The BRIC Prophecy: How a 2001 Report Redefined Global Finance and What Comes Next

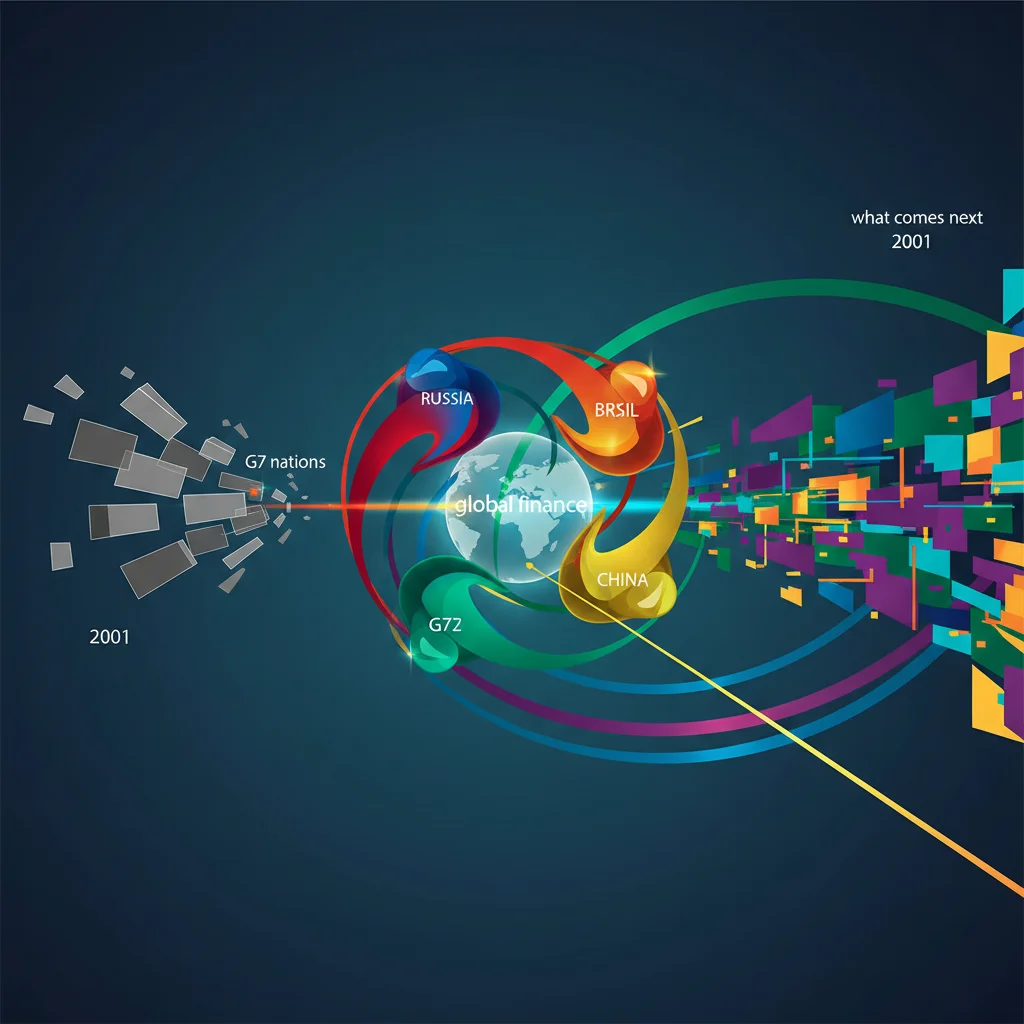

In the autumn of 2001, the world of global finance was operating on a familiar script. The G7 nations—the United States, Japan, Germany, the UK, France, Italy, and Canada—were the undisputed titans of the global economy. They set the rules, dominated international institutions, and were the primary destination for serious capital. The dot-com bubble had just burst, casting a long shadow over technology stocks, and the geopolitical landscape was about to be irrevocably altered. Into this environment stepped Jim O’Neill, then Chief Economist at Goldman Sachs, with a research paper that would not only coin a new term but would fundamentally reshape investment strategies and geopolitical discourse for the next two decades.

His paper, “Building Better Global Economic BRICs,” introduced an acronym for four countries he believed were on a trajectory to collectively reshape the world: Brazil, Russia, India, and China. It was more than a catchy moniker; it was a bold, data-driven prophecy. O’Neill argued that due to their massive populations, favorable demographics, and burgeoning economic reforms, the BRIC nations were poised to become a dominant force, potentially eclipsing the G7 in economic might by the middle of the century. This wasn’t just an academic observation; it was a call to action for the world of investing, urging a pivot towards these rising giants.

More than twenty years later, how has this prophecy held up? Was the BRIC thesis a flash in the pan, or did it truly identify a tectonic shift in the global order? This article will delve into the original BRIC concept, analyze its performance, and explore what the future holds for emerging markets in an era increasingly defined by financial technology and digital disruption.

The Pre-BRIC World: A Unipolar Economic Order

To appreciate the impact of O’Neill’s paper, one must recall the