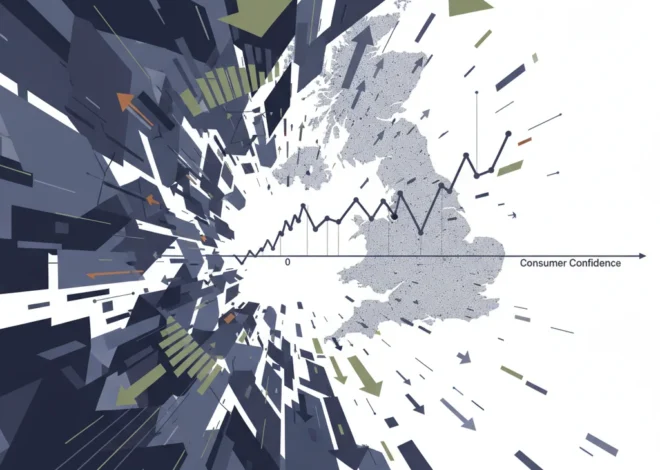

In the fast-paced world of finance, certainty is the most valuable—and rarest—of commodities. Investors, executives, and policymakers are in a constant search for a clear signal amidst the noise, a reliable forecast that can illuminate the path forward. This hunger for clarity often leads us to the doorsteps of experts: the seasoned analysts, the brilliant economists, and the data-driven quants who promise to map the future of the stock market and the broader economy.

But what if the map itself is the problem? A recent letter to the editor in the Financial Times, simply titled “Unflattering Flynn quote,” serves as a poignant, if brief, reminder of a deep and dangerous pitfall in our reliance on financial prophecy. While the letter itself was sparse, it points toward a powerful idea, often attributed to the late intelligence researcher James Flynn. The quote, in its various forms, captures a profound truth about expertise: “The hubris of the expert is to mistake a map for the territory, and then sell the map as a guaranteed destination.”

This single sentence is a masterclass in risk management. It’s a warning that resonates from the trading floors of Wall Street to the boardrooms of Silicon Valley, and it holds critical lessons for anyone involved in investing, finance, or strategic planning. In this article, we will deconstruct this “unflattering” quote, explore the history of failed expert predictions, and offer a framework for navigating a world where no map can ever truly capture the terrain.

Deconstructing the Expert’s Trap: Map vs. Territory

At its core, Flynn’s observation is built upon a concept popularized by the Polish-American philosopher Alfred Korzybski: “The map is not the territory.” It’s a simple idea with profound implications. A geographical map can show you roads, rivers, and cities, but it cannot convey the experience of the terrain—the steepness of a hill, the heat of the sun, or the sudden downpour. It is a representation, a useful abstraction, but it is not reality itself.

In the world of economics and finance, our “maps” take many forms:

- Econometric Models: Complex mathematical systems designed to forecast GDP, inflation, or unemployment.

- Valuation Models: Discounted cash flow (DCF), price-to-earnings (P/E) ratios, and other tools to determine a company’s worth.

- Technical Charts: Visual representations of price movements and trading volumes used to predict future stock performance.

- Analyst Reports: Detailed documents providing “Buy,” “Hold,” or “Sell” recommendations.

These maps are indispensable. They help us organize complex information, identify patterns, and make informed decisions. The danger arises from what Flynn calls “the hubris of the expert”—the moment the creator of the map falls in love with their creation. They forget its limitations. They mistake their elegant, logical model for the messy, irrational, and infinitely complex reality of the global economy. The final, and most perilous step, is “selling the map as a guaranteed destination”—presenting a forecast not as a probability, but as a certainty. This is where investors get hurt.

The AI Gold Rush: Are You Investing in the Shovels or Just the Hype?

A Brief History of Broken Compasses: The Graveyard of Financial Forecasts

History is littered with the ghosts of confident predictions made by the brightest minds in finance. These moments serve as stark reminders that the territory is always more powerful than the map.

One of the most infamous examples comes from the brilliant economist Irving Fisher, who, just weeks before the devastating Wall Street Crash of 1929, declared that “stock prices have reached what looks like a permanently high plateau.” (source). His map, based on the economic data of the “Roaring Twenties,” completely missed the speculative bubble and systemic fragility that defined the territory.

Decades later, in 1998, the territory struck back again with the collapse of Long-Term Capital Management (LTCM). The hedge fund was run by a dream team of Wall Street traders and two Nobel Prize-winning economists. Their sophisticated risk-management models suggested that a simultaneous, multi-market crisis of the kind that occurred was a statistical impossibility. Yet, when Russia defaulted on its debt, their map was set ablaze, and the firm lost $4.6 billion in a matter of months, requiring a massive bailout orchestrated by the Federal Reserve to prevent a systemic collapse (source).

