The Gulliver Effect: How a Thousand Legal Threads Could Tie Down the US Economy

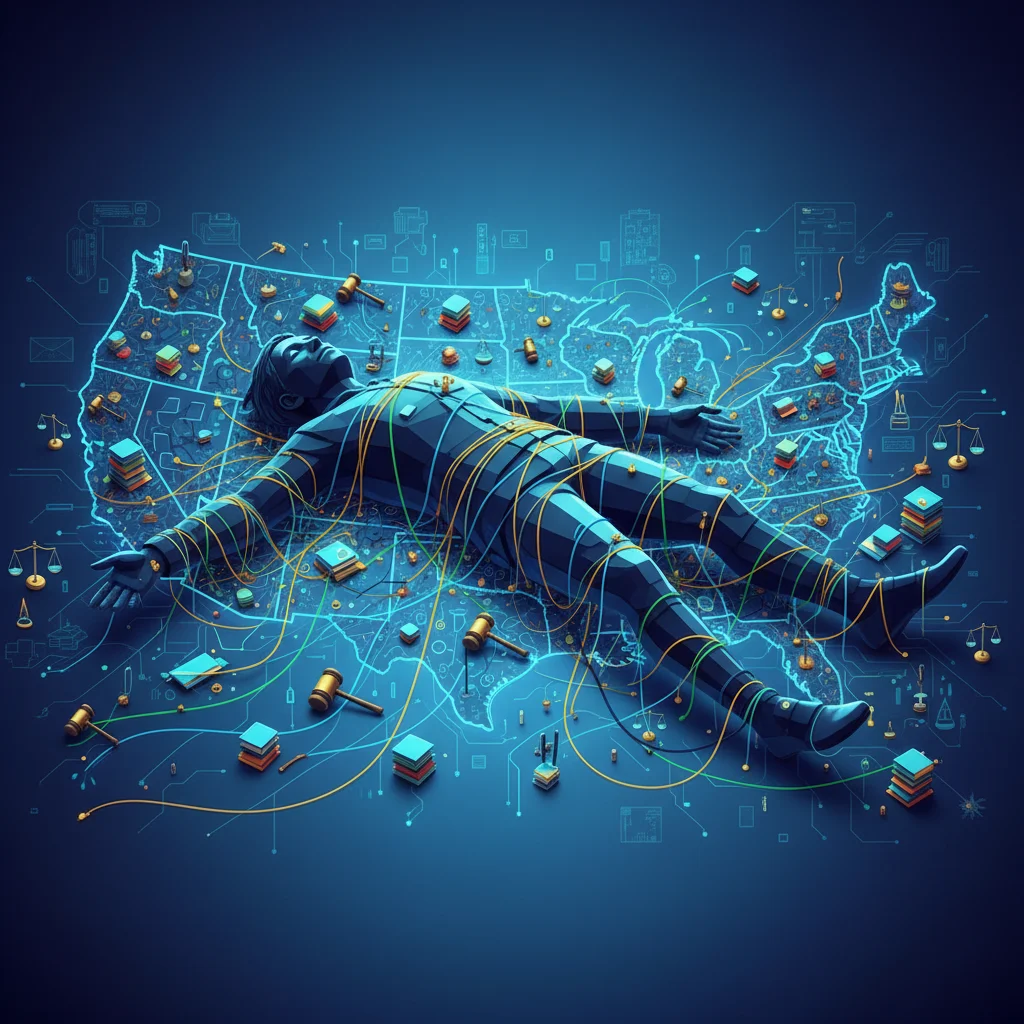

In a brief but remarkably potent letter to the Financial Times, a reader named Mike Bond offered a powerful metaphor for the current American political landscape: “Donald Trump is Gulliver, tied down by a thousand Lilliputian lawsuits.” (source) This single sentence, referencing Jonathan Swift’s 18th-century satire, Gulliver’s Travels, paints a vivid picture. It’s not a single, mighty foe that restrains the giant, but the collective strength of countless tiny threads, each one insignificant on its own, but overwhelming in unison.

