The Quantum Enigma: Inside IonQ’s High-Stakes Bet to Revolutionize Computing and Finance

In the rarefied world of quantum computing, a field that operates at the very edge of physics and imagination, a bold declaration echoes from the boardroom of IonQ: “We’re physicists who are also capitalists.” This statement, from former CEO Niccolo de Masi, encapsulates the central tension surrounding one of the most talked-about and controversial companies in the sector. IonQ is not just building what it claims is a revolutionary new type of computer; it’s navigating the turbulent waters of the public stock market, facing down skeptical investors and short-sellers along the way.

The promise of quantum computing is nothing short of world-changing. These machines, which leverage the bizarre principles of quantum mechanics, could solve problems currently intractable for even the most powerful supercomputers. Their potential applications could reshape entire industries, from medicine and materials science to financial technology and global logistics. For investors, this represents a tantalizing opportunity—a ground-floor entry into a technology that could define the 21st-century economy.

But the path from a physics lab to a profitable, publicly-traded enterprise is fraught with peril. IonQ’s journey, which included a high-profile debut on the stock market via a Special Purpose Acquisition Company (SPAC), has been a case study in the collision of deep science and high finance. The company makes bold claims about the superiority of its technology, but these assertions have been met with equally fierce criticism, creating a deeply polarized debate. Is IonQ pioneering the future, or is it a high-tech mirage built on unproven claims? This article delves into the technology, the controversy, and the profound implications for the future of investing in deep tech.

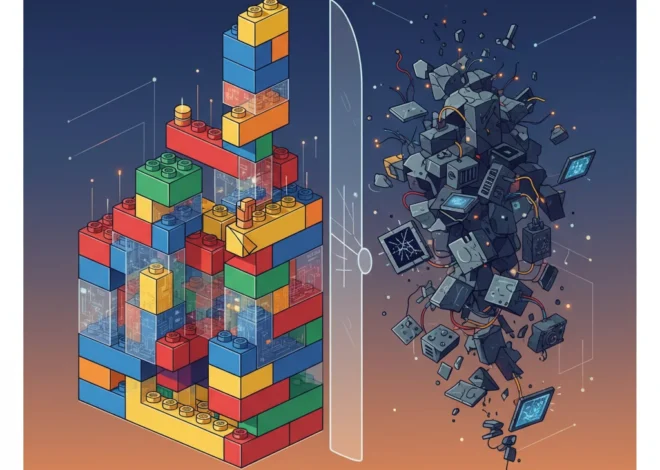

The Quantum Divide: A Tale of Two Technologies

At the heart of the debate is a fundamental disagreement about the best way to build a quantum computer. The majority of major players, including giants like Google and IBM, have placed their bets on “superconducting circuits.” These are essentially tiny, artificial atoms built on silicon chips and cooled to temperatures colder than deep space to exhibit quantum behaviors. They are fast but notoriously fragile and prone to errors, a phenomenon known as “decoherence.”

IonQ has chosen a different, and it argues, superior path: “trapped-ion” technology. Instead of building artificial atoms, IonQ uses nature’s own perfect qubits—individual atoms (ions) of the element Ytterbium. These ions are suspended in a vacuum by electromagnetic fields and manipulated with precisely targeted lasers. The company contends that this method produces more stable, more accurate, and ultimately more powerful qubits that are easier to scale into a formidable computing machine.

To understand the landscape, here is a comparison of the two leading approaches to building a quantum computer:

| Feature | Trapped-Ion (IonQ’s Approach) | Superconducting Circuits (Google, IBM’s Approach) |

|---|---|---|

| Qubit Source | Individual, naturally occurring atoms (ions) | Man-made circuits on a silicon chip |

| Key Advantage | High fidelity and stability; long coherence times (qubits last longer) | Faster gate speeds (calculations are quicker) |

| Operating Conditions | Operates at room temperature (though in a vacuum) | Requires extreme cooling to near absolute zero |

| Connectivity | Qubits can be fully connected to each other | Qubits can typically only connect to their nearest neighbors |

| Major Challenge | Slower processing speeds compared to superconducting systems | High error rates and extreme sensitivity to environmental “noise” |

IonQ’s leadership is adamant that their choice will ultimately win the quantum race. They argue that while rivals are focused on building more and more “noisy” qubits, IonQ is focused on building fewer, higher-quality qubits that are more computationally useful. This is the cornerstone of their pitch to investors and the wider market.

