The Billion-Dollar Judgment: Inside the Epic Collapse of EdTech Giant Byju’s

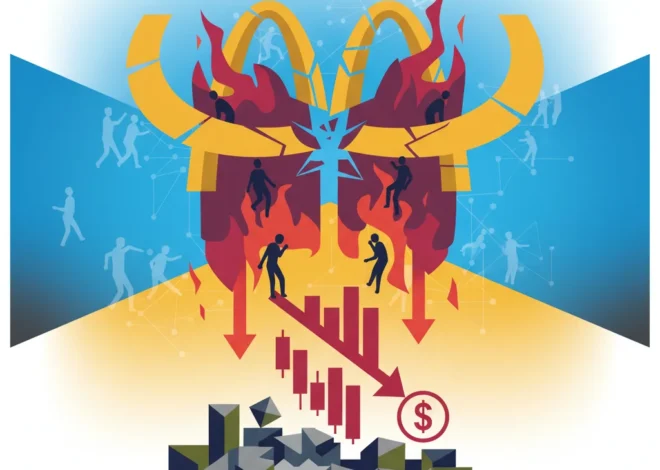

Once the shining beacon of India’s startup ecosystem, a titan of educational technology valued at a staggering $22 billion, Byju’s is now a cautionary tale echoing through the halls of venture capital firms and boardrooms worldwide. The company’s spectacular fall from grace has culminated in a dramatic legal showdown, with a US bankruptcy court recently ordering its founder, Byju Raveendran, to personally account for a disputed sum nearing $1 billion. This isn’t just the story of a struggling company; it’s a deep dive into the perils of hyper-growth, the breakdown of corporate governance, and the harsh realities of the global finance landscape when the music stops.

The latest chapter in this saga unfolded in a Delaware courtroom, where the company, once celebrated for its innovative approach to learning, found itself locked in a bitter dispute with its creditors. The conflict centers on a $1.2 billion term loan, a financial instrument that has become the fulcrum of the company’s unraveling. Lenders have accused Byju’s and its founder of a “calculated scheme of fraud,” alleging that they deliberately concealed an astonishing $533 million of the loan’s proceeds, spiriting the funds away to a little-known hedge fund. This has led to a series of legal battles, culminating in the US court’s decisive and damaging order.

From Classroom Hero to Courtroom Defendant: The Rise and Fall

To understand the magnitude of this collapse, one must first appreciate the meteoric rise. Byju’s, founded by former teacher Byju Raveendran, captured the imagination of parents and investors alike. It promised to revolutionize education through engaging digital content, and for a time, it delivered on a massive scale. The COVID-19 pandemic acted as a supercharger, as school closures worldwide drove millions of students online, sending Byju’s valuation into the stratosphere.

Fueled by billions in venture capital from marquee investors, the company embarked on an aggressive, debt-fueled acquisition spree, snapping up competitors and complementary businesses. This strategy, however, masked underlying issues. As the world reopened and students returned to physical classrooms, the demand for online tutoring waned. Simultaneously, questions began to surface about the company’s aggressive sales tactics, its opaque financial reporting, and a corporate culture that prioritized growth above all else. The very foundation of this EdTech empire was beginning to show deep and alarming cracks.

Trump's Billion Lawsuit Threat Against BBC: A New Frontier of Financial Risk for Global Media?

The following table illustrates the dramatic swing in the company’s valuation, a stark visualization of its journey from tech darling to troubled entity.

| Year | Valuation (USD) | Key Event |

|---|---|---|

| 2018 | $1 Billion | Achieves unicorn status. |

| 2020 | $12 Billion | Pandemic-fueled growth and major funding rounds. |

| 2022 | $22 Billion | Peak valuation amid global expansion and acquisitions. |

| 2023 | Under $3 Billion | Major valuation markdowns by investors like BlackRock (source). |

| 2024 | $225 Million | Valuation implied by a recent rights issue, a 99% drop from its peak (source). |

The Anatomy of a Legal Quagmire

The core of the current legal crisis is the $1.2 billion term loan B (TLB), which Byju’s raised in 2021. As the company’s financial health deteriorated, it defaulted on interest payments, triggering a clause that put the lenders in control. The lenders’ primary allegation is that Byju’s leadership intentionally moved over half a billion dollars out of its US-based subsidiary, Alpha Inc. (which is now in bankruptcy), to prevent the creditors from accessing it. The money was allegedly transferred first to a shell company and then to an obscure hedge fund, Camshaft Capital, whose founder was revealed to be just 23 years old.

This maneuver has infuriated creditors and led the US bankruptcy judge to issue a stern rebuke, stating there is “strong evidence” that the funds were concealed. The court order now requires Byju Raveendran and his co-founder wife, Divya Gokulnath, to provide a detailed accounting of where the money is and to refrain from any further transfers. This represents a significant blow, piercing the corporate veil and placing personal accountability squarely on the founders.

Behind Closed Doors: Why the NY Fed's "Impromptu" Meeting with Wall Street Is a Warning Sign

Broader Implications for the Economy and Investing Landscape

The fallout from Byju’s implosion extends far beyond the company itself. It casts a long shadow over India’s startup scene, which had been a hotbed of global investing. International investors may now apply a higher level of scrutiny and demand more stringent governance structures before writing checks, potentially cooling the flow of capital. The dream of a blockbuster IPO on the public stock market, once seen as Byju’s inevitable destiny, is now a distant memory, serving as a stark reminder of the volatility of private market valuations.

For the broader economy, the failure of a company that employed tens of thousands and was a symbol of national innovation is a significant blow. It highlights the fragility of job creation tied to venture-backed growth models that are not sustainable. Furthermore, the case underscores the growing importance of cross-border insolvency laws and the ability of courts in one jurisdiction, like the US, to exert influence over founders and assets in another, like India. This has massive implications for how global financial technology and other tech firms structure their international operations and debt.

The Investor's Polymath: Decoding the Puzzles of Modern Finance

What’s Next on the Agenda?

The path forward for Byju’s is fraught with uncertainty. The company is fighting battles on multiple fronts: against its lenders in the US, with its own shareholders who have voted to oust the CEO, and with employees facing layoffs and unpaid dues. The court’s order puts immense pressure on Byju Raveendran to cooperate, with the threat of contempt charges and further legal action looming.

The most likely scenarios involve a court-supervised restructuring, the forced sale of valuable assets like the Aakash Institute, or a complete liquidation. Regardless of the outcome, the brand has been irrevocably damaged. The trust of parents, students, employees, and investors has been shattered. The story of Byju’s is no longer about the future of education; it’s about the harsh lessons of financial mismanagement and the enduring importance of integrity in business.

As the legal proceedings continue to unfold, the global business community will be watching closely. The final chapter of Byju’s will serve as a definitive case study in corporate governance, the responsibilities of leadership, and the painful consequences of an ambition that outpaces accountability. It’s a lesson written not in a textbook, but in the cold, hard language of a billion-dollar court order.