The Billionaire’s Dilemma: Switzerland’s 50% Inheritance Tax and the Global War for Wealth

The Alpine Tremor: Is Switzerland’s Financial Paradise at a Crossroads?

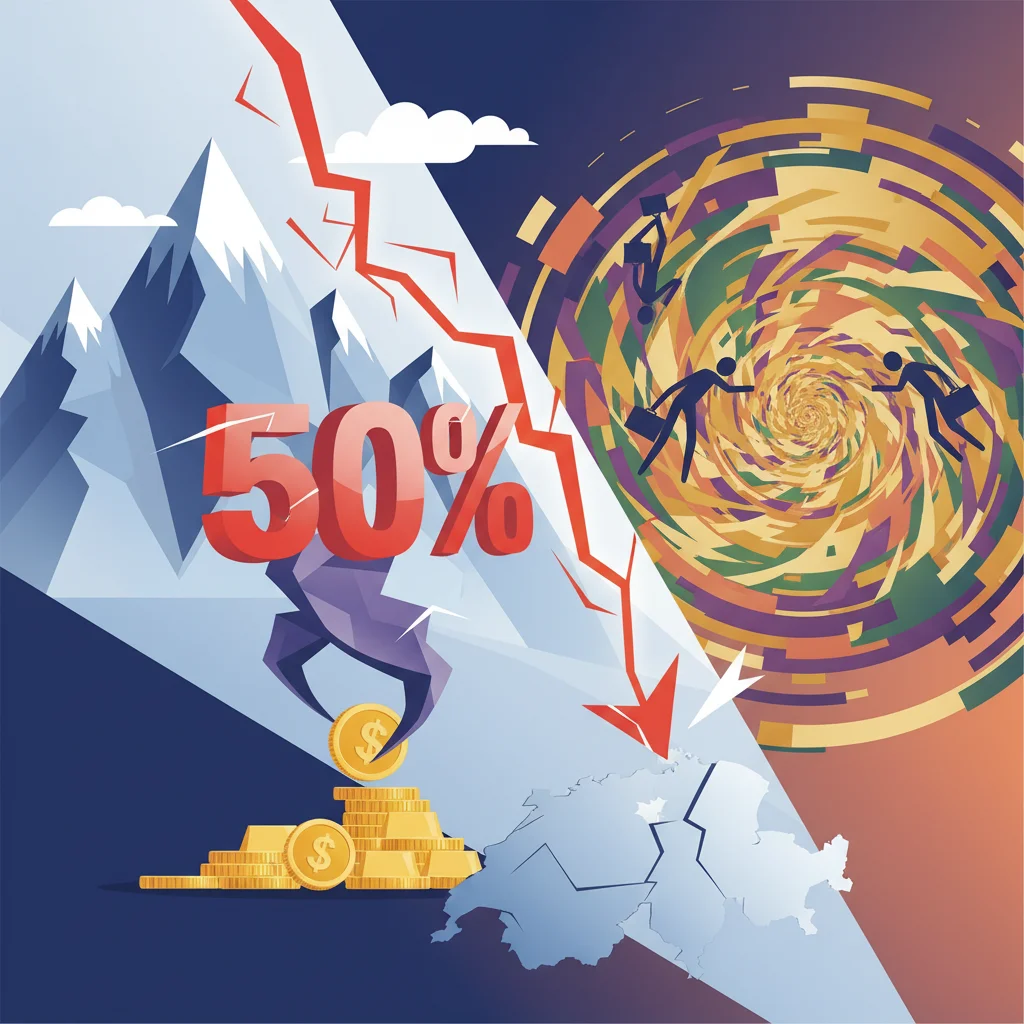

For centuries, Switzerland has cultivated an image of unshakable stability, discreet banking, and a welcoming environment for global capital. It’s a brand built on predictability and financial security. But a seismic proposal is challenging this long-standing identity: a vote on a potential 50% inheritance tax targeting the nation’s super-rich. This isn’t just a domestic policy debate; it’s a move that sends ripples across the international finance landscape, forcing a confrontation with a fundamental question of modern economics: should governments aggressively tax accumulated wealth for the public good, or should they compete to lure it from other nations?

The initiative, born from a growing global discourse on wealth inequality, strikes at the heart of Switzerland’s economic model. As governments worldwide grapple with post-pandemic debt and social pressures, the super-rich have become a focal point for fiscal policy. The Swiss proposal is a potent case study in this global tug-of-war, pitting the principles of social equity against the pragmatic fear of capital flight. For investors, finance professionals, and business leaders, the outcome of this vote and the conversations it ignites are more than just headlines—they are a bellwether for the future of wealth, investing, and international tax policy.

Unpacking the 50% Proposal: A Tax on Legacy

The core of the Swiss initiative is a proposed federal inheritance tax of 50% on estates exceeding a significant threshold, potentially impacting inheritances valued in the tens of millions of Swiss francs. Proponents argue that such a measure is a necessary tool to combat soaring wealth concentration. They contend that a small fraction of the population holds a disproportionate amount of the nation’s assets, and a tax on large inheritances could fund vital public services like education, healthcare, and infrastructure, thereby strengthening the national economy for all.