Beyond the political commentary, this “Gulliver Effect” serves as a crucial analytical framework for investors, finance professionals, and business leaders. When a figure of immense political and economic influence becomes ensnared in a web of legal and regulatory challenges, the repercussions extend far beyond the courtroom. They create ripples of uncertainty that can impact everything from the stock market and investing strategies to the trajectory of the national economy. This article will dissect the Gulliver Effect, exploring its quantifiable impact on markets, its potential to stall policy, and the strategies investors can employ to navigate the resulting volatility.

Deconstructing the Metaphor: The Giant and the Threads

To fully appreciate the financial implications, we must first understand the players in this modern retelling of Swift’s tale. Gulliver, a surgeon who washes ashore on the island of Lilliput, awakens to find himself pinned to the ground by a vast network of ropes, staked by a civilization of people just six inches tall. In our context, Gulliver represents a powerful political force—in this case, a former and potentially future president—whose sheer scale of influence can move markets and shape national policy.

The Lilliputians are the multifaceted, persistent, and numerous challenges. They are not a single, monolithic enemy but a swarm of individual actors and processes:

- State and federal lawsuits

- Congressional investigations

- Regulatory hurdles

- Mounting legal fees and financial penalties

- The constant drain of time, focus, and political capital

The core insight of the metaphor is this: the primary risk isn’t necessarily a single “knockout blow” from one major lawsuit. Instead, the danger lies in the cumulative distraction and constraint. A Gulliver focused on breaking each tiny thread individually has less capacity to address the larger challenges facing the nation—from inflation and monetary policy to geopolitical tensions and the regulatory future of financial technology.

Political Risk and Market Volatility: Quantifying the “Lilliputian” Effect

For investors, the Gulliver Effect manifests primarily as heightened political risk, a key driver of market volatility. Financial markets abhor uncertainty, and a protracted, multi-front legal battle involving a major political leader is the very definition of uncertainty. This isn’t just a theoretical concern; it has measurable consequences.

The CBOE Volatility Index (VIX), often called the market’s “fear gauge,” historically shows sensitivity to political events. Research has demonstrated that periods of heightened policy uncertainty, such as contentious elections or major political scandals, often correlate with spikes in the VIX, signaling investor anxiety and leading to choppier market conditions. According to a study by the Federal Reserve Bank of St. Louis, while markets tend to perform well on average in election years, the months immediately preceding a presidential election often see higher-than-average volatility as investors price in potential policy shifts.

The economic drag is twofold:

- Direct Costs: The financial resources expended on legal defense are substantial. While these may not directly impact the national GDP, they represent a significant diversion of capital that could otherwise be used for political campaigning, policy development, or investment.

- Indirect Costs: This is the more significant economic factor. A constrained leader is a distracted one. The bandwidth required to manage dozens of legal challenges detracts from the ability to negotiate trade deals, shepherd legislation through Congress, and provide clear guidance on critical economic issues. This can lead to policy paralysis, where crucial decisions regarding the economy, banking regulations, and infrastructure are delayed or abandoned.

The Economic Agenda at a Crossroads

A central question for business leaders and those involved in finance is how this constrained reality might alter a potential administration’s economic agenda. The platform may promise sweeping changes, but the practical ability to implement them could be severely hampered. Below is a comparative analysis of stated policy goals versus the potential outcomes under the Gulliver Effect.

