The $24 Billion Gambit: Are GoTo and Grab Forging Southeast Asia’s Ultimate Super App?

In the high-stakes world of Southeast Asian technology, the tectonic plates are shifting once again. A dramatic leadership overhaul at Indonesia’s tech giant, GoTo, is fueling intense speculation about the revival of a mega-merger with its long-time rival, Grab. The potential creation of a consolidated ride-hailing, delivery, and fintech behemoth, valued at an estimated $24 billion, could permanently reshape the region’s digital economy.

The catalyst for this renewed M&A chatter is the appointment of Patrick Walujo, a seasoned private equity veteran and an early backer of Gojek, as GoTo’s new chief executive. This move is widely interpreted as a signal to investors that the era of relentless, cash-burning competition may be coming to an end, with a new focus on profitability and strategic consolidation. For anyone involved in regional investing, this is more than just a C-suite shuffle; it’s a potential game-changer for the entire Southeast Asian stock market landscape.

But what would this merger actually mean? And is it a move of strategic genius or a desperate gambit for survival? Let’s delve into the forces driving this potential deal, the immense opportunities it presents, and the colossal hurdles that stand in its way.

A New Captain at the Helm: The Walujo Effect

To understand the significance of this potential merger, one must first appreciate the change in leadership. Andre Soelistyo, who steered the company through its complex merger between ride-hailing champion Gojek and e-commerce leader Tokopedia to form GoTo, is stepping aside. His replacement, Patrick Walujo, is not just any executive. As a co-founder of Northstar Group, one of Indonesia’s most prominent private equity firms, Walujo was one of the first institutional investors to see the promise in Gojek.

His appointment is seen by many analysts as a clear mandate from the board to prioritize shareholder value and chart a sustainable path to profitability. In an industry notorious for its high operational costs and price wars, achieving profitability has been the elusive holy grail. Walujo’s background in finance and deal-making suggests he is uniquely positioned to navigate the complex negotiations required to bring two fierce rivals together. According to the Financial Times, sources close to the situation indicate that Walujo is “more open” to a merger than his predecessor, a sentiment that has electrified the finance community (source).

The Super App Dream: A Tale of Two Titans

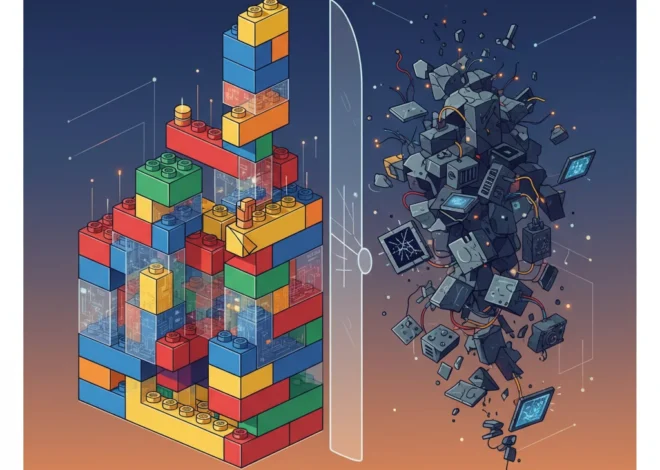

Both Grab and GoTo have spent the better part of a decade locked in a fierce battle for dominance across Southeast Asia. Their ambition was never just about hailing a ride or ordering a meal; it was about building an indispensable “super app”—a single platform that integrates dozens of daily services, with digital payments and financial technology at its core.

A combined entity would be a formidable force, creating a near-monopoly in certain sectors across key markets like Indonesia, Singapore, Vietnam, and Thailand. The synergies are obvious: eliminating duplicate costs in marketing and promotions, combining engineering talent, and creating an unparalleled dataset of consumer behavior. For investors, this translates into a clearer, faster path to profitability. For consumers, the future is less certain, with potential for reduced choice and higher prices.

