Beyond the Headlines: How 50,000 New Apprenticeships Could Reshape the UK’s Economic Future

A Strategic Investment in Human Capital: Unpacking the UK’s Youth Employment Initiative

In a significant move aimed at bolstering the UK’s economic foundation, the government has announced a new initiative to create 50,000 new apprenticeships as part of a major push for youth employment. While the headline number is compelling, the true story lies in the strategic allocation of these opportunities across high-growth sectors like Artificial Intelligence (AI), engineering, and hospitality. This is not merely a social program; it’s a calculated fiscal policy designed to address one of the most persistent challenges in modern economics: the skills gap. For investors, finance professionals, and business leaders, understanding the deep-seated implications of this policy is crucial for navigating the future landscape of the UK economy and identifying emerging opportunities.

At its core, this initiative is a direct injection of capital into the nation’s most valuable asset: its people. By funding on-the-job training, the government aims to create a more resilient, adaptable, and productive workforce. This move acknowledges a fundamental economic truth—that long-term growth is not built on financial engineering alone, but on the tangible skills and innovation capacity of the population. The focus on future-proof industries signals a clear vision for where the UK sees its competitive advantage in the global market.

Beyond the Checkout Cart: The PandaBuy Breach and Its High-Stakes Lessons for the Global Economy

The Macroeconomic Ripple Effect: From Apprenticeships to Economic Growth

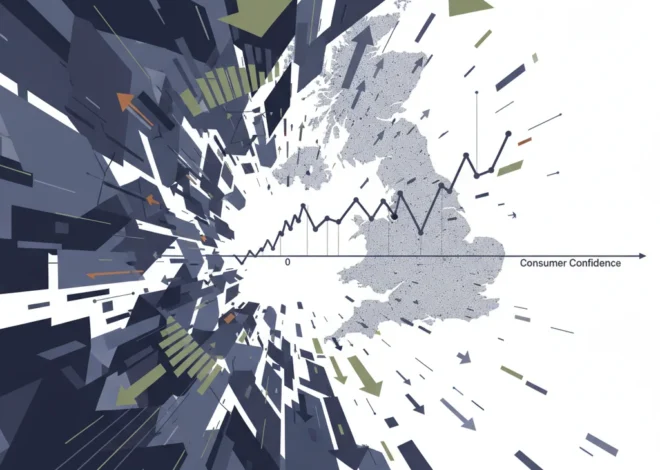

From a macroeconomic perspective, a large-scale apprenticeship program is a powerful tool. Its effects ripple through various facets of the economy, influencing everything from Gross Domestic Product (GDP) to inflation. Firstly, it directly tackles structural unemployment, particularly among the youth, a demographic whose potential is often underutilized. Lowering youth unemployment not only reduces social welfare costs but also increases the tax base and consumer spending power, creating a virtuous cycle of economic activity.

Secondly, the program is a direct assault on the productivity puzzle that has plagued the UK for over a decade. A workforce equipped with modern, in-demand skills—especially in tech and engineering—is inherently more productive. According to a report by the Learning and Work Institute, skills shortages are estimated to cost the UK economy £4.4 billion annually. By closing this gap, the initiative has the potential to unlock significant productivity gains, which is a key driver of non-inflationary growth. For the banking and finance sectors, a more productive economy means a more stable and profitable operating environment, with healthier credit markets and increased demand for financial services.

Targeted Sectors: A Blueprint for the Future Economy

The selection of AI, engineering, and hospitality is far from arbitrary. It represents a strategic diversification of the UK’s economic strengths. The table below outlines the rationale and the specific skills in focus for these key areas.

| Target Sector | Strategic Importance | Key Skills in Demand |

|---|---|---|

| Artificial Intelligence (AI) | Driving innovation across all industries, from finance to healthcare. Essential for maintaining global competitiveness. | Machine Learning, Data Science, Natural Language Processing, AI Ethics, Python Programming. |

| Engineering | Core to infrastructure, manufacturing, and green energy transition. A chronic skills shortage area. | Mechanical & Electrical Engineering, Civil Engineering, Software Engineering, Renewable Energy Systems. |

| Hospitality | A major employer and contributor to the service economy, vital for tourism and post-pandemic recovery. | Management, Digital Marketing, Customer Service Excellence, Culinary Arts, Supply Chain Logistics. |

An Investor’s Roadmap: Where Capital Meets Human Capital

For the savvy investor, this government policy is a clear market signal. It highlights sectors poised for government support and, more importantly, a fortified talent pipeline. A recurring risk for companies, especially in the tech sector, is the high cost and difficulty of acquiring skilled labor. This initiative directly mitigates that risk for UK-based firms in AI and engineering, potentially making them more attractive long-term investments.

Companies that actively participate in the apprenticeship scheme may see improved operational efficiency, higher innovation rates, and better employee retention—all factors that positively impact the bottom line and, consequently, the stock market valuation. Investors should look beyond the immediate financial statements and analyze a company’s commitment to workforce development as a leading indicator of future resilience and growth. This is where the worlds of investing and human resources strategy intersect, creating a more holistic view of corporate health.

The Feta Effect: Why a Greek Livestock Crisis is a Red Flag for the Global Economy

The Fintech Revolution: Why AI Skills are the New Currency in Finance

The emphasis on AI skills has profound implications for the financial technology (fintech) and broader banking sectors. The future of finance is inextricably linked with AI. From algorithmic trading and AI-powered fraud detection to personalized banking and robo-advisory services, the demand for talent that can build, manage, and ethically deploy these systems is exploding. A national push to create a generation of AI-literate professionals could give the UK’s already-thriving fintech scene a significant competitive edge.

Moreover, emerging technologies like blockchain rely on a sophisticated understanding of software engineering and cryptography. While not explicitly mentioned, the skills developed in high-level engineering and AI apprenticeships are directly transferable to this space. A deeper talent pool can accelerate innovation in decentralized finance (DeFi), secure digital identities, and transparent supply chains. In essence, this apprenticeship program is laying the groundwork for the next wave of disruption in financial technology, making the UK a more fertile ground for both startups and established players.

A Call to Action for Business Leaders

This government initiative is not a passive benefit; it’s an opportunity that requires active participation from the private sector. Business leaders should view this as more than just a potential subsidy for hiring. It is a chance to co-create the workforce they need for the future. By partnering with educational institutions and the government, companies can shape apprenticeship curricula to ensure they are perfectly aligned with their specific technological and commercial needs.

The long-term return on investment is substantial. Businesses gain access to a pipeline of motivated, skilled talent, reduce recruitment costs, and build a corporate culture of learning and development. The Office for National Statistics has previously reported on the positive correlation between training expenditure and business performance (source). Embracing this program is a strategic decision that strengthens not only the individual firm but also the entire industry ecosystem.

The ROI of Righteousness: Deconstructing Tony's Chocolonely's Assault on an Unethical Economy

Conclusion: Building a More Resilient Economic Engine

The promise of 50,000 new apprenticeships is far more than a political soundbite. It is a strategic, multi-faceted investment in the UK’s economic infrastructure. By focusing on critical skills gaps in sectors like AI and engineering, the policy aims to boost productivity, foster innovation, and secure the nation’s long-term competitiveness. For the financial community, it presents a clear signal of government priorities and highlights sectors ripe for growth and investment. For business leaders, it is a call to action to help shape the next generation of talent. While challenges in implementation remain, the fundamental principle—investing in human capital—is one of the most reliable strategies in economics for building a prosperous and resilient future.