Beyond the Handshake: How the US-Japan Rare Earths Pact is Reshaping Global Finance and Tech

The Unseen Engine of Our Modern World

Take a moment to consider the device you’re using to read this. Whether it’s a smartphone, a laptop, or a tablet, it is powered by a set of obscure elements you’ve likely never heard of, yet cannot live without. Neodymium, yttrium, terbium—these are just a few of the 17 “rare earth elements” (REEs) that form the backbone of modern technology. They are the secret ingredient in everything from electric vehicle motors and wind turbines to the miniaturized electronics in our pockets and the sophisticated guidance systems in defense technology. For decades, the global economy has hummed along, powered by a supply chain for these critical minerals that was efficient but dangerously concentrated. Now, a landmark agreement between the United States and Japan, as reported by the Financial Times, signals a seismic shift in this landscape—a move designed to usher in a “golden age” for the alliance and, more importantly, to rewrite the rules of global resource competition.

This isn’t just a political headline; it’s a profound development with far-reaching implications for investors, business leaders, and anyone involved in the global finance ecosystem. The pact to secure a stable supply of rare earths is a direct response to a critical vulnerability: China’s long-standing dominance over the market. This strategic realignment promises to ripple through the stock market, influence corporate strategy, and create new frontiers for investing in everything from mining to recycling technology. In this analysis, we will delve deep into what this alliance truly means, exploring the challenges, the opportunities, and the financial shockwaves it is set to create.

What Are Rare Earths and Why the Urgency?

The term “rare earth” is something of a misnomer. These elements aren’t necessarily rare in the earth’s crust, but they are rarely found in economically extractable concentrations. The real challenge lies in the complex, costly, and often environmentally hazardous process of mining and separating them into high-purity materials. This difficulty is precisely why the supply chain became so concentrated in the first place.

Their importance cannot be overstated. They are “enabling elements” that impart unique magnetic, luminescent, and catalytic properties to materials, making modern technological marvels possible. Without them, our world would look very different.

To understand the stakes, consider the specific applications of just a few of these critical minerals:

| Rare Earth Element | Critical Application | Economic Sector Impact |

|---|---|---|

| Neodymium (Nd) & Praseodymium (Pr) | High-strength permanent magnets | Electric Vehicles, Wind Turbines, Consumer Electronics (speakers, hard drives) |

| Yttrium (Y) & Europium (Eu) | Red phosphors in LED screens and lighting | Displays, Televisions, Energy-efficient Lighting |

| Terbium (Tb) & Dysprosium (Dy) | Additives to magnets for high-temperature performance | Defense Technology (missile guidance), Hybrid Vehicles, Industrial Motors |

| Lanthanum (La) | Catalytic converters, camera lenses, battery alloys | Automotive, Optics, Energy Storage |

This dependence makes the stability of the REE supply chain a matter of national and economic security. Any disruption could bring key sectors of the global economy to a grinding halt.

Beyond the Pitch: What a Football Match Teaches Investors About Geopolitical Risk

De-Risking from the Dragon: The Geopolitical Chessboard

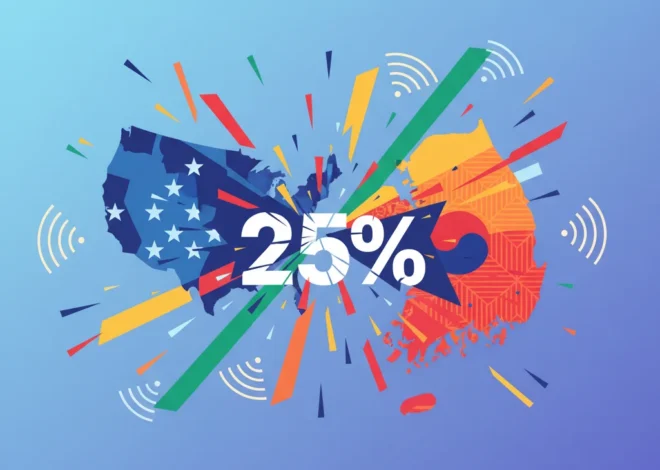

For years, the global REE market has been dominated by a single player. According to the U.S. Geological Survey, China accounted for approximately 70% of global rare earth mining and a staggering 90% of the complex processing in 2022. This has given Beijing immense geopolitical leverage, which it has not been afraid to use. In 2010, China temporarily halted REE exports to Japan during a territorial dispute, sending shockwaves through global markets and serving as a stark wake-up call for policymakers and corporate leaders (source).