Chile at a Crossroads: How a Political Shockwave Could Reshape Its Economy and Markets

The Billion-Dollar Controversy: Hype vs. Reality

Confidence in one’s technology is standard in Silicon Valley, but IonQ’s claims have attracted an unusual level of scrutiny. The company’s public listing and bold pronouncements made it a prime target for critics, most notably the activist short-seller Scorpion Capital. In 2022, Scorpion released a scathing report that labeled IonQ a “brazen scam,” accusing the company of vastly exaggerating its technological capabilities and deceiving investors.

The core of the criticism revolves around the difficulty of verifying quantum computing claims. Unlike a traditional computer, you can’t simply run a standard benchmark and get a clear performance score. The metrics are complex, esoteric, and can be presented in ways that flatter the technology. Skeptics argue that IonQ’s publicly demonstrated devices are not the powerful, general-purpose machines they are marketed as, but rather elaborate physics experiments with limited practical application at their current stage.

IonQ has vehemently denied these allegations, dismissing them as the work of financially motivated critics who misunderstand the science. They point to their peer-reviewed research, their partnerships with major cloud providers like Microsoft Azure and Google Cloud, and their progress on technical roadmaps as evidence of their legitimate and groundbreaking work. This public battle highlights a critical challenge in the deep tech investing landscape: how can non-expert investors, analysts, and even seasoned finance professionals perform effective due diligence on a technology that requires a Ph.D. in quantum physics to fully comprehend?

Geopolitical Tremors: How a Diplomatic Row Over Taiwan is Rattling the Japanese Stock Market

For investors, this creates a new paradigm of risk and reward. The potential upside is astronomical, but the due diligence process is incredibly opaque. Unlike evaluating a software company’s user growth or a retailer’s sales, evaluating a quantum computer’s “algorithmic qubits” is nearly impossible for an outsider. This information asymmetry creates fertile ground for both visionary breakthroughs and spectacular failures. The lesson here is that investing in this space is less like traditional stock-picking and more like early-stage venture capital, where diversification, a long-term horizon, and a healthy dose of skepticism are paramount.

The Quantum Revolution in Finance and Economics

Beyond the corporate drama, the real question is what a functional quantum computer could mean for the world. The impact on finance, banking, and the global economy would be particularly profound, creating both unprecedented opportunities and existential threats.

One of the most anticipated applications is in complex optimization problems. Quantum computers could revolutionize financial modeling, allowing for near-instantaneous analysis of millions of variables to optimize investment portfolios, price complex derivatives, and manage risk with a level of sophistication that is currently unimaginable. This could dramatically enhance the efficiency of markets and the practice of trading.

However, the technology also poses a grave threat. The very foundation of modern digital security—from online banking to blockchain and cryptocurrencies—relies on encryption algorithms that are too complex for classical computers to break in a reasonable timeframe. A sufficiently powerful quantum computer could, in theory, shatter this encryption in minutes. This “quantum threat” has spurred a global race within the fintech and cybersecurity industries to develop “quantum-resistant” cryptography to secure our future digital infrastructure.

The broader economic implications are staggering. Quantum computing could accelerate the discovery of new materials, leading to hyper-efficient batteries and solar panels. It could design new drugs and therapies by simulating molecules with perfect accuracy. It could optimize global supply chains, weather forecasting, and climate change modeling. Each of these breakthroughs represents a multi-trillion-dollar economic transformation, underscoring why governments and corporations are pouring billions into the field (source).

The Great British Savings Reset: A Blueprint for National Financial Resilience

The Verdict on the Quantum Gamble

IonQ stands as a symbol of the modern technological gold rush—a company built on brilliant science, fueled by capitalist ambition, and scrutinized under the bright lights of the public market. Whether its trapped-ion approach will prevail over the superconducting machines of its rivals remains one of the most important unanswered questions in technology today.

For investors and business leaders, the takeaway is nuanced. The quantum computing revolution is not a matter of “if,” but “when” and “who.” The journey will be long, and there will likely be casualties along the way. Companies like IonQ are taking immense risks, but they are also pushing the boundaries of human knowledge. The line between a visionary and a charlatan is often only visible in hindsight. For now, the story of the “physicist-capitalists” serves as a compelling, high-stakes drama at the intersection of science, finance, and the future of the global economy.