The table below highlights a few notable instances where the expert’s map led investors astray.

| The Prediction (The Map) | The Expert | The Outcome (The Territory) |

|---|---|---|

| “Stock prices have reached what looks like a permanently high plateau.” (Oct 1929) | Irving Fisher, Economist | The Wall Street Crash of 1929 and the Great Depression began days later. |

| “We believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited.” (March 2007) | Ben Bernanke, Fed Chairman | The subprime crisis triggered the 2008 Global Financial Crisis, the worst economic downturn since the Great Depression. |

| Risk models showed that the probability of their portfolio’s daily losses was infinitesimally small. (Pre-1998) | Long-Term Capital Management (LTCM) | The fund collapsed in 1998 after the Russian financial crisis, nearly taking the global financial system with it. |

These are not isolated incidents. A study by the International Monetary Fund (IMF) has consistently shown that private-sector economic forecasts often fail to predict recessions, even just a year in advance (source). The maps are consistently, and often spectacularly, wrong when the territory shifts unexpectedly.

The Swiss Paradox: Why Real Value Trumps Financial Engineering

The Double-Edged Sword of Modern Financial Technology

One might assume that the rise of Big Data, artificial intelligence, and sophisticated fintech would solve the map-territory problem. With more data and faster processing, can’t we build a perfect map? The reality is more complicated.

Modern financial technology is a double-edged sword. On one hand, it provides incredible tools for analysis. Algorithmic trading can execute complex strategies in microseconds, and AI can detect patterns in market data that are invisible to the human eye. The rise of DeFi (Decentralized Finance) on the blockchain offers a new level of transparency in financial transactions.

However, this technological leap also amplifies the core problem. These systems are, at their heart, just more intricate maps. An algorithm is a set of rules based on historical data—the old territory. When a “black swan” event occurs, an event that lies outside the model’s training data, these automated systems can fail spectacularly, leading to flash crashes and unforeseen systemic risks. The illusion of control becomes greater, the potential hubris more profound, and the speed of failure almost instantaneous. The core of banking and finance remains rooted in human trust and behavior, variables that are notoriously difficult to model.

Your Compass in a World Without Guarantees

If we cannot trust the maps to be perfect, how should we navigate the financial world? The answer lies in shifting from a strategy of prediction to one of preparation and resilience. We must become better navigators of the territory, not just blind followers of the map.

For Investors:

- Focus on Principles, Not Predictions: Instead of chasing the next hot stock tip, build your strategy on timeless principles: diversification, asset allocation that matches your risk tolerance, and a long-term perspective.

- Embrace Humility and a Margin of Safety: Acknowledge that you cannot predict the future. As Benjamin Graham taught, always invest with a “margin of safety”—buy assets for significantly less than your estimate of their intrinsic value. This provides a buffer if your map is wrong.

- Be a Skeptic: When you hear a forecast delivered with absolute certainty, your skepticism should be at its highest. Ask questions. What are the underlying assumptions? What could make this forecast wrong?

For Business Leaders:

- Prioritize Scenario Planning: Instead of relying on a single economic forecast, develop strategies for a range of possible futures—a severe recession, a period of high inflation, a technological disruption, etc. A resilient business is one that can adapt to different territories.

- Build an Adaptable Organization: Foster a culture that is agile and responsive to change. The companies that thrived during the COVID-19 pandemic were not the ones that predicted it, but the ones that could pivot their operations quickly.

Germany's Hydrogen Paradox: A Multi-Billion Euro Bet on an Empty Market?

Conclusion: Reading the Terrain

The “unflattering Flynn quote” that sparked a reader’s letter is more than just a clever aphorism. It is a fundamental principle for survival and success in any complex system, from military strategy to public health to modern finance. It reminds us that our models of reality are not reality itself.

The best analysts, investors, and leaders are not those with the most complex maps, but those who understand the limitations of their tools. They use forecasts as a single data point, not as a gospel. They spend more time studying the underlying fundamentals—a company’s competitive advantage, the health of its balance sheet, the long-term trends shaping an industry—than they do trying to predict the next wiggle of the stock market. They respect the territory, in all its unpredictable and chaotic glory.

So, the next time you are presented with a confident forecast, a detailed model, or a “guaranteed” investment destination, pause and remember the wisdom of the map and the territory. Use the map for guidance, but always keep your eyes on the road ahead.