The new US-Japan agreement is a direct and strategic countermove. It’s a cornerstone of the broader “friend-shoring” or “ally-shoring” policy, which seeks to reconfigure critical supply chains to run through allied, politically stable nations. By pooling resources, technology, and investment capital, the US and Japan aim to build a parallel, resilient supply chain that is less susceptible to political coercion. This involves everything from joint investment in new mines in friendly countries to collaborative research on more efficient and environmentally friendly processing techniques.

The real “golden age” will depend on more than just this agreement. It will require sustained public-private partnerships, a revolution in recycling technology, and a fundamental shift in corporate investing from short-term cost optimization to long-term supply chain resilience. Investors should watch for the emergence of new financial technology platforms designed to fund these massive infrastructure projects, and perhaps even the use of blockchain to provide transparent, verifiable tracking of these new, secure supply chains. This is a marathon, not a sprint, and the early movers in finance and industry who understand this will be the ultimate winners.

The Financial Fallout: Where Should Investors Be Looking?

For the savvy investor and business leader, this geopolitical shift creates a landscape ripe with opportunity and risk. The flow of capital is set to be redirected, creating clear winners and losers across the stock market and private equity spheres. Understanding these dynamics is key to navigating the changing tides of the global economy.

The implications for finance and trading are vast:

- Mining and Exploration Companies: The most direct beneficiaries will be non-Chinese REE mining companies, particularly those in Australia, Canada, and the United States. Companies like MP Materials (USA) and Lynas Rare Earths (Australia) are poised for significant growth as they become the strategic suppliers for this new alliance. Expect a surge in M&A activity and venture capital flowing into junior miners with promising deposits.

- Technology and Manufacturing: Tech giants in the US and Japan can breathe a sigh of relief. A more secure supply chain means less volatility and risk for companies reliant on REEs, such as Apple, Tesla, and major defense contractors. This stability could be priced into their stocks over the long term.

- Recycling and Green Tech: The high cost and environmental impact of new mining will turbocharge innovation in REE recycling. Start-ups and established firms developing technologies to reclaim these valuable elements from e-waste will become highly attractive investment targets. This aligns perfectly with the growing ESG (Environmental, Social, and Governance) investing trend.

- Financial Services and Banking: This industrial realignment requires massive capital. Investment banking divisions will be busy structuring deals, raising debt, and facilitating IPOs for companies in this new supply chain. Asset managers will likely launch new ETFs and mutual funds focused specifically on “critical minerals” or “supply chain resilience,” offering retail investors a way to participate.

Beyond the Cobblestones: Why San Miguel de Allende is a New Frontier for Finance and Investment

Here is a simplified breakdown of the potential market impact:

| Sector | Potential Impact & Opportunity | Associated Risk |

|---|---|---|

| REE Mining (Non-China) | Increased demand, higher prices, government subsidies, long-term contracts. | High capital expenditure, long project timelines, price volatility, environmental regulations. |

| EV & Green Energy | Supply chain security, stable input costs, ability to meet production targets. | Initial supply constraints before new sources come online, competition for resources. |

| Defense & Aerospace | Guaranteed access to critical components for advanced weaponry and systems. | Potential for short-term cost increases as new supply chains are established. |

| E-Waste Recycling Tech | Massive growth potential, government R&D funding, ESG investment appeal. | Technological scalability challenges, complexity of collecting and processing e-waste. |

The Long Road to a “Golden Age”

While the promise of a “golden age” is powerful, the path forward is paved with challenges. Building this new ecosystem requires more than just political will and financial capital. It demands breakthroughs in materials science and processing financial technology. Western nations must confront the environmental legacy of mining and develop new, sustainable methods that can win public approval. The cost of capital and labor is significantly higher than in China, a fundamental economic hurdle that must be overcome through superior technology and efficiency.

Furthermore, the world of economics teaches us that markets adapt. China will not stand idly by. It may respond by lowering prices to make new Western projects uncompetitive or by focusing its resources on the next generation of advanced materials. This strategic competition is a dynamic game that will unfold over decades.

Ultimately, the US-Japan rare earths agreement is one of the most significant economic and geopolitical developments of our time. It is the formal recognition that in the 21st century, the security of our digital and green infrastructure is as critical as the security of our physical borders. For those in finance, investing, and business, this is not a distant political story—it is a fundamental market shift that is happening now. The handshake in the news today is drawing the blueprint for the supply chains, technologies, and investment portfolios of tomorrow.