| Policy Area | Stated Goal (Unconstrained “Gulliver”) | Potential Outcome (Constrained “Gulliver”) |

|---|---|---|

| Tax Policy | Broad, permanent tax cuts for corporations and individuals to stimulate economic growth. | Legislative gridlock; reliance on executive orders with limited scope. Political capital spent on defense, not on complex tax reform. |

| Deregulation | Aggressive rollback of regulations across the energy, finance, and environmental sectors. | Slower pace of change. Regulatory agencies may become battlegrounds, leading to policy inconsistency and deterring long-term investing. |

| International Trade | Use of tariffs as a primary negotiation tool to secure “better deals” for the U.S. | Inconsistent and unpredictable trade policy as focus shifts. Potential for allies and adversaries to exploit perceived domestic weakness. |

| Financial Technology (Fintech) | Foster innovation with a light-touch regulatory approach, particularly for blockchain and digital assets. | Regulatory vacuum or contradictory signals. Lack of clear federal guidance could stifle institutional adoption and push innovation offshore. |

This table illustrates the chasm between ambition and execution. For sectors like banking and fintech, which depend on clear, predictable regulatory frameworks, a distracted administration creates a challenging environment for planning and investment. The uncertainty principle in physics has a parallel in economics: when the position of policymakers is uncertain, the momentum of capital slows.

Global Ripples: From Wall Street to the World

The Gulliver Effect is not a purely domestic phenomenon. The United States remains the anchor of the global financial system, and its political stability is a foundational assumption for international investors. When the world’s largest economy faces a period of prolonged internal strife and policy unpredictability, the consequences are global.

First, it can impact the U.S. dollar. While the dollar’s status as the world’s primary reserve currency is well-entrenched, sustained political turmoil can erode confidence. A report from the International Monetary Fund (IMF) highlights the dollar’s slowly declining share of global reserves, a trend that could be accelerated if global capital perceives the U.S. as an unreliable steward of the financial system. This has direct implications for trade, foreign investment, and the cost of borrowing for the U.S. government.

Second, it affects global policy coordination. Major international challenges, from climate change to the regulation of emerging technologies like AI and blockchain, require American leadership. A Gulliver tied down by domestic squabbles is a less effective partner on the world stage, creating a power vacuum that other nations, potentially with competing interests, are eager to fill. For multinational corporations, this translates to a more fragmented and less predictable global business environment.

Navigating a Lilliputian World: Strategies for Investors

While the macroeconomic picture may seem daunting, astute investors can take concrete steps to fortify their portfolios against the volatility of the Gulliver Effect. The goal is not to eliminate risk—an impossible task—but to manage it intelligently.

- Focus on Fundamentals: In times of political noise, the value of fundamental analysis becomes paramount. Look past the daily headlines and focus on companies with strong balance sheets, consistent cash flow, and durable competitive advantages. These are the businesses best equipped to weather periods of economic uncertainty.

- Diversification is Key: This age-old advice is more critical than ever. Diversify not just across asset classes (stocks, bonds, commodities) but also geographically. A portfolio with exposure to international markets can provide a buffer against U.S.-centric political risk.

- Hedge Against Volatility: For more sophisticated investors, options and other derivatives can be used to hedge against downside risk. Buying put options on a broad market index, for example, can act as a form of portfolio insurance during turbulent times.

- Identify Sector-Specific Opportunities: Political uncertainty doesn’t affect all sectors equally. Industries like defense or infrastructure could benefit from bipartisan support regardless of who is in power. Conversely, sectors highly sensitive to regulation, like healthcare or financial technology, may face greater headwinds. A report by BlackRock on geopolitical risk highlights the importance of a sector-based approach to investing in the current climate.

Conclusion: The Giant’s Enduring Shadow

Mike Bond’s “Trump as Gulliver” metaphor is more than a clever political observation; it is a vital risk-assessment tool for anyone with a stake in the economy. It reminds us that systemic constraints can be just as impactful as decisive actions. The collective weight of a thousand legal, political, and regulatory threads can create a powerful gravitational pull, slowing momentum, fostering uncertainty, and altering the course of economic policy.

For business leaders and finance professionals, the path forward is not to predict the giant’s every move but to build resilient strategies that can withstand the tremors caused by his struggles. By focusing on fundamental strengths, diversifying assets, and maintaining a long-term perspective, it is possible to navigate the complex landscape of a Lilliputian world and find stability even when the giant is tied down.