The arguments in favor are compelling from a social perspective. A study by Credit Suisse has previously highlighted Switzerland as having one of the highest concentrations of wealth in the developed world. A significant inheritance tax, advocates say, would not only generate substantial revenue but also promote a more meritocratic society where success is less dependent on generational wealth. However, the opposition’s counterarguments are equally potent and rooted in economic pragmatism. They warn of a mass exodus of high-net-worth individuals (HNWIs), family-owned businesses, and the vast capital they control. This “capital flight” could, they argue, erode the tax base, weaken the Swiss franc, and damage the country’s world-renowned banking and wealth management sectors, ultimately costing the country more than the tax would generate.

Cracks in the Golden Empire: Is Mining Giant Barrick Gold on the Brink of a Break-Up?

A Global Phenomenon: The “Lure vs. Extract” Doctrine

Switzerland’s dilemma is not unique; it’s a microcosm of a global trend. Countries are increasingly forced to choose a side in the “lure versus extract” battle for mobile capital. On one side, nations like France and Spain have implemented or increased wealth taxes. On the other, countries like Italy, Portugal, and the UAE have created highly attractive “golden visa” programs and favorable tax regimes designed specifically to attract HNWIs.

This creates a complex and competitive international environment. Below is a comparative look at how different nations approach wealth and inheritance taxation, illustrating the divergent strategies at play.

| Country | Top Inheritance/Estate Tax Rate | Notable Wealth Tax Policy |

|---|---|---|

| Switzerland (Proposed) | 50% (Federal) | Currently, inheritance taxes are cantonal; some have none. A national tax would be a major shift. |

| France | 45% | Replaced its general wealth tax with a tax on real estate wealth (IFI). |

| United States | 40% (Federal Estate Tax) | High exemption amount ($13.61 million per individual in 2024 source). |

| United Kingdom | 40% | Tax is levied on the value of an estate above a £325,000 threshold. |

| Singapore | 0% | Abolished estate duty in 2008 to attract wealth. |

| UAE (Dubai) | 0% | No income, inheritance, or wealth tax, positioning it as a major global wealth hub. |

As the table shows, the strategic divergence is stark. While some European nations maintain high tax rates, hubs in Asia and the Middle East are aggressively positioning themselves as tax-friendly havens, creating immense pressure on traditional financial centers like Switzerland.

The Ripple Effect: From the Stock Market to Fintech Innovation

Should the tax be approved, the immediate concern for the markets would be its impact on the Swiss stock market. A significant outflow of capital from resident HNWIs could lead to selling pressure on Swiss equities and a potential weakening of the franc. Family-owned businesses, a cornerstone of the Swiss economy, might be forced to sell assets or relocate headquarters to avoid breaking up the business to pay the tax bill upon the founder’s death. This uncertainty could dampen investor sentiment and increase volatility in sectors heavily reliant on domestic capital.

Beyond the traditional markets, this policy shift could be a massive catalyst for the fintech sector. The demand for sophisticated wealth management and tax optimization tools would skyrocket. We would likely see an explosion in:

- Wealth Structuring Platforms: Financial technology solutions that help HNWIs legally and efficiently structure their assets across multiple jurisdictions.

- Digital Asset Management: A surge in investing in and managing digital assets like cryptocurrencies and tokenized real-world assets, which offer different mobility and jurisdictional characteristics.

- RegTech (Regulatory Technology): Advanced software to help individuals and institutions navigate the increasingly complex web of international tax laws and reporting standards.

This dynamic creates a high-stakes game of innovation. As governments build higher fiscal walls, the fintech industry provides the ladders and tunnels. It’s a technological and regulatory arms race that will define the future of wealth management.

The 'True Faith' Principle: How One Catalyst Can Redefine a Company's Economic Trajectory

The Future of Swiss Banking: Adapt or Decline?

For Switzerland’s legendary banking industry, this proposal is an existential threat and a powerful call to action. The era of relying solely on secrecy and stability is over. To thrive, Swiss banks must evolve. They need to pivot from being passive custodians of wealth to proactive, global advisors who can navigate complex cross-border tax regimes and integrate cutting-edge financial technology. The value proposition must shift from “your money is safe and secret here” to “we provide the global expertise and technological tools to preserve and grow your wealth in a complex world.”

This means embracing innovation in trading platforms, offering sophisticated advice on everything from art to blockchain assets, and providing unparalleled expertise in international law. A “Yes” vote on the inheritance tax would be a painful catalyst, but it could force an evolution that is already long overdue. The banks that succeed will be those that become technology companies specializing in finance, rather than traditional banks merely using technology.

Conclusion: A Defining Moment for a Financial Titan

The Swiss vote on a 50% inheritance tax is far more than a local ballot measure. It is a defining moment that encapsulates the central economic conflict of our time. It forces a nation, and indeed the world, to weigh the moral imperative of reducing inequality against the economic risks of capital mobility. The outcome will not only shape Switzerland’s future as a financial hub but will also serve as a crucial data point for every other government navigating this treacherous terrain.

For investors and business leaders, the message is clear: the rules of wealth are being rewritten. The interplay between national tax policy, global capital flows, and disruptive technology like fintech and blockchain is creating a new and dynamic landscape. Whether Switzerland chooses to extract more from its wealthiest residents or reaffirm its status as a safe harbor, the decision will echo through the halls of global finance, influencing economic strategy and investment decisions for years to come.