To grasp the scale of this potential entity, let’s compare the two giants:

| Feature | GoTo (Gojek & Tokopedia) | Grab |

|---|---|---|

| Primary Markets | Indonesia, Vietnam, Singapore | Singapore, Malaysia, Indonesia, Thailand, Vietnam, Philippines, Cambodia, Myanmar |

| Core Services | Ride-hailing, Food Delivery, Logistics, E-commerce (Tokopedia) | Ride-hailing, Food Delivery, Groceries, Logistics |

| Fintech Arm | GoPay, GoTo Financial (including digital banking services) | GrabPay, GrabFinance, GXS Bank (Digital Bank) |

| Key Investors | SoftBank, Alibaba, Google, Tencent, GIC | SoftBank, Uber, Didi Chuxing, Toyota |

| Public Listing | Indonesia Stock Exchange (IDX: GOTO) | NASDAQ (GRAB) |

The most compelling aspect of the merger lies within their fintech divisions. Combining GoPay and GrabPay, along with their respective ventures into digital banking and lending, would create a financial services powerhouse with unprecedented reach into Southeast Asia’s underbanked population. This is the engine that could truly drive long-term, high-margin growth. China's AI Gambit: Fueling an Economic Revolution or a Political Rebellion?

Financial Realities and the Investor Push

The pressure for this merger isn’t just internal; it’s coming from a global shift in investor sentiment. The era of cheap capital that fueled tech growth is over. Today, the market rewards profitability, not just user acquisition. Both Grab and GoTo have seen their stock prices languish since their public debuts, with investors growing impatient with persistent losses. As of early 2023, GoTo reported a staggering net loss of IDR 40.4 trillion (approx. $2.7 billion) for the 2022 fiscal year, highlighting the urgent need for a strategic pivot (source).

A merger offers a compelling solution to this profitability puzzle. The potential cost savings are immense. According to industry estimates, the two companies spend hundreds of millions of dollars annually competing against each other through subsidies and promotions. Eliminating this competitive overlap would immediately improve their financial health. Furthermore, a consolidated market position would grant them greater pricing power, allowing them to adjust fares and fees to better reflect true operational costs—a crucial step in sustainable economics.

This move is a classic case of market consolidation often seen in mature industries. For those involved in active trading, the volatility surrounding these merger talks presents both opportunity and risk, as the market attempts to price in the complex probability of the deal’s success.

The Towering Wall of Regulation

While the business and financial logic for a merger seems strong, the path is fraught with peril, chief among them being regulatory approval. A GoTo-Grab entity would command a dominant, if not monopolistic, share of the ride-hailing and food delivery markets in several countries, most notably Indonesia. Competition authorities across the region will scrutinize this deal with extreme prejudice.

Regulators will be concerned about several key issues:

- Consumer Harm: Will a lack of competition lead to unfairly high prices for consumers?

- Merchant & Driver Impact: Will the new entity use its market power to squeeze commissions from restaurant partners and reduce incentives for drivers?

- Innovation: Would a monopoly stifle innovation in the region’s burgeoning digital economy?

Previous merger talks between the two have reportedly collapsed over precisely these concerns, alongside disagreements on control between the founders. Overcoming this regulatory wall will require a masterful campaign of lobbying, potential divestments of certain business units, and concrete commitments to protect the interests of consumers and partners. The 5 Business Crises Shaping Tomorrow's Leaders: What Top Professors Are Teaching Now

Beyond the Merger: The Future of Southeast Asia’s Digital Landscape

Regardless of the outcome, these developments signal a new phase of maturity for Southeast Asia’s tech scene. The land-grab phase is over. The new era will be defined by financial discipline, strategic consolidation, and a relentless focus on building sustainable business models.

If the merger succeeds, it will create a regional champion with the scale to compete on a global level. It would validate the super app model and could trigger a wave of further consolidation across the tech landscape. It would also be a massive win for early investors like SoftBank, who have poured billions into both companies and have been key proponents of a truce (source).

If it fails, both GoTo and Grab will be forced to continue their difficult, solitary marches toward profitability. They will need to find other ways to cut costs and innovate, all while fending off nimble, sector-specific competitors and the ever-present threat of rivals like Sea Ltd.’s ShopeeFood.

Carrots, Sticks, and Crude Oil: Decoding the High-Stakes Economic Chess Match in Venezuela

Conclusion: A Defining Moment

The potential merger between GoTo and Grab is more than a corporate transaction; it’s a defining moment for Southeast Asia’s digital future. The appointment of Patrick Walujo has opened a critical window of opportunity to end a long and costly war. The deal promises a titan of financial technology and on-demand services, a streamlined path to profitability, and a major victory for patient investors.

However, the journey is paved with immense challenges, from clashing corporate cultures to the monumental task of securing regulatory approval. For business leaders, investors, and consumers across the region, the coming months will be a period of intense observation. The outcome of this $24 billion gambit will not only determine the fate of two of the region’s most iconic companies but will also set the course for its entire digital economy